Meet The Company Helping Restart The Nuclear Revolution In The U.S.

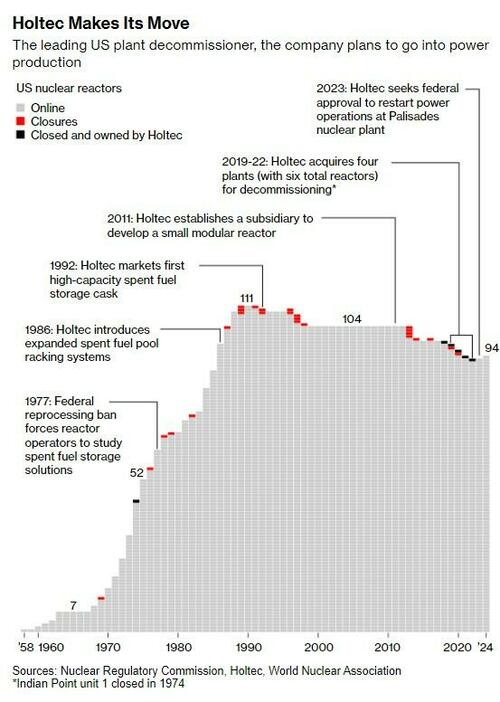

A company called Holtec has become the voice for restarting the nuclear power revolution in the U.S.

As it becomes clear that the nation’s needs for power are far underserved, and will certainly be in the future with the adoption of AI, one company, currently the “top US manufacturer of storage equipment for nuclear waste”, is advocating for restarting cold reactors across the country.

Lately, the company’s ambitions have soared. Since 2019, it’s acquired four retired nuclear plants originally intending to decommission them: Indian Point (NY), Oyster Creek (NJ), Pilgrim (MA), and Palisades (MI), according to Bloomberg.

Tearing down old reactors promised good returns due to the hefty trust funds tied to cleanup costs. Holtec quickly became the nation’s leading nuclear decommissioner.

And, as the report notes, despite initially purchasing Palisades to dismantle it, Holtec is now planning to restart the reactor with a $1.5 billion loan from the DOE, marking the first time a cold reactor would be revived in the U.S. However, Holtec lacks experience in running nuclear plants.

While concerns have been raised due to Holtec’s safety violations in the past four years of decommissioning, others consider such infractions normal in this tightly regulated industry. Nevertheless, nuclear power is increasingly seen as key to curbing greenhouse gas emissions, and Holtec aims to have Palisades online again soon and launch its own small modular reactors (SMRs) by the end of the decade.

SMRs, factory-built reactors that can be assembled onsite, represent a highly complex and largely unproven endeavor for Holtec and the industry – yet one we have written about extensively as the obvious next step for the industry. Just yesterday we highlighted Sam Altman’s now-greenlighted nuclear SPAC, trading under ALCC before switching to OKLO at the end of this week.

Holtec, meanwhile, is headquartered in Jupiter, Florida, but its business hub is the Camden, New Jersey campus and factory. Founder and CEO Krishna Singh’s office overlooks the Delaware River, facing Philadelphia, where he earned a Ph.D. in mechanical engineering from the University of Pennsylvania in 1972 after emigrating from India.

He specialized in heat-exchange systems, crucial training for reactor design, which involves managing the high temperatures generated by fission reactions to produce power.

Bloomberg writes that Holtec made its mark with a storage system for spent uranium fuel rods, addressing the mid-1980s problem of overcrowded indoor cooling pools. Singh’s innovation was a durable rack that minimized fuel rod movement during earthquakes, allowing plants to store more rods in the pools. With this patented design, he founded Holtec, and within a few years, his racks dominated the market.

Traditionally, decommissioning involved shutting down reactors and letting them sit for decades. The Nuclear Regulatory Commission (NRC) gives operators up to 60 years to complete the process, funded by a trust built from utility ratepayer contributions. For instance, Palisades had $552 million in its trust fund when it closed. The long timeline allows funds to grow and radioactivity to decay.

However, Holtec, NorthStar Group Services Inc., and EnergySolutions Inc. have adopted a different approach, starting decommissioning much earlier. Leveraging their expertise with radioactive materials, they complete the job in years instead of decades, keeping a share of any leftover trust fund money.

“Not only does Holtec intend to bring Palisades back online, it also plans by the end of the decade to have its own small modular reactors up and running,” Bloomberg writes.

Back in April we had previously written that a lot of the U.S.’s reactors could wind up coming back online. “There are a couple of nuclear power plants that we probably should, and can, turn back on,” Jigar Shah, director of the US Energy Department’s Loan Programs Office, told Bloomberg in an interview.

In March, Shah’s office approved a loan to Holtec International Corp. to reopen the Palisades nuclear plant in Michigan. This was a historical shift, and it was the first nuclear power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Nuclear power is the largest single source of carbon-free electricity. Given onshoring trends, electrification of transportation and buildings, and, of course, as we’ve noted in “The Next AI Trade,” the proliferation of AI data centers will overload power grids nationwide unless a significant upgrade is seen.

We again highlighted the enormous investment opportunity last month titled “Everyone Is Piling Into The “Next AI Trade””, which lists companies powering up America for the digital age.

Nearly 3.5 years ago, we provided readers with a straightforward investment thesis: “Buy Uranium: Is This The Beginning Of The Next ESG Craze” Back then, it became apparent to us that the resurrection of the nuclear power industry was imminent.

And the trend is only gaining steam as the revival of nuclear power plants will continue benefiting some of the largest uranium producers, such as Cameco. We told readers to buy uranium stocks, such as Cameco around the $10 handle – now it’s at $50 a share.

You can read Bloomberg’s full feature on Holtec here.

Tyler Durden

Thu, 05/09/2024 – 20:00