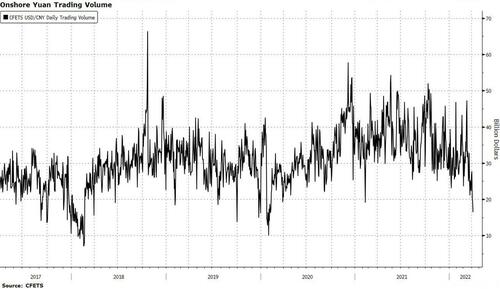

Yuan Trading Dries Up As Shanghai Lockdown Drags On

By Ye Xie, Bloomberg Markets Live commentator and analyst

Three things we learned last week:

1. Yuan trading has evaporated since Shanghai went into lockdown. Onshore yuan trading volume declined to $16 billion on Friday, the lowest since March 2020 and down from the daily average of $30 billion last month. The interbank market is dominated by banks buying and selling currencies on behalf of their clients. These transactions are backed by import and export contracts or investment activities. So the dwindling trading reflects a significant slowdown in economic activity. Shanghai accounted for 29% of yuan trading by banks for their clients in February, more than any other region in China.

2. Bad news is perceived to be good news for Chinese markets now. Real-estate and construction stocks rallied last week because investors expect Beijing to take action to shore up the economy, including boosting infrastructure spending and relaxing housing restrictions. Premier Li Keqiang vowed to stabilize foreign trade and investment after a meeting with businesses and economists, state media reported Friday. Economists expect the PBOC to cut the one-year medium-term lending facility rate to 2.75% from 2.85% this week.

3. U.S.-China policy divergence has led to capital outflows. Overseas investors dumped a record 51.8 billion yuan ($8 billion) of Chinese government debt in March, according to Bloomberg calculations based on data from Chinabond. While Beijing is poised to ease, Fed officials have turned more hawkish. The minutes of the Fed’s March meeting showed officials are likely to shrink the central bank balance sheet by more than $1 trillion a year while raising interest rates “expeditiously” to cool inflation. Three-year and five-year Treasury yields are already higher than their Chinese counterparts, reducing the allure of China’s debt. Another hot CPI report this week is likely to widen the interest-rate differential further.

Tyler Durden

Sun, 04/10/2022 – 20:30