Futures Tumble After Powell Rugpull, BOE Hike On Deck

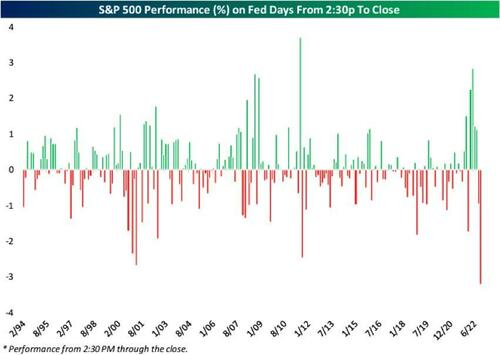

After Powell’s exquisite rugpull, where the most dovish Fed statement in almost one year was followed by the most brutally hawkish press conference where the Fed chair basically told markets to eat shit and die when he said that interest rates could go higher than previously projected, leading to the worst final 90 minutes of trading on a Fed day in history…

… US index futures extended their plunge on Thursday, signaling more losses for equities ahead of another 75bps rate hike (give or take) by the Bank of England. As of 730 a.m. ET, contracts on the S&P 500 dropped 0.7%, while Nasdaq 100 futures were down 0.9%, extending earlier losses.

Both underlying equity indexes have fallen for three straight days, with the S&P 500 losing 2.5% on Wednesday. The dollar gained as investors looked toward US jobs data, which may help to determine the pace of upcoming rate hikes. The pound fell more than 1% as concern mounted that a smaller-than-expected BOE hike could compound sterling’s drop, while Norway’s krone fell after its central bank delivered the smallest increase in its benchmark rate since June. 10Y Treasury yields soared to 4.20% while the 2s10s curve inverted the most in 2022, tumbling to -0.53%.

“Every time the market gets a little bit of dovish hope, it gets smacked on the nose with a rolled up newspaper,” said Scott Rundell, chief investment officer at Mutual Ltd. “There’s a lot of volatility still ahead.”

“There was perhaps a hint that the ‘jumbo’ rates increases are coming to an end, and this was sufficient for bond, credit and equity markets to initially at least perform well. The reality that the hiking cycle isn’t over yet is likely to limit the upside,” said Sandra Holdsworth, head of rates UK at Aegon Asset Management.

The Fed’s 75 basis-point increase is likely to be followed by a similar-sized hike from the Bank of England later on Thursday, though rates there are potentially limited by the risk of a severe recession. Powell disappointed traders betting on a pivot as the US economy remains resilient to stubbornly high inflation.

While Powell did his best to guide to lower future rate hikes while tightening financial conditions, investors haven’t found much respite in earnings either, with the season so far proving a mixed bag: both Moderna and Peloton imploded in premarket trading on poor earnings and a catastrophic outlook: Moderna plunged as much as 16% in premarket trading after cutting its vaccines purchase agreements guidance for 2022, while Peloton cratered 21% on a revenue miss and slashing Q2 revenue guidance. In other premarket moves, Qualcomm fell after maker of smartphone processors issued a weaker-than-expected forecast, citing the slowdown in phone markets. Rok also sank after offering cautious commentary about the advertising market. Etsy, EBay and Booking Holdings rallied after robust results. Here are some other premarket movers:

Cognizant shares fell around 10% in premarket trading following its third-quarter report as analysts say that the results and guidance reflect ongoing challenges the consultancy and outsourcing firm faces, which are now being complemented by a weakening macro picture.

Robinhood shares climbed as much as 4.8% in premarket trading. The online brokerage reached profitability earlier than expected, which analysts said was a positive sign that should increase investor confidence in the company’s strategy.

Lumen Technologies shares plunged as much as 16% in premarket trading, after the phone company reported earnings that fell short of expectations and eliminated its dividend, a move that which Wells Fargo analysts said was a “difficult” though a correct decision, that would allow the company to invest for growth.

Altice slumps 23% in premarket trading after the cable television provider reported worse-than-expected earnings per share in the third quarter and analysts drew attention to the company’s high levels of leverage and continued subscriber losses.

CF Industries earnings missed expectations on lower ammonia pricing, though analysts say the outlook for the fertilizer firm remains solid and a new share buyback is likely to be welcomed. CF shares fell 5.1% in premarket trading on thin volumes.

Fortinet shares fell about 13% in premarket trading as softer billings growth guidance and the cybersecurity firm’s decision to stop providing its closely-watched backlog number are both likely to be taken negatively, analysts say.

Booking (BKNG US) reported third-quarter revenue that beat the average analyst estimate, as the online travel agency continues to see resiliency in demand despite macro headwinds. Shares were up 5.1% in US postmarket trading.

“Prospects for riskier asset classes look weaker as interest rate hikes continue to curtail economic growth worldwide,” Pictet chief strategist Luca Paolini said. “We therefore remain underweight on equities, whose valuations are even more difficult to justify after the recent market rally.”

European stocks fell as Fed Chair Powell’s warning of a higher peak rate continues to roil assets. Euro Stoxx 600 down 1.1%. FTSE 100 outperforms peers, while IBEX lags, dropping 1.4%. All major sectors were in the red, with real estate, travel, technology, construction and autos the main underperformers.

Earlier in the session, Asian stocks snapped a three-day advance, with Hong Kong and mainland China shares losing ground after the government affirmed its Covid-Zero stance. China’s Caixin services PMI contracted more than expected. The MSCI Asia Pacific ex-Japan Index fell as much as 2.1%, led by consumer discretionary and tech shares. Nearly all markets in the region were down, with Australia slumping almost 2% and tech-heavy market Taiwan dropping nearly 1%. Japan was closed for a holiday. Fed Chair Jerome Powell’s comments that tightening still has “some ways to go” were perceived to be more aggressive and hawkish than before, triggering a reversal in US shares that spilled over into Asia. The Fed raised interest rates by 75 basis points for the fourth time in a row.

“Investors may be disappointed that they did not get the pivot from the FOMC that they are wishing for, given the hawkish tone overnight,” Tai Hui, chief market strategist for APAC at JPMorgan Asset Management, wrote in a note. “This could keep some pressure on risk appetite in the coming weeks.” Declines in Chinese and Hong Kong stocks dragged the region lower after the nation’s top health body said the zero-tolerance approach remains the overall strategy to fight Covid-19. Shares in the market rallied earlier in the week as speculation grew over the nation’s reopening. “We expect the dynamic Zero-Covid strategy will stay, but there will be increasing flexibility of its implementation as authorities have now got more experience and confidence in quickly deploying control measures,” said Redmond Wong, a market strategist at Saxo Capital Markets

In fixed income, yields are higher across the board, led by Europe. US Treasuries hold losses as US trading day begins, extending the bear-flattening move unleashed by Wednesday’s Fed communications with Treasury yields adding 7bps to 11bps with the largest uptick seen in the short end of the curve. 2-year yield reached a new multiyear high, pushing 2s10s curve toward its YTD low. Yields across the curve higher by 7bp-10bp, 10-year around 4.18%; 2s10s little changed at -53bp after approaching -55bp, lowest since Oct. 14. US 2-year topped near 4.735%, fresh post-2007 high, 5-year at 4.423%, highest since Oct. 21, when YTD high 4.504% was reached. Dollar issuance slate empty so far after a quiet Wednesday; six issuers have sold $8 billion so far this week. Bunds and gilts trade broadly in line with Treasuries across the 10-year sector; money markets are pricing in around 72bp of rate hikes for the Bank of England meeting.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.2% as the greenback advanced versus all of its Group-of-10 peers. JPY and CAD are the strongest performers in G-10 FX, while GBP tumbles ahead of the BOE. Crude futures decline.

The euro extended a decline to trade at an almost two-week low versus the greenback. Italian bonds lead euro-area peers lower as money markets raised ECB rate-hike bets in response to Wednesday’s hawkish Fed outcome.

The pound tumbled as much as 1.4% to 1.2337 per dollar before the Bank of England’s interest-rate meeting, as concern mounted that a smaller-than-expected hike could compound sterling’s drop. Gilt yields rose by around 8-10bps. The BOE is expected to raise interest rates 75bps to 3%. Options show that price action following the Bank of England decision has the potential to signal the pound’s direction into year-end

Norway’s krone pared losses after falling to a one-week low of 10.3710 per euro after Norges Bank raised its policy rate by 25bps to 2.50%, with estimates almost evenly distributed between a 25bps and a 50bps hike

Aussie yields climbed ~10bps across the curve. The Aussie fell more than 1% in European trading after earlier reversing an intraday loss as Australia’s trade surplus surged to A$12.4b in September from A$8.3b in August, exceeding economists’ forecast of A$8.8b

The yen held up best against the dollar among G-10 peers, with Japan on holiday

Commodities are under broad pressure given the continued post-FOMC advances in the USD, crude benchmarks lower by over USD 1.00/bbl. Metals are similar under USD-induced pressure, spot gold dropping further from the USD 1650/oz mark with LME copper below USD 7.5k/T once again. Spot gold falls roughly $14 to trade near $1,622/oz.

Bitcoin is modestly firmer on the session but continues to trade within fairly narrow parameters above the USD 20k mark post-FOMC as participants look to upcoming risk events.

Looking the day ahead now, and the main highlight will be the BoE’s policy decision and Governor Bailey’s press conference. We’ll also separately hear from the BoE’s Mann and a range of ECB speakers including President Lagarde, and the ECB’s Kazaks, Panetta, Nagel, De Cos, Elderson, Villeroy, Visco, Makhlouf and Centeno. Data releases include the ISM services index from the US, the weekly initial jobless claims, and September data on the trade balance. Lastly, earnings releases include Starbucks, PayPal and Moderna.

Market Snapshot

S&P 500 futures down 0.2% to 3,761.00

STOXX Europe 600 down 1.1% to 408.90

MXAP down 1.6% to 137.74

MXAPJ down 2.1% to 438.83

Nikkei little changed at 27,663.39

Topix up 0.1% to 1,940.46

Hang Seng Index down 3.1% to 15,339.49

Shanghai Composite down 0.2% to 2,997.81

Sensex down 0.3% to 60,705.30

Australia S&P/ASX 200 down 1.8% to 6,857.88

Kospi down 0.3% to 2,329.17

German 10Y yield up 4.5% to 2.24%

Euro down 0.5% to $0.9767

Brent Futures down 1.3% to $94.92/bbl

Gold spot down 0.5% to $1,627.50

U.S. Dollar Index up 1.17% to 112.65

Top Overnight News from Bloomberg

ECB President Christine Lagarde warned that a “mild recession” is possible but that it wouldn’t be sufficient in itself to stem soaring prices

Wall Street money managers looking to pile back into Treasuries after months of losses will have to contend with a Federal Reserve that stands ready to raise the stakes every step of the way

Central banks bought 399 tons of bullion in the third quarter, almost double the previous record, according to the World Gold Council. Just under a quarter went to publicly identified institutions, stoking speculation about mystery buyers

Turkish annual inflation accelerated for the 17th month in a row in October to 85.5% y/y, driven by a surge in food prices and energy costs, to its likely peak during President Recep Tayyip Erdogan’s two decades in power

A more detailed look at global market courtesy of Newsquawk

APAC stocks were mostly lower with the global risk appetite subdued in the aftermath of the FOMC, while the risk tone was also not helped by a deterioration in Chinese Caixin PMI data and the absence of Japanese participants for Culture Day holiday. ASX 200 was pressured as underperformance in the mining-related sectors led the broad declines in the index and after the New South Wales Chief Health Officer warned of a looming wave of COVID infections. KOSPI was contained amid geopolitical concerns after North Korea’s recent record number of missile launches, while it continued firing missiles again today. Hang Seng and Shanghai Comp were negative after Chinese Caixin Services and Composite PMI data worsened and with China’s National Health Commission reiterating adherence to zero-COVID policy, while the HKMA also raised rates by 75bps in lockstep with the Fed.

Top Asian News

Hong Kong Monetary Authority raised the base rate by 75bps to 4.25%, as expected, while the Macau Monetary Authority also raised its base rate for the discount window by 75bps to 4.25%.

RBNZ said there is high confidence that they can get inflation under control and that the labour shortage is the single most constraining factor for businesses in New Zealand, while Governor Orr also noted a laser-like focus on returning inflation to the 1%-3% target.

Earthquake shakes buildings within Tokyo, Japan, via Reuters citing witnesses; reports indicate an intensity of 4 and a magnitude of 5.2, epicentre in Chiba.

Malaysia Raises Key Rate by a Quarter Point Ahead of Vote

Kahoot Drops 17% After 3Q Revenue Misses Estimates

China’s Top PC Maker Boosts Profit After Lowering Costs

Latest Fed Hike Reverberates Through Asia as Policy Makers React

Sharp Yen Swing Has Traders on Watch for Post-Fed Japan Reaction

European bourses are subdued across the board, Euro Stoxx 50 -0.8%, as the post-Powell pressure reverberates across from APAC trade. Sectors are all in the red with the exception of banking names that are deriving some benefit from yields and conscious of numerous European earnings within the sector, including BNP and ING. Stateside, futures are lower across the board though only marginally so with a busy session ahead incl. BoE and ISM Services PMI; ES -0.3%, NQ -0.3%. Morgan Stanley (MS) reportedly plans to begin layoffs in the coming weeks as deal making slows, according to Reuters citing sources. Cigna Corp (CI) Q3 2022 (USD): EPS 6.04 (exp. 5.71), Revenue 45.3bln (exp. 44.76bln); raises FY22 outlook.

Top European News

Coal Gives Profit Boost to Offshore Wind Developer Orsted

BMW, Stellantis See Europe Demand Slowing as Inflation Bites

Rolls- Royce Falls as Engine Deliveries Hit Low End of Forecasts

Uniper Posts €40 Billion Loss as Russia Throttles Gas Supply

BNP Rides Rising Rates as Debt Trading Fuels Profit Beat

ING Plans €1.5 Billion Buyback as One-Off Charges Hit Profit

FX

USD continues to rise to the detriment of peers across the board following the FOMC/Powell-presser; DXY to a 112.91 peak from a 111.81 base.

JPY is the relative outperformer amid holiday outages for the region, the ever present possibility of intervention and perhaps some haven allure given broader risk aversion; though, USD/JPY is back above 148.00.

GBP is the standout underperformer given the USD action but also vs EUR, with EUR/GBP lifting past 0.8650 pre-BoE with the Pound unable to derive any real respite from upward PMI revisions.

NOK has been impaired by an as-guided but sub-market pricing 25bp hike from the Norges Bank; interestingly, Governor Bache hasn’t given much away on the likely December magnitude thus far.

Fixed Income

Core benchmarks under pressure across the board as yields continue to extend, particularly at the short-end of the UST curve.

Gilts are the relative outperformers, though still lower by over 50 ticks pre-BoE, as while 75bp is expected a ‘dovish’ surprise/dissent cannot be ruled out entirely.

Bunds are in-fitting with their US peer and significantly lower though they have held onto support at the 137.00 mark; for reference, numerous ECB speakers haven’t had much sway on EGB price action thus far.

Commodities

Commodities are under broad pressure given the continued post-FOMC advances in the USD, crude benchmarks lower by over USD 1.00/bbl.

Though, desks are cognisant of the substantial drawdowns in crude stockpiles this week as a potential cushioning factor.

Metals are similar under USD-induced pressure, spot gold dropping further from the USD 1650/oz mark with LME copper below USD 7.5k/T once again.

Urals and Siberian Light oil loadings from Novorossiisk set at 2.47mln/T for November (2.84mln/T in October), via Reuters citing sources

Central Banks

Norges Bank hikes by 25bps to 2.50% (exp. evenly split between 25bp & 50bp); the policy rate will most likely be raised further in December.. Click here for full details, reaction and newsquawk analysis.

ECB’s Kazaks says a EZ recession is already his baseline, but it should be shallow. Monetary policy must continue to tighten; rates need to go much higher, no need for a pause at turn of the year.

ECB’s Panetta says the medium term inflation outlook presents clear upside risks, further policy adj. is warranted. Need to bring inflation back to target as soon as possible, but not sooner.

ECB’s Lagarde says a recession is not sufficient to tame inflation.

ECB’s Centeno says a good part of rate hikes should already have occurred, EZ inflation should peak this quarter, via Publico.

Geopolitics

Ukrainian President Zelensky said a Russian plane fired cruise missiles on Wednesday which flew across the Black Sea corridor used to export grain, according to Reuters.

Russia’s Kremlin says Russia’s resumption of the grain agreement does not mean that it has been automatically extended and its results must be evaluated before a decision is made, via Al Jazeera.

South Korean military detected that North Korea fired one long-range and two short-range missiles, while it was reported that the North Korean missile went through a stage of separation but may have failed after the second stage separation, according to Yonhap.

US condemned North Korea’s ICBM launch and called on North Korea to refrain from further provocations and engage in sustained and substantive dialogue, according to Reuters.

US Event Calendar

07:30: Oct. Challenger Job Cuts YoY 48.3%, prior 67.6%

08:30: 3Q Unit Labor Costs, est. 4.0%, prior 10.2%

08:30: 3Q Nonfarm Productivity, est. 0.5%, prior -4.1%

08:30: Initial Jobless Claims, est. 220,000, prior 217,000

08:30: Continuing Claims, est. 1.45m, prior 1.44m

08:30: Sept. Trade Balance, est. -$72.2b, prior -$67.4b

09:45: Oct. S&P Global US Services PMI, est. 46.6, prior 46.6

10:00: Oct. ISM Services Index, est. 55.2, prior 56.7

10:00: Sept. Durable Goods Orders, est. 0.4%, prior 0.4%

10:00: Sept. -Less Transportation, est. -0.5%, prior -0.5%

10:00: Sept. Cap Goods Ship Nondef Ex Air, prior -0.5%

10:00: Sept. Cap Goods Orders Nondef Ex Air, est. -0.6%, prior -0.7%

10:00: Sept. Factory Orders Ex Trans, est. 0%, prior 0.2%

10:00: Sept. Factory Orders, est. 0.3%, prior 0%

DB’s Jim Reid concludes the overnight wrap

Markets could have saved themselves a lot of heartache and debate over the last 13 days as the WSJ article from Nick Timiraos was ultimately fairly accurate. However, the problem was that the market has been paying more attention the step-down debate Mr Timiraos hinted at rather than the rest of the article saying that the terminal rate may need to go higher. Even after the initial statement last night, the market focused on the former (with good reason). However, by the end of the press conference it was clear that this was a hawkish dovish pivot! If that makes any sense!

Let’s try to make sense of things. Firstly, the Fed of course hiked 75bps as virtually everyone expected. See our full US economics team’s wrap here.

Upon the release of the statement, markets quickly latched on to the inserted phrase that the “Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation” when assessing the path of future tightening. Market pricing assumed that this meant the Fed was teeing up a pivot, leading to a strong rally in yields and risk. The pivot/pause rally was short-lived, however, as Chair Powell stepped up to the mic and quickly disabused any interpretation that suggests a pause was forthcoming. He did so directly, saying that it was very premature to be thinking about a pause, and also by contextualising the new Statement language, highlighting that the hiking cycle had three important components: 1) the pace the Fed gets to terminal, 2) how high terminal needs to get, and 3) how long policy needs to stay restrictive. The new statement language only pertains to ‘1)’, and the Chair emphasized that the pace is not nearly as important anymore given how much tightening the Fed has done to date. Indeed, the Chair sounded more hawkish on the latter two points, noting that the data since September’s dots call for an even higher terminal rate, and that the Fed had a ways to go until achieving an appropriately restrictive stance. The tighter for longer restrictive policy stance also had the Chair bring his economic outlook closer to DB’s, as he downgraded the Fed’s prospects of achieving a soft landing, upgrading the probability he placed on a recession.

Powell was hawkish elsewhere in the presser, noting that it was still riskier to under- rather than over-tighten, given how precariously balanced inflation expectations are as core inflation continues to stay elevated. Over a longer time horizon, Powell noted that the historical record argued against prematurely loosening policy when inflation was this high. While some asked about greenshoots in the battle against inflation, Powell was much more focused on a labour market which remained historically tight and showing no signs of letting up.

The slower pace but higher terminal message (one that was reflected in that aforementioned WSJ article) was eventually well-understood by the market. Pricing for the December FOMC moved down -2.0bps to 56.5bps, while terminal pricing for May moved up +5.0bps to 5.10%, a new cycle high. Meanwhile, the rest of the Treasury yield curve and the S&P 500 fully retraced the post-statement pre-press conference rally, leaving 2yr yields +7.5bps higher and 10yr yields up +5.9bps, having climbed +18.7bps and +13.3bps, respectively, from the post statement lows. There is no cash trading of Treasuries in Asia this morning with Japan on holiday. (Meanwhile, the S&P 500 finished the day -2.50% having been +0.98% after the statement, making it the worst Fed day for the S&P 500 since January 2021. Likewise, the NASDAQ rallied into positive territory after the statement (+0.93%), only to take a sharp turn lower to end the day down -3.36%. In overnight trading, US futures are showing a small rebound with contracts tied to the S&P 500 (+0.25%) and NASDAQ 100 (+0.32%) both trading in positive territory. Qualcomm’s shares fell -7.10% after hours though following earnings where they lowered revenue guidance for the upcoming quarter on the back of slowing phone demand as well as continued Covid lockdowns in China.

Ahead of the Fed, European markets put in a pretty downbeat performance, with the major equity indices including the STOXX 600 (-0.29%) moving lower. That followed the release of the final manufacturing PMIs for October in Europe, which saw downward revisions relative to the flash readings and cemented the sense that Q4 had got off to a pretty weak start for the continent. For example, the manufacturing PMI for the Euro Area as a whole was revised down to 46.4 (vs. flash 46.6), with downward revisions in France and Germany too.

Looking forward, central banks will stay in the spotlight today as the BoE announce their latest decision, with a 75bps hike widely expected that would take Bank Rate up to 3% and its highest level since 2008. Since the BoE’s last meeting in September, an awful lot has happened in the UK, including a mini-budget that triggered market turmoil, a temporary BoE intervention to buy longer-dated gilts, a policy reversal on most of that mini-budget, and then Liz Truss’ replacement as PM by Rishi Sunak. That volatility has been reflected in market pricing for today’s decision as well. Straight after the last meeting, overnight index swaps were pricing in a 75bps hike, but at the height of the mini-budget turmoil they went as far as pricing in more than 200bps worth by today, including a decent chance of an intermeeting hike. However, as the situation has calmed down, pricing has returned to its original starting point of a 75bps hike again, which is what our UK economist is forecasting for today as well (link here).

Gilts strongly outperformed ahead of the BoE’s decision today, with the 2yr yield seeing a sizeable move lower of -17.3bps, whilst the 10yr yield was down -7.1bps. That contrasted with the rest of Europe, where yields on 10yr bunds (+0.4bps), OATs (flat) and BTPs (+2.9bps) were all little changed.

The overnight sharp losses on Wall Street are echoing in Asia this morning with the Hang Seng (-2.82%) leading losses followed by the CSI (-1.23%), the Shanghai Composite (-0.63%) and the KOSPI (-0.31%). Additionally, China’s top health body, the National Health Commission reaffirming the government’s Zero-Covid stance is also weighing on sentiment after excitement earlier in the week that China was set to loosen restrictions. Elsewhere, markets in Japan are closed for a holiday.

Data coming out of China showed that the Caixin services PMI for October further contracted to 48.4, the lowest reading since May after deteriorating to 49.3 in September thus underscoring the impact of strict COVID-19 restrictions sweeping the country. Elsewhere, Australia’s trade surplus in September (A$12.4 bn) widened substantially from A$8.7 bn in August (v/s A$8.8 bn expected) led by a big surge in exports (+7.0% m/m) with little change in imports. Staying on Australia, bonds have tumbled with yields on the 3yr bond (+10.7 bps) climbing upwards, trading at 3.46% after the Fed.

Looking at yesterday’s other data, the ADP’s report of private payrolls from the US showed growth of +239k in October (vs. 185k expected). That comes ahead of tomorrow’s jobs report, where our US economists expect nonfarm payrolls to have grown by +225k. Otherwise, German unemployment rose by +8k in October (vs. +12.5k expected), leaving the unemployment rate at 5.5% as expected.

To the day ahead now, and the main highlight will be the BoE’s policy decision and Governor Bailey’s press conference. We’ll also separately hear from the BoE’s Mann and a range of ECB speakers including President Lagarde, and the ECB’s Kazaks, Panetta, Nagel, De Cos, Elderson, Villeroy, Visco, Makhlouf and Centeno. Data releases include the ISM services index from the US, the weekly initial jobless claims, and September data on the trade balance and from the Euro Area we’ll also get the unemployment rate for September. Lastly, earnings releases include Starbucks, PayPal and Moderna.

Tyler Durden

Thu, 11/03/2022 – 07:55