The Five Biggest Takeaways From This Results Season

By Sagarika Jaisinghani, Bloomberg Markets Live reporter and analyst

This earnings season hasn’t been for the faint-hearted, marked by profit warnings, job cuts and share-price volatility — all while high inflation and dollar strength wreak havoc. The bad news is that worse may be to come.

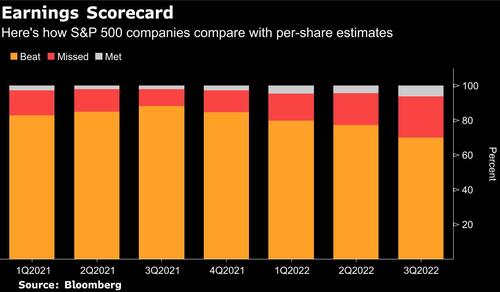

S&P 500 companies had the lowest share of profit beats since the first quarter of 2020, according to data from Bloomberg Intelligence, even after expectations were lowered going into the season. Those that missed — such as Alphabet Inc. and FedEx Corp. — were severely punished, while investors rewarded the likes of Intel Corp. for concrete plans to deal with rising costs and an economic downturn.

“Earnings this quarter were an early hint of what’s to come as we go through an environment of slowing growth,” said Ronald Temple, head of US equity at Lazard Asset Management. “Estimates have started to come down but they don’t yet reflect the economic outlook and need to fall much more.”

Note: Latest quarter accounts for companies that have reported; excludes Energy, Diversified REITs.

Even after Thursday’s huge sentiment boost from good inflation news, investors will need to assess how slower growth and rising costs will affect margins going forward, as well as how prepared companies are for a raft of other factors — from staffing to the impact of China’s reopening.

Here’s what we learned from third-quarter results:

Margin Squeeze Is Getting Worse

Data from JPMorgan Chase & Co. showed more pressure on margins this quarter as companies faced higher costs for materials, energy and labor, while slowing consumer demand limited their ability to raise prices.

With firms including Nike Inc. and appliances maker Whirlpool Corp. issuing profit warnings, Barclays Plc strategists said in a report that management teams in general were now less optimistic about maintaining high margins.

Analysts have been cutting margin expectations — but some say more is needed. “Input costs should be plateauing, but that won’t be enough to erase the pain for the bottom line” next quarter, said Sophie Lund-Yates, an equity analyst at Hargreaves Lansdown. “It isn’t just costs that are pinching margins, but weaker revenue growth too.”

Staffing Tops CEO Concerns

Conference calls showed that executives are facing a staffing headache. Big tech firms are embarking on huge layoffs in a new age of austerity for the industry — but companies in other sectors are struggling to find enough staff in a tight labor market. Wages have also become a pain point as workers contend with soaring living costs.

Esty Dwek, chief investment officer at Flowbank SA, expects layoffs to spread from tech to other sectors. “Prudence will be the name of the game going forward,” she said.

China Still a Curveball

China’s Covid Zero policy continued to have a global impact, with Apple Inc. saying shipments of its latest iPhone models will be lower than previously expected after lockdowns disrupted factories. But as the country relaxes restrictions, investors are counting on a boost to global earnings.

China generates about 6% of revenue for companies in the Russell 1000 Index, with technology, energy and consumer companies set to benefit the most from a reopening, according to Bloomberg Intelligence. Still, one curveball could come from the impact on inflation as demand for commodities and the yuan rises, strategists warn.

Europe Set for a Shock

A sharp increase in energy company profits and euro weakness meant European earnings held up far better than those in the US and emerging markets — but the region may be in for a shock next year.

Bloomberg Intelligence strategists see Europe’s lead fizzling out as Chinese earnings return to double-digit growth and US profits pick up. Europe will suffer due to a slowdown in energy earnings and as companies and consumers endure a gas crisis this winter.

Analysts Are Always Too Positive

While profit estimates for the next couple of years have been coming down, the number and magnitude of misses this quarter showed that analysts were still too cheerful.

Willem Sels, global chief investment officer of private banking and wealth at HSBC Holdings Plc, said the current outlook for inflation and economic growth suggests no US earnings growth for 2023. With analysts projecting a 6% increase, “estimates are still too optimistic,” he said.

Tyler Durden

Sat, 11/12/2022 – 18:20