WTI Rebounds Off Two-Month Lows After API Reports Crude Draw

Oil prices decline today as the last few day’s rollercoaster continued after a hotter than expected PPI print, leaving WTI near nine-week lows.

Crude has been on a downward path since April, with the geopolitical risk premium from tensions in the Middle East largely evaporating. Refinery run cuts and narrowing timespreads have signaled a slightly softer market. Yet prices remain elevated for the year as OPEC and its allies restrict flows.

However, an OPEC report published Tuesday showed that OPEC+ members making extra output cuts pumped 568,000 barrels a day above their agreed limit last month. The alliance is widely expected to extend curbs at a meeting June 1.

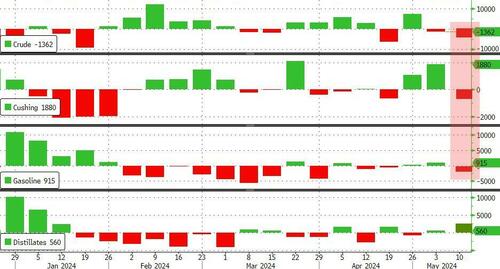

API

Crude -3.1mm (-1.1mm exp)

Cushing -601k

Gasoline -1.27mm (unch exp)

Distillates +349k (+300k exp)

API reported a bigger than expected crude draw (and stockpiles at the Cushing hub also declined). Products saw gasoline stocks drop while distillates built…

Source: Bloomberg

WTI was hovering just above $78 – around two month lows – ahead of the API print and rallied on the data…

“(The) focus is turning to the US CPI release on Wednesday which will be a make-or-break release for the Fed and guide its next policy move,” Saxo Bank noted.

Tyler Durden

Tue, 05/14/2024 – 16:40