Record-Matching 10Y Auction Tails Despite Solid Demand

After yesterday’s stellar 3Y auction kickstarted refunding week, moments ago the Treasury sold a 10Y paper in an auction that left a bit to be desired.

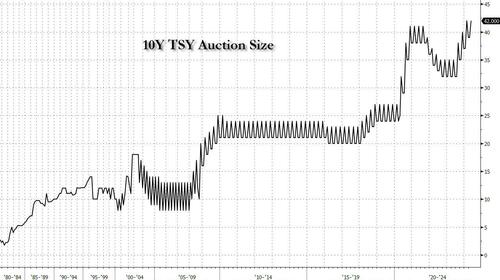

Starting at the top, the 10Y auction size rose from $39BN in April to a record-matching $42BN in May, and surpassing the record auction sizes sold during the peak of the covid crisis.

The high yield was 4.483%, down modestly from last month’s 4.56% but tailing the 4.473% When Issued by 1basis point, the third consecutive tail in a row.

The bid to cover rose from 2.336 to 2.486%, right on top of the 2.49% six-auction average.

The internals were also ok, with Indirects awarded 65.5%, up from 61.8%, if below the 66.1% recent average. And with Directs taking down 18.7%, modestly above the 17.0% recent average, Dealers were left with 15.7% of the auction, the lowest since February.

Overall, this was a solid if slightly soggy auction, where the biggest negative was the modest tail, although in retrospect, there have been 13 tails in the past 15 10Y auctions, so the top-line disappointment is now pretty much standard, and the fact that internals were an improvement from last month is probably why yields did not spike after the auction.

Tyler Durden

Wed, 05/08/2024 – 13:23