Big Taper, Bad Data, & Buyback Bonanza Sparks Buying Frenzy In Bonds & Stocks

The markets took on a Dickensian dimension this week as while “it was the worst of times (for economic data), it was the best of times (for stocks)”…

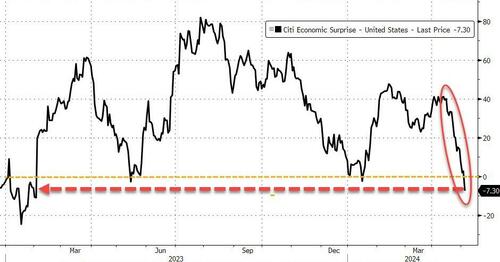

The US Macro Surprise Index continued its serial disappointment plunge into the red – the weakest since Feb 2023 (not helped at all by today’s payrolls miss)…

Source: Bloomberg

With growth data plunging while inflation data soared…

Source: Bloomberg

Bad news was good news though as the market only had eyes for Powell’s big taper and the buyback bonanza (from AAPL and the rest), and today’s NFP Goldilocks results (175k vs. 240k expected) as wage softness helps to ease inflation fears.

Small Caps leading the bunch amid a big short-squeeze and S&P lagging (but all green on the week)…

All the majors rallied up to their 50DMAs but were unable to breakout…

Nasdaq performed well with MAG7 stocks wildly choppy, but overall pushing back up towards record highs…

Source: Bloomberg

‘Most Shorted’ stocks suffered the biggest squeeze in two months (and biggest two-week squeeze since Jan 2023)…

Source: Bloomberg

Of particular note was Utes outperforming (while energy lagged) as the ‘Next AI Trade’ goes mainstream. Financials were also red on the week…

Source: Bloomberg

Bonds were also bid all week with yields down 12-20bps as the short-end outperformed…

Source: Bloomberg

And 2Y yields at 5.00% were thoroughly rejected as yields plunged today back below pre-CPI spike levels..

Source: Bloomberg

The dollar dropped this week, erasing almost all of the post-CPI gains…

Source: Bloomberg

Gold prices were lower on the week (second week in a row), despite the weak dollar and ‘easing’ by The Fed…

Source: Bloomberg

Despite a decent bounce back today, bitcoin was down on the week, testing back up to $62,000…

Source: Bloomberg

…after an ugly week of aggregate net outflows from BTC ETFs…

Source: Bloomberg

Oil prices plunged this week – down all five days for the worst in three months – back to near two-month lows…

Source: Bloomberg

And finally, rate-cut expectations have surged this week with 2024 now pricing in two full cuts and 2025 three more cuts…

Source: Bloomberg

Is this what Powell wanted? To ease financial conditions again!?

Tyler Durden

Fri, 05/03/2024 – 16:00