The Chinese EV Wall In Europe Is Breaking

Despite EU investigations and jawboning from within the industry, it looks as though Europe has faced the inevitable: it needs to “face up” to the fact that Chinese EVs have arrived, and probably aren’t going anywhere, anytime soon.

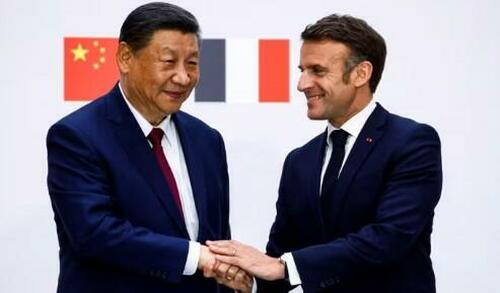

Chinese President Xi Jinping arrived in Paris on Sunday to ease trade tensions with a wary Europe. Accompanied by a business delegation focused on the electric vehicle industry, including Envision Group, SAIC Motor, and Xpeng Motors, the visit served as both a shopping trip and networking opportunity, Nikkei reported.

“We want to welcome more Chinese investors to France,” President Emmanuel Macron said during the visit.

As we have been writing about extensively for the last 6 months, the shift to electrification has changed the global auto industry’s dynamics, which were once dominated by European brands. Now, China now leads in EV production, compelling European automakers to address the growing Chinese competition.

According to Nikkei, with the EU set to ban combustion engines by 2035, China plans to expand exports and production, maintaining a significant lead in affordable EVs.

As consumers shift to EVs, European manufacturers fear losing market share. Chinese brands, which made up only 7.9% of EU’s electric vehicle sales in 2023, up from 0.4% in 2019, are projected to reach a 20% market share by 2027, according to Transport & Environment.

Felipe Munoz, senior analyst at JATO Dynamics told Nikkei: “When we’re talking about these mass market segments, it’s mainly about price … and when you look at [Chinese brands’] price positioning compared to European rivals, there is always an advantage.”

Gregor Sebastian, a senior analyst at Rhodium Group, told Nikkei Asia: “I don’t think in Europe there’s the necessary capital at the moment to really do this without China, and on top of that … in terms of the technology we’re also behind China.”

Europe remains divided over the potential influx of Chinese EVs. The European Commission has launched an investigation into Chinese EV subsidies, potentially leading to preliminary duties in May and permanent tariffs in November.

German Chancellor Olaf Scholz recently visited Beijing to ease trade relations, advocating for fair competition. While brands like Volkswagen and BMW welcome Chinese investment, others remain cautious.

Despite concerns, Europe is the largest destination for Chinese EV-related FDI, attracting $7.6 billion in 2023 following $11.8 billion in 2022. Chinese automakers like SAIC and BYD are investing in local factories to build tailored cars for European consumers. Xi Jinping’s trip includes a visit to Hungary, where BYD and Great Wall Motor are expanding, and Chery recently announced a joint venture plant in Spain.

“The student has overcome the teacher,” Munoz added. He said Chinese cars are now “at the same level or even more in terms of quality, in terms of design, in terms of appeal, and in price.”

Recall back in March we wrote about Mercedes CEO slamming the idea of import tariffs on Chinese EVs.

“Don’t raise tariffs. I’m a contrarian, I think go the other way around: take the tariffs that we have and reduce them,” Mercedes-Benz boss Ola Källenius said at the time.

Källenius said that the increased competition would “help Europe’s carmakers produce better cars in the long run” and that government protectionism is “going the wrong way”, Financial Times reported this week.

He called Chinese companies looking to export to Europe a “natural progression of competition and it needs to be met with better product, better technology, more agility.”

“That is the market economy. Let competition play out,” he added. “We did not ask for this [probe]. We as companies are not asking for protection, and I believe the best Chinese companies are not asking for protection. They want to compete in the world like everybody else.”

“If we believe protectionism is the thing that gives us long-term success, I believe history tells us that is not the case,” he added. “We live in a pragmatic world and realize there are some expectations to the general market economy rule . . . but if we seek our fortune in increased protectionism, we are going the wrong way.”

Recall back in September 2023 we wrote that the EU was opening an investigation into Chinese EV subsidies.

At the time, we noted that European Commission President Ursula von der Leyen was taking exception with the fact that “the global market is flooded with cheap Chinese cars”.

Tyler Durden

Thu, 05/09/2024 – 04:15