Yen & Yellen Yank Stocks, Bonds, & The Dollar On Otherwise Quiet Day

A quiet micro and macro day was dominated by Treasury’s QRA news (which spoiled all the fun by coming in less than some hyperbolic expectations), and Japanese intervention the FX markets.

Before the QRA headlines, Goldman’s trading desk noted that overall activity levels were down -19% vs the trailing 2 weeks with market volumes down -7% vs the 10dma, and added that “our floor is dead-paired buy vs sell, but HFs are net sellers and LOs are net buyers.”

After the QRA, activity picked up… to the downside.

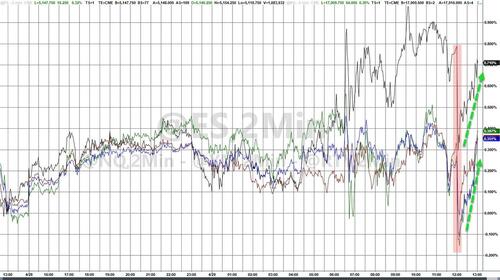

And that prompted a rapid down-draft in stocks shortly after 3pmET (led by Small Caps which had been outperforming). However, that didn’t last long as traders quickly remembered that the buyback window reopens later this week. All the majors ended higher on the day with Small Caps leading and the S&P and Nasdaq lagging. By the last few minutes, all the QRA anxiety was long-gone and stocks were surging back towards the highs…

The Dow and Russell 2000 both found support at their 100DMA on the initial QRA dip and bounced right off it…

‘Most Shorted’ stocks dumped on the QRA news, after extending the large two-day squeeze from Thurs/Fri. The basket still ended green on the day…

Source: Bloomberg

TSLA made headlines with news from China that the carmaker’s full-self-drive will be cleared for us, rallying 15% for its best day in three years…

Yields also kneejerked higher on the QRA news but not enough to ruin the day, with yields down 2-4bps across the curve (with the belly outperforming)…

Source: Bloomberg

By the end of the day, yields were at the low of the day and stocks at the high of the day…

Source: Bloomberg

Elsewhere the reaction was muted as traders tried to figure out what the QRA news meant.

The dollar index was dominated by Japanese officials fiddling while Tokyo burns…

Source: Bloomberg

…after yen plunged overnight to its 1990 lows and the very visible hand stepped in…

Source: Bloomberg

Did Japan’s “benign neglect” come to an end?

Source: Bloomberg

Gold was magnificently unmoved by the Borrowing and BoJ buggery, ending very modestly lower…

Source: Bloomberg

Oil ended lower on the day, legging down three times, interestingly in tune with Japan’s intervention…

Source: Bloomberg

Bitcoin was lower today after a modest rollercoaster over the weekend. Notably BTC found support at $62,000 and bounced this afternoon…

Source: Bloomberg

Finally, fear is being rapidly rinsed out of the markets once again…

Source: Bloomberg

…and financial conditions will start easing…

Source: Bloomberg

…too much (again) for Powell’s liking (even in an election year)

Tyler Durden

Mon, 04/29/2024 – 16:00