Micron Slides After Cutting Wafer Starts By 20%, Slashing CapEx; Drags Chipmakers Lower

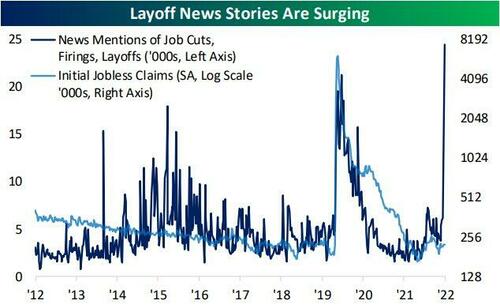

As the global recession starts to accelerate, we are seeing not only mass layoffs…

… first mostly among tech companies and soon everywhere else…

… but also companies realizing that demand they have budgeted for 2023 will not materialize. We just saw earlier today with Target which plunged after slashing its guidance and warning of a sharp slowing in consumer spending in recent weeks, and moments ago we saw that in an entirely different industry, when chipmaking giant Micron Technology said it was slashing capex by reducing DRAM and NAND wafer starts by about 20% versus 4Q 2022 in response to market conditions.

The company said that it is “these reductions will be made across all technology nodes where Micron has meaningful output” and added that Micron is also working toward additional capex cuts. In calendar 2023, Micron now expects its year-on-year bit supply growth to be negative for DRAM, and in the single-digit percentage range for NAND.

“Micron is taking bold and aggressive steps to reduce bit supply growth to limit the size of our inventory. We will continue to monitor industry conditions and make further adjustments as needed,” said Micron President and CEO Sanjay Mehrotra. “Despite the near-term cyclical challenges, we remain confident in the secular demand drivers for our markets, and in the long term, expect memory and storage revenue growth to outpace that of the rest of the semiconductor industry.”

The chipmaker elaborates that recently, “the market outlook for calendar 2023 has weakened” and adds that “in order to significantly improve total inventory in the supply chain, Micron believes that in calendar 2023, year-on-year DRAM bit supply will need to shrink and NAND bit supply growth will need to be significantly lower than previous estimates.”

The news hammered MU stock, which dropped as much as 6% before rebounding modestly.

Nvidia and Advanced Micro Devices were among semiconductor companies that were dragged lower in sympathy; both NVDA and AMD slid as much as -2.4% as realization the coming recession will further cripple demand across the semis space.

Tyler Durden

Wed, 11/16/2022 – 09:27