Markets Now Face Make Or Break Inflation Data

By Michael Msika, Bloomberg markets live reporter and strategist

European stocks are hovering around record highs on conviction that interest rates will come down and revive the economy, making this week’s inflation data a key to extending the rally.

Monetary policies in the US and in Europe are expected to diverge for a few months, with the European Central Bank seen cutting rates earlier than the Fed with inflation looking more in check on the old continent. Yet, US data is always in the driver’s seat when it comes to financial markets, and this week should be no exception, making it all about US CPI.

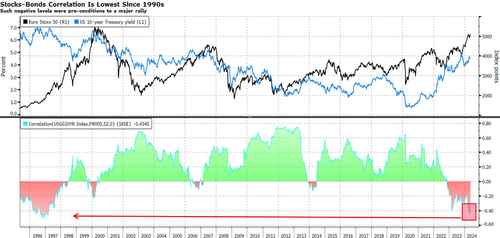

Whatever the print, the impact that the figure may have on bond yields is looking increasingly important as the correlation between European equities and US treasury yields is now the most negative since the mid-1990s, a pre-condition to a major rally back then.

Morgan Stanley strategists led by Marina Zavolock see the case continuing to build up for a 1990s play-book that saw stocks rallying around the Fed pivot, driven by bond-sensitive sectors like real estate, construction and materials, as well as utilities. “A key catalyst to make or break the trade is this week’s US CPI print,” they say.

The disinflation process is continuing but has been stalling in past months, triggering a repricing in the outlook for rate cuts, particularly in the US. Yet, the subsequent wobble seen in stock markets in April has now been erased, with volatility back to subdued levels both in the US and in Europe. In fact, our preferred measure of near-term stress, the 2/8 VIX future spread is already back to calm levels.

“We think vol (VIX) and vol-of-vol (VVIX) have now found a lower bound in the near-term,” say UBS derivatives strategists led by Maxwell Grinacoff, seeing over 1% implied move for the market on CPI data. “We favor selling puts to fund upside call spreads to position for a moderate retracement higher in volatility risk premia ahead of key CPI and retail sales data.”

Granted, the market has been sensitive to macro data, especially inflation, as shown in the chart below. While some of the moves have often been short-lived, investors may want to keep in mind that the S&P 500 has not had a 2% drop in over 300 trading days, which is abnormal, so some deeper correction can’t be excluded based on history.

Still, one thing that could play in favor of the market is that positioning is now a bit more balanced. While vol control funds’ allocation is still near the historical maximum, CTAs have reduced their equity long positions globally, and risk parity funds also trimmed their exposure to around historical average, according to Deutsche Bank strategists.

“Squeeze risks for rate-sensitive laggards on a CPI miss outweigh downside risks on a CPI beat,” say Bank of America derivatives strategists including Ohsung Kwon. They add that with inflation above consensus for five straight months, the rates market has already priced out five cuts so far this year. But they see equities able to tolerate higher inflation. An in-line print should also be net positive, removing the inflation overhang at least in the near term, they say.

“We expect this week’s April CPI report will likely be central to market participants’ focus and the tone that the market will likely take on near term,” says Oppenheimer Asset Management chief strategist John Stoltzfus. “Near-term volatility could in our view continue to present opportunity for investors to ‘catch babies that get thrown out with the bath water’ in periods of market down drafts.”

Tyler Durden

Tue, 05/14/2024 – 08:20