Yen’s First Intervention Rally Owed Very Little to Short Squeeze

By Garfield Reynolds, Bloomberg Markets Live reporter and strategist

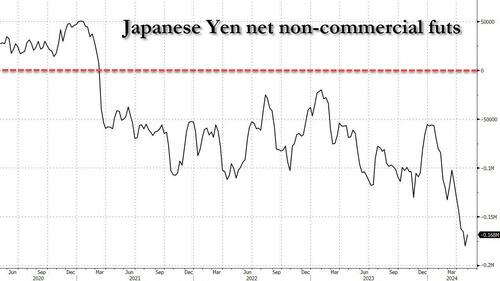

The first of Japan’s apparent twin interventions last week may have capped USD/JPY for some time to keep the pair under 160. But that had very little to do with flushing out yen short positioning at least with the initial move. Large speculators as covered by CFTC data through last Tuesday were still very strongly positioned for yen declines, highlighting both why Japan was so willing to apparently step in again on Thursday morning Tokyo time, and why it may need to do so several more times in the coming weeks.

The latest CFTC reading shows yen bears trimmed positions for the first time in seven weeks, but they only cut back by 11,531 contracts — less than the shorts added in the prior week to April 23!

So the newest, weakest hands look to be the only ones who got forced out when Japan sold an estimated $35b to buy yen. That did at least stop the CFTC shorts exceeding the record 188,000 contracts touched in 2007, though it left them at extreme levels.

Perhaps the second time Japan stepped in — after the Federal Reserve’s Wednesday decision — caused more of a positioning shift, coming as it did in the US session rather than during Tokyo hours. But we won’t find out how much of an impact until this coming Friday’s release from the CFTC.

Tyler Durden

Mon, 05/06/2024 – 00:36