Amid Sharp Rise In Accumulation, Bitcoin Price Action Increasingly Disconnected From On-Chain Demand

Analyst Retrospective April 2022, by Copper.co

How to value Bitcoin continues to be a seriously debated topic despite on-chain metrics showing a clear direction in demand. Small and medium investors have upped their take of the supply and exchange balances continue to drop. Decentralized Finance markets are showing more parked wrapped Bitcoin and less borrowing of the cryptocurrency too. But, cash and carry plays are only showing lukewarm returns and funding rates remain flat.

* * *

Volatility makes Bitcoin seem like a complex asset to assess when in reality, it’s a pure supply and demand play. There are no cashflows. Its ability to be used in transaction settlement outside of moving in and out of exchanges is a tiny portion still. It ultimately boils down to whether or not there are more enthusiastic long-term buyers than short-term sellers. On-chain data gives investors a better picture. Traders, on the other hand, are creating copy/paste bots with the most obvious technical analysis metrics. Some win, some lose.

Sharp rise in accumulation

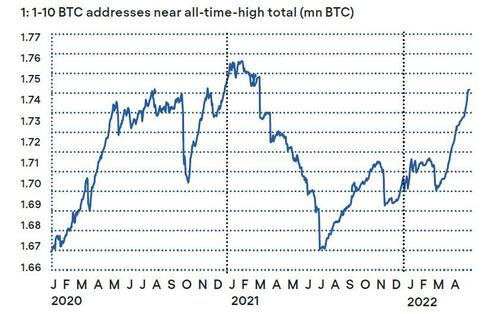

The sharpest visible rise in holdings has happened with medium size investors holding 1-10 Bitcoins. For the first time since 2020, markets have not taken account the increase in holdings (see chart).

This begs the question whether markets have new information on the price of Bitcoin outside demand, or there is a significant lag in accounting for reduced supply. Due to US equity market correlation, it’s more plausible that it’s the latter.

Since the start of February 2022, the addresses increased their size by a whopping 51k Bitcoins in less than three months at the fastest rate and most accumulation seen since the end of 2020, when Bitcoin was still at the $10k mark (see chart). The on-chain

cost of these holdings averages to $47k per Bitcoin. This was also the average cost seen by small retail investors in 2021.

In essence, these addresses alone have siphoned off over 89% of the new Bitcoin supply for the period of 1 February till 6 April 2022, when investors began to buy in heavily.

And these investors are opportunistic. Observable is that they are more price sensitive and begin to exit before a new price top is formed. Their current direction and thesis are crystal clear. And these on-chain investors haven’t been the only consistent buyers either.

Adding up, bit by bit

There are numbers of players within the Bitcoin investment space, but none other than small retail holders who self-custody have been so consistent in demand with a long-term perspective.

Since the start of the year, 0-1 BTC addresses increased by nearly 40k Bitcoins. That alone would be 47% of the new supply this year. However, readers of Copper’s research already knew this from our previous Analyst Retrospective.

Average daily accumulation from small retail investors kicked off 2Q22 in grand style, hitting a new high of 0.06% (see chart 3).

At average growth rates, and into the next Bitcoin halving estimated in May 2024, current prices would imply very little new supply overhang would be left just from these small retail investors. Even at a 0.03% daily change, which compounds quickly, would see retail investors siphon off all of the new supply (see chart 4).

It would be very diffcult not to see prices increase. Bitcoin doesn’t break supply and demand economics into new theories; it adheres to the most classic of equations. Price volatility, of course, is a different story and still a riddle to traders and investors alike.

But what we can say for certain is that 90% equivalent of the new Bitcoin supply minted in 2022 has gone on-chain to addresses holding 0-10 BTC. There is little new supply overhang from small and medium investors alone.

DeFi short sellers take pause

Another metric to keep a close eye on is supply changes on DeFi protocols. The most utility in borrowing wrapped Bitcoin is really to short it on decentralised exchanges. But there has been a growing shi% in supply and demand dynamics on popular protocol Compound Finance (see chart 5).

Lending utilization for wBTC on Compound hit a new low of just 3%. More Bitcoin is making its way into the supply side, while demand has dropped more than four times seen at different cycles during 2021. And it’s not that the returns are great by any stretch of the imagination with annual yields standing at less than a 0.01%. The expectation is clearly value appreciation.

Tyler Durden

Mon, 04/11/2022 – 20:20