One Bank Predicts Republicans Pick Up 75 Seats In The House And 11 In The Senate

By Philip Marey of Rabobank

“Expected Midterm Loss”

Summary

Based on historical statistical relationships, we find that the distressing state of the economy and Biden’s low approval rating should deliver a landslide victory for the Republicans. We calculate an expected midterm loss for the Democrats of 75 seats in the House of Representatives and 11 seats in the Senate. That would give the Republicans solid majorities in both the House and the Senate.

In contrast, current polls point to a more modest Republican victory, where the Democrats could still keep their majority in the Senate. We conclude that either pollsters are still having trouble reaching potential Republican voters or the Republicans are wasting a golden opportunity to gain firm control of both the House and the Senate.

Even if the Democrats maintain their majority in the Senate, a Republican majority in the House of Representatives will put an end to President Biden’s expansive fiscal policy plans. This will limit additional inflationary pressures from the federal government.

For financial markets, this divided government outcome with political gridlock for the next two years should come as no surprise, so the impact on markets should be modest. However, major market moves can be expected if the Democrats unexpectedly succeed in holding on to their majority in the House of Representatives as well. This would keep the door open to ambitious left wing policies that could further fuel inflation. This would have a positive effect on longer term interest rates. At the same time, it could also lead to increased taxation and regulation. This could have a negative impact on rates. The fear that prevails will determine the net effect on rates.

Introduction

Midterm elections usually lead to an electoral loss for the political party occupying the White House. Since this loss has occurred in different economic and political circumstances, this suggests that the party of the President gets punished no matter what, after two years in office. However, there is substantial variation in the amount of seats lost in the House of Representatives and the Senate, which could point at additional factors contribution to the midterm loss. In this special we investigate which factors determine the size of the midterm loss and then calculate Biden’s expected midterm loss, based on the current values of these factors. We also discuss the impact of the possible midterm election outcomes on economic policy and financial markets.

A history of midterm loss

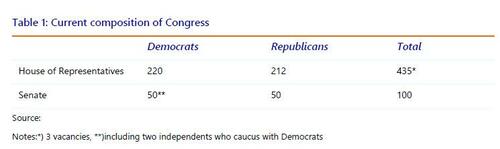

Currently, the Democrats have a majority in the House of Representatives and in the Senate1 (Table 1). Elections for the House of Representatives take place every two years, for all 435 seats. Elections for the Senate take place every two years, but not for all 100 seats. It takes three elections to go through 100 seats. So each election, only about 33-35 seats are at stake. Presidential elections take place every 4 years; therefore the elections for Congress that do not coincide with a presidential election are called midterm elections.

It is a well-known phenomenon that midterm elections tend to lead to a loss in seats in Congress for the presidential party. The average midterm loss in the House (since 1950) is 24.8 and in the Senate (since 1958, when the amount of seats was increased from 96 to 100) it is 2.9. Note that the number of seats at stake in the Senate is considerably smaller (about a third of the 100) than in the House (all 435). If we translate the Senate loss to the House scale the average midterm loss would be 38.3. This suggests that Senate races are more competitive than House races where some districts have high concentrations of either Republicans or Democrats.

These average losses can be used as the unconditional expectations for this year. However, since this is an exceptional year in economic terms, with an outburst of inflation and a technical recession, it could be useful to find an expected midterm loss based on factors that historically have affected the election outcome. There is considerable variation in midterm election outcomes, which may be attributed to economic factors and other factors. Can we find the expected midterm loss conditional on these factors? In other words, given the current state of the economy and other factors that affect voter behavior, how large would the midterm loss be if the 2022 outcome follows historical statistical relationships?

A model of midterm loss

To calculate the expected midterm loss for the Democrats, we start with a model for the House of Representatives that has been proposed by political scientist Seth Masket. His model explains the change in House seats for the presidential party as a function of the number of seats in the elections two years ago, the approval rating of the president, and the growth in per capita real disposable personal income (RDI). Economic factors affecting the election results are captured by RDI growth, while the approval rating is also influenced by non-economic factors. Masket did not estimate a model for the Senate.

Masket achieves an R2 of 0.67 for his House model, but his regression equation is not well balanced with changes in seats on the left hand side and levels of seats on the right hand side of the equation. After we rewrite the model in terms of shares, the re-estimated model shows an improved fit and the R2 of the model is boosted to 0.89. Rewriting the model in terms of shares brings out the strong linear relationship between the share of seats in the midterms and the elections two years ago. Subsequently we apply the adapted model to the Senate as well. We used Masket’s data for the House of Representatives and obtained additional data for the Senate from www.senategov/history/partydiv.htm Our estimation results are shown in Table 2. The R2, which can range from 0 to 1, indicates the fit of the model. A higher R2 means a better fit. The R2 measures how much of the variation in the dependent variable is explained by the independent variables in the model. The p-value of a coefficient measures whether the impact of the variable is statistically significant. A lower p-value indicates stronger statistical significance of a coefficient. Usually, if the p-value is lower than 0.05, the variable is called statistically significant.

We use the same model for the House and the Senate. Note that both have a high R2, but in the Senate model only the previous share of seats is a statistically significant variable. Nevertheless, the coefficients in the House and Senate models do not differ very much. Statistically speaking, the most robust result is the mean reversion in the share of seats. Both in the House and the Senate the coefficients are large but smaller than one (0.78 and 0.84 to be precise). This means that the share of seats in the presidential elections two years ago does help in forecasting the midterm share of seats, but there is a systematic midterm loss of 22% in the House and 16% in the Senate, if we correct for the effect of other factors. In addition, there is a 12ppt loss in share in the House and a 3 ppt loss in share in the Senate irrespective of the previous election result. To make up for this midterm loss, the approval rating and positive RDI growth boost the share of seats.

Rewritten in terms of shares, in addition to improving the linear fit, we can better compare the estimated causalities for the House with those for the Senate. However, we should take into account that in the Senate only about a third of the seats are at stake. If we compare the two models, then the smaller share at stake in the Senate is reflected in both the higher coefficient for the share of seats two years ago and the smaller size of the negative constant term. The smaller positive coefficients for RDI growth and the approval rating could also be seen in this light.

Note that using a linear model should be seen as a local approximation. In fact, if we plug in extreme values for the explanatory variables, the model could predict shares larger than 1 or smaller than 0. For the Senate, the logical consistency conditions are even stricter, because only about one third of the seats is at stake. To make predictions for extreme circumstances, we could try to fit a sigmoid function. However, for less extreme circumstances a linear model should suffice and it allows for statistical inference despite the small sample.

Expected midterm loss

If we plug in the current approval rating for President Biden and the current rate of RDI growth in the estimated models, as well as the shares of seats in the elections two years ago, we can calculate the expected midterm gain for the Democrats. Historically, the average presidential approval rating by Labor Day has been 51.9%. Average RDI growth has been 2.3%. In his January 2022 article, Masket assumed 43% approval and 4% RDI growth. This implied a 25 seats loss in the House for the Democrats. Masket did not estimate a model for the Senate. However, RDI growth has turned out disastrous more recently, and Biden’s approval has deteriorated, therefore we find a much worse result for the Democrats.

The model uses the per capita real RDI growth rate from Q2 in the election year to Q2 a year before. This gives a dismal figure of -4.5%, which partly reflects the technical recession that the US economy experienced in the first half of this year. Note that RDI growth is measured in real terms, so high inflation also has a negative impact as purchasing power is being eroded by inflation.

The model takes the president’s approval rating on Labor Day. This year that was September 5 and Gallup’s poll for September 1-16 yielded an approval rating of 42%. Note that in the polling period October 3-20 Biden’s approval fell to 40%.

If we plug in these values (-4.5% and 42%) in the two models we get an expected gain for the Democrats in the House of Representatives (this is in line with Masket’s updated calculations made in August) of -75 seats and in the Senate (for which Masket did not estimate a model) -11 seats. This would mean that the Democrats lose their majorities in the House and the Senate.

Comparison with midterm forecasts

However, expected midterm loss should not be interpreted as a forecast of the midterm election outcome, but rather as a benchmark. It is an estimate of the impact of the current economic situation and the president’s approval rating on the election outcome. The actual election outcome can diverge because of other factors that are driving voter behavior. What’s more, our expected midterm loss model does not take into account the regional information that affects specific Senate and House races and can be picked up by more detailed polling and analysis. What are the most recent forecasts telling us? Both FiveThirtyEight and RealClear Politics expect the Republicans to get a majority in the House of Representatives, but they show a more modest loss for the Democrats than implied by our expected midterm loss model. More importantly, they point to only a very small loss for the Democrats in the Senate. In fact, they think that Democrats could very well be able to keep their majority, This would be a much more favorable result for the Democrats than implied by expected midterm loss. Or perhaps better formulated: this would suggest electoral underachievement by the Republicans.

While FiveThirtyEight and RealClear Politics are aimed at providing an accurate forecast of the actual election outcome, our simple regression model captures the expected outcome based on the current state of the economy and approval rating. How do we interpret the expected midterm losses calculated from our share models for the House of Representatives and the Senate? They are larger than recent forecasts from surveys. We should keep in mind that the expected midterm loss is the loss of seats that should be expected – based on historical statistical relationships – for the current approval rating of the president, the current rate of RDI growth, and the current amount of seats for the presidential party.

One explanation for expected midterm loss to imply a larger Red Wave than recent surveys suggest is that the latter are still underestimating the Republican vote. Potential voters on the right of the political spectrum have become less likely to respond to polling in recent years.

Another explanation is that other factors than Biden’s approval and RDI growth are holding back the Republicans. It is no wonder that Democrats continue to invoke the specter of Trump to encourage voters to support Democratic candidates. Although Trump is not on the ballot in the midterms – neither is Biden –, the Democrats try to make the election about Trump in order to divert the attention of the voters from the highest inflation rate since the 1980s. What’s more, even in Republican circles there are doubts about the quality of some Republican candidates. Finally, non-economic topics such as abortion rights could also help the Democrats in some states. To put it differently, if the Republicans win the midterm elections, but their midterm gains are smaller in size than the expected midterm loss of the Democrats, they will have scored a victory that could have been much larger given the current approval rating of Biden and the current state of the economy. According to our model, these factors should cause a landslide victory for the Republicans.

Economic policy implications

If the Republicans take the House of Representatives, the current House Minority Leader, Kevin McCarthy, is likely to become the House Majority Leader. He has already presented his priorities in his Commitment to America. McCarthy is a pragmatist and has tried not to be identified with specific policies or ideologies. He has managed to remain on good footing with former President Trump. Therefore he delegated parts of Commitment to America to other top House Republicans. We are not supposed to call this “commitment“ a policy plan, but it consists of four themes: a strong economy through curbing costs and fighting inflation, a safe nation with reduced crime and a secure border, freedom in relation to schools and confronting Big Tech, and accountable government. The fourth theme is likely to result in House hearings on Biden policies.

However, even if Republicans gain control of the House of Representatives and the Senate, it will be difficult for them to push through partisan legislation, because President Biden can veto their bills. On the flipside, they will be able to block Democratic attempts at legislation. Consequently, with divided government, any legislation will have to be bipartisan. If not, gridlock will prevail in the next two years.

This means that President Biden is left with his executive powers and foreign and trade policy, which have been delegated to a large extent to the White House by previous legislation in Congress. However, Congress controls the purse of the federal government. This means that the Republicans can still affect foreign policy. For example, they have already indicated that they want to cut spending aimed at supporting Ukraine. Evidently, it is commitment to America, not to Ukraine.

So even if the Democrats maintain their majority in the Senate, a Republican majority in the House of Representatives will put an end to President Biden’s expansive fiscal policy plans. This will limit additional inflationary pressures from the federal government. A Republican House could also severely restrict Biden’s ambitions to increase regulation of the business sector or to raise taxes on corporations and the wealthy.

Market impact

Since most polls indicate the Democrats will lose at least their majority in the House of Representatives, divided government with political gridlock starting early 2023 should come as no surprise to financial markets. The bigger market impact would follow from an unexpected Democratic majority in both the Senate and the House. For example, FiveThirtyEight puts the probability of the Democrats winning both chambers at only 15%. As far as Democratic control of both chambers of Congress brings more government spending, it could add to inflationary pressures which should push up US treasury yields. At the same time, higher taxes could have a downward effect on yields if this is perceived as detrimental to growth. The same is true for additional regulation aimed at the business sector. The net effect on rates depends on which fear will prevail in the markets: inflation or stagnation.

Conclusion

We do not have the pretention that a simple regression model is able to give highly accurate predictions of the midterm elections. However, our model does provide some insight in the systematic relationship between the state of the economy, the president’s approval rating and the midterm loss of the presidential party. Therefore, it provides a benchmark for the election outcome. And it shows that based on historical statistical relationships, the impact of high inflation and Biden’s low approval rating should hand the Republicans an overwhelming victory in the midterms. If this does not materialize, it could be a sign of electoral weakness of the Republicans that has implications beyond these midterms. And if it does materialize, it shows that pollsters still cannot find the Trump voters.

Tyler Durden

Tue, 11/08/2022 – 06:35