Yield-Curve Inversion At Low Interest-Rate Levels “Is A Nightmare For The Fed”

Authored by Joseph Carson, former chief economist at AllianceBernstein,

Curve Inversion At Low Levels of Interest Rates Is Problematic For the Fed & Finance Not the Economy

The inversion of the two-year and ten-year yields creates more problems for the Fed and the financial markets than for the economy.

That’s because the yield curve inversion has occurred at a relatively low level of interest rates, far too low to slow final demand and squash inflation pressures.

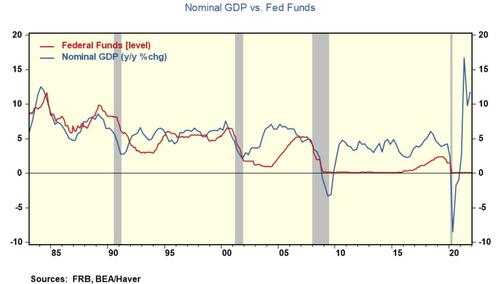

History shows that yield curve inversions offer an accurate negative view of the economy’s future path only when accompanied by a level of interest rates that prove prohibitive. In the past, restrictive interest rates were when the federal funds rate and market rates equaled or exceeded the growth in nominal income.

Notably, that is not the case today. On the contrary, it’s the exact opposite. A record gap exists between Nominal GDP growth of 10% in the past year and the current fed funds of .5%. There is even a record spread between Nominal GDP and two and ten-year yields of around 2.5%.

Yield curve inversion at low-interest rate levels is a nightmare for the Fed.

Past experiences dealing with cyclical inflation pressures tell the Fed that it needs to increase the cost of credit to slow final demand before it can successfully dampen inflation pressures.

Take a look at the current trends in the housing market. Mortgage rates have moved above 4% for the first time since 2019. Yet, borrowing costs for a house purchase still are attractive given that house prices are rising close to 20% a year, people’s house prices expectations remain at double-digit levels for the foreseeable future, and wages for most workers are growing close to 7%. In other words, money is still too cheap to slow housing demand and house price inflation.

If the bond market is not responding to high reported inflation by marking up yield levels because it believes the inflation cycle will die or it trusts the Fed to bring it under control, that puts added pressure on the Fed to act more aggressively. And, as the Fed lifts official rates to dampen final demand growth and quell inflation, it will encounter market and political backlash of triggering more curve inversion.

A sustained inversion between fed funds, nominal GDP, and market rates may occur as policymakers attempt to bring inflation to their 2% target. After a decade (2010 to 2020) of a near-zero federal funds rate as policymakers tried to hit its 2% price target, investors will encounter of much different and higher cost of credit landscape.

One key takeaway is that high-multiple growth stocks which have outperformed value stocks for the past decade should see a ‘reversal of fortune” in the next decade.

Tyler Durden

Wed, 04/06/2022 – 06:30