“There’s Worry On The Horizon”: JPMorgan Shocks Wall Street With Huge Loss Provision, First Since COVID Crash

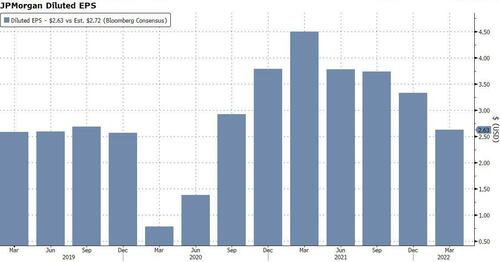

JPMorgan launched Q1 earnings season on a decidedly sour note, with the stock sliding 4% after the largest US commercial bank reported earnings that not only missed expectations but were the worst since the covid crisis in Q1 2020.

And while the bank’s trading operations performed admirably and came in well above expectations, JPM’s investment banking group suffered badly and as a result of sharply higher rates and a surge in volatility, both equity and debt underwriting cratered. How bad was it? Consider that equity underwriting plummeted 76% year-over-year to a puny $249 million, while debt underwriting slumped 20%.

There was more: in an unexpected twist, the bank revealed that it suffered a $524 million loss tied to market fallout from Russia’s invasion of Ukraine, and was driven by “funding spread widening as well as credit-valuation adjustments relating to both increases in commodities exposures and markdowns of derivatives receivables from Russia-associated counterparties.”

Naturally, Jamie Dimon tried to sound cheerful, saying in prepared remarks that “we remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels”, but over the longer-term even Dimon, that perpetual optimist, saw major storm clouds gathering, warning that he sees “significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

It was this growing pessimism about the direction of the economy that prompted JPMorgan to do something it hasn’t done since the depths of the covid crash in mid-2020: after six consecutive quarters of reserve releases, JPM actually added to its loan loss allowance by over $900 million, the first such increase since March 2020.

When and why do banks not release loan loss reserves? When they expect (or have already experienced) a significant deterioration in the macro environment… like right now.

This is how Bloomberg Intelligence senior analyst Alison Williams put it:

“The big number that investors are going to be focused on is the loss provision — $902 million. This follows several quarters of reserve releases — and we got a number much bigger than we expected. This is confirmation that there is some worry on the horizon.”

Reserve release aside, the bank’s total loans at the end of the first quarter rose 5% from a year earlier, with commercial loans up 10% and credit-card loans 15% higher. However, as has been the case ever since the Fed took over capital markets with QE, it was deposits that soared far more, and in Q1 hit a record $2.6 trillion, up 13%, and $1.5 trillion more than a year ago.

As Bloomberg notes, loan growth has been a key focus for investors looking for signs of a rebound after a lending slowdown tied to pandemic-era stimulus. And while loans are indeed growing, deposits continue to grow far faster refuting the primary tenet of the Magic Money Tree theory that is MMT, that loans create deposits, when it has now become all too clear that in this broken financial system, it is the Fed that creates deposits, and demand for loans – i.e., organic economic growth – remains far below where deposits suggest it should be for one simple reason: without the support of the Fed, the US economy will crater, and JPM is starting to realize just this.

One final point: all those deposits on JPM’s balance sheet may be inert, i.e., a byproduct of the Fed’s debt monetization where the cash proceeds end up in someone’s bank account, but very soon JPMorgan will have to start paying interest on all those trillions. We doubt Jamie Dimon will be pleased when that happens.

Tyler Durden

Wed, 04/13/2022 – 15:45