Blackrock’s Larry Fink Jumps On “Next AI Trade”, Warning World Will Be “Short Power”

At the start of April, we penned a lengthy report for premium subs discussing why artificial intelligence data centers, the electrification of the economy, and onshoring trends will result in a major upgrade of the nation’s power grid. We followed the note up on Monday with a report titled Everyone Is Piling Into The “Next AI Trade.”

Now , BlackRock Chairman and Chief Executive Larry Fink has jumped on the “Next AI Trade” theme at a World Economic Forum event on Monday.

“I do believe to properly um build out AI. We’re talking about trillions of dollars of investing. So data centers today could be as much as 200 megahertz – and they’re now talking about data centers being one gigawatt. That powers a city,” Fink told the audience.

He pointed out that he spoke with the head of one tech company, who said their data centers currently require about 5 gigawatts of power. By 2030, the person told Fink that number could jump to 30 gigawatts.

“The amount of power that’s needed to use AI has a huge impact on society,” Fink said.

He then asked: “So where’s that power going to come from? Are we going to take it off the grid? What does that mean for elevated energy prices?”

Fink then said the surge in power demand because of AI data centers is a “huge investment opportunity.”

He warned: “The world is going to be short power – short power – and to power these data companies you cannot have this intermittent power like wind and solar.”

“You need dispatchable power because they can’t turn off and on these data centers,” he continued.

So what kind of clean, reliable energy could Fink be hinting at?

Well, nuclear, as we’ve explained to readers as early as December 2020: “Buy Uranium: Is This The Beginning Of The Next ESG Craze.”

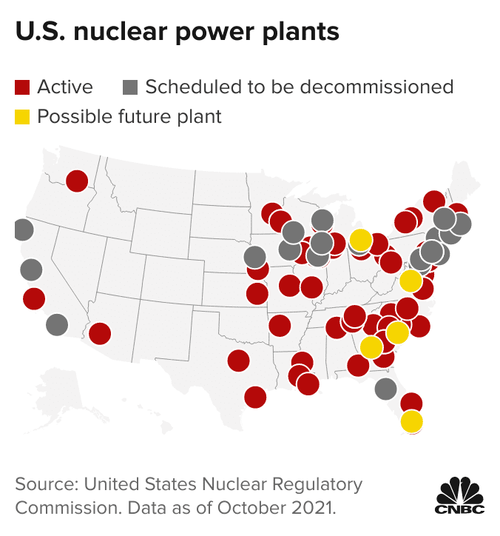

This week, the nuclear power industry appears to be gaining a major comeback. The federal government is expected to continue restarting shuttered nuclear power plants in the coming years, according to Jigar Shah, director of the US Energy Department’s Loan Programs Office, who spoke with Bloomberg on Monday.

In March, Shah’s office approved a loan to Holtec International Corp. to reopen the Palisades nuclear plant in Michigan. This was a historical shift, and it was the first nuclear power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Shah said, “A lot of the other players that have a nuclear power plant that has recently shut down and could be turned back on are gaining that confidence to try.” He declined to give specifics about which plants were slated to reopen.

Now, the head of the world’s largest asset manager, with $10 trillion in assets under management, is a believer in the “Next AI Trade,” as everyone is seriously piling in.

Tyler Durden

Tue, 04/30/2024 – 18:00