Chinese Stock Rally Likely To Stall Without Robust Earnings

By Henry Ren, Bloomberg Markets Live reporter and strategist

Earnings for China Inc. are looking somewhat better, though likely not enough to keep fueling the recent stock market rally.

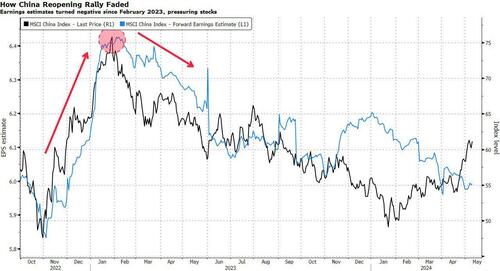

Strategists say the bounce spurred by low valuations needs a full-blown earnings recovery to continue. Remember the lesson from China’s Covid reopening trade, which began favorably in late 2022 and lasted only three months.

During that period when the MSCI China Index rallied 59% from trough to peak, analysts raised forward earnings expectations by about 10%. However, earnings revisions turned negative starting in February 2023, and Chinese stocks never managed to regain their strength.

This year, after a 25% rebound from the bottom in January, Chinese stocks are once again at a tipping point, with investors turning to earnings for potential catalysts. First-quarter reports so far are decidedly mixed.

Firms listed on the mainland have recorded a 4% decline in earnings as their gross profit margins lingered at low levels, according to UBS strategists. It’s a similar picture for MSCI China components.

Companies making up a third of the benchmark index posted a 5% drop in sales, JPMorgan cautioned in a May 1 note.

Next week’s reports from big-cap internet companies probably will determine how this earnings season registers on the index level. Weak retail sales growth in March and a decline in per-capita tourist spending during the May 1-5 national holiday are bad omens for the sector, which is highly affected by consumer sentiment.

Better earnings are critically important, especially at a time when tailwinds that lifted Chinese stock gauges into bull territory are tapering off. The MSCI China Index is now technically overbought for the first time since January 2023.

Meanwhile, Japanese equities have stabilized and US markets have digested the idea that fewer Federal Reserve rate cuts are coming, reducing the urgency for global funds to diversify away from developed markets.

But it’s not all doom and gloom. The number of mainland-listed firms missing estimates declined this reporting season, and large-cap stocks are undergoing more upward earnings revisions, according to Morgan Stanley strategists led by Laura Wang.

Some select industries still show signs of improvement, despite macro data being “weak and mixed,” said Vivian Lin Thurston, a fund manager at William Blair Investment Management in Chicago. Export-driven companies and appliance makers have stood out, she noted.

Still, more patience is required if the recovery is to broaden. “What we do have is some better news on some specific sectors because the expectations are very low,” said Societe Generale strategist Frank Benzimra. “But it’s just too early to say that this is a sustainable upturn.”

Tyler Durden

Thu, 05/09/2024 – 22:20