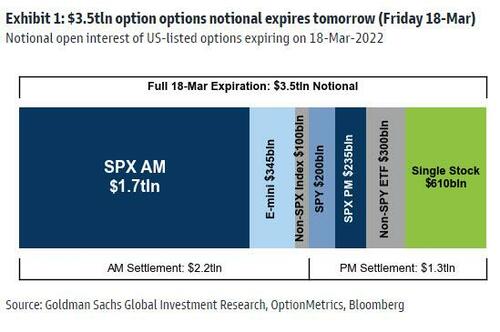

Market Faces Major ‘Gamma Unclench’ From Friday’s $3.5 Trillion Op-Ex

Tomorrow’s equity option expiration is large, with more near-the-money SPX open interest than any since 2019, and investors will also be watching the ETN market given the substantial size of expiring VXX (VIX futures ETN) call options without the potential (as of now) for new shares to be created.

The Fed-week “rally into Op-Ex” move remains in place but after yesterday’s post-hawkish-Powell meltup, some of that short/negative delta has been unwound faster than anticipated. Notably, as SpotGamma explains, yesterday saw a total lack of positive call deltas in the SPY & QQQ. You can see below that SPY traders were fairly heavy call sellers (appears to be in the money call sellers) into the AM short-stock cover, and then after 1PM ET and through the FOMC flow was neutral. The QQQ chart was similar.

The point being that if the Fed tripped some macro buy signal you’d think the response from call buyers & put sellers would be significant positive deltas… and that is not what we saw.

Just how much theoretical Delta are we talking about being bought-back off the lows from two days ago (post-Monday through Wednesday)?

SPX / SPY Net $Delta went from -$592.1B to -$342.5B, a +$249.6B change since Tuesday

QQQ Net $Delta went from -$43.0B to -$24.7B, an +$18.3 two-day change

IWM Net $Delta went from -$15.5BB to -$7.7B, a +$7.8B two-day change

HYG Net $Delta went from -$19.8B to -$13.0B, a +$6.8B two-day change

The point being, yesterday was a short cover rally through put destruction. Short cover rallies are inherently unstable, and while short-term markets shifted hawkishly to price in rate-hikes to around 2.00% by year-end, they are also now pricing in 50bps of rate-cuts in 2023-2024!

Sopurce: Bloomberg

As Nomura’s Charlie McElligott points the markets are rightfully anticipating widespread curve inversions and ultimately that implies only one thing: recession.

And as implied vols were crushed (and Spot rallied), McElligott points out that actually gave Dealers back some of their “short Gamma” (Vol down -> Gamma up)—where now, at least from the SPX / SPY and QQQ perspective, we are now back in the “Zero Gamma” pocket (4329 and ~$340, respectively), where if we can hold or even temporarily move back into a “long Gamma vs spot” position, it can act to squelch the intraday ranges and persistent overshoots both upside- and downside-, as options Dealers inch back into a location where they can again act as “liquidity makers”

Remember, “long Gamma” means Dealers are again able offer futures into upside moves, bid futures into downside moves—providing stability and preventing “shock gaps”

But in a “short Gamma” regime, however, options Dealers act as “liquidity takers”—which has been the key determinant in the past few month’s commentary on illquidity which contributes to the volatility (hence my “chicken or the egg” observation!)

So which strikes matter the most now into Op-Ex / what % of overall $Gamma is set to expire / current & max Gamma sensitivity?

SPX / SPY currently “pinning” btwn 4400 strike ($4.1B $Gamma), 4350 ($2.5B), 4300 ($2.4B); currently see ~43% of the $Gamma dropping-off for Friday’s expiration; currently at “Zero Gamma” level, “Max Short Gamma” at 4125 and -$17B per 1% move

Source: Nomura

QQQ $350 strike ($640mm $Gamma), $345 ($608mm), $340 ($595mm); currently see 56% of the $Gamma dropping-off for Friday’s expiration; currently at “Zero Gamma” level, “Max Short Gamma” at $314 and ~-$1.7B per 1%

Source: Nomura

IWM $200 strike ($471mm $Gamma), $205 ($274mm), $195 ($199mm); currently see 63% of the $Gamma dropping-off for Friday’s expiration; currently a modest “Short Gamma vs Spot” at -$100mm per 1% currently, “Max Short Gamma” at $192 and ~-$600mm per 1%

Source: Nomura

HYG $82 strike ($973mm $Gamma), $81 ($799mm), $80 ($477mm); currently see 58% of the $Gamma dropping-off for Friday’s expiration; currently still very “Short Gamma vs Spot” at -$1.0B per 1% move, “Max Short Gamma” at $79, -$1.2B per 1% move

Source: Nomura

That is a lot of gamma to ‘unclench’.

McElligott concludes that we still are not seeing a wholesale client shift to “chase” or “play offense” (i.e. big and broad upside Call buying on a sentiment shift), at least as of yet; in-fact, contrarian signal or not, most conversations remain about timing the fade or putting hedge back on into the market rally.

Accordingly, SpotGamma thinks OPEX flows will continue to be supportive of markets into Friday. However, we are currently having a hard time finding data that implies options-based support into next week. This would change if we see a pickup in call flows and/or a push above 4400 in the S&P.

Tyler Durden

Thu, 03/17/2022 – 11:30