Wall Street Gives Up On Corporate Profit Outlooks

By Jessica Menton, Bloomberg Earnings Watch reporter

Wall Street is finally caving on its forecasts for corporate earnings for the next couple of years.

For some investors, it’s still short of a capitulation in sentiment that would signal battered equities are getting close to a bottom.

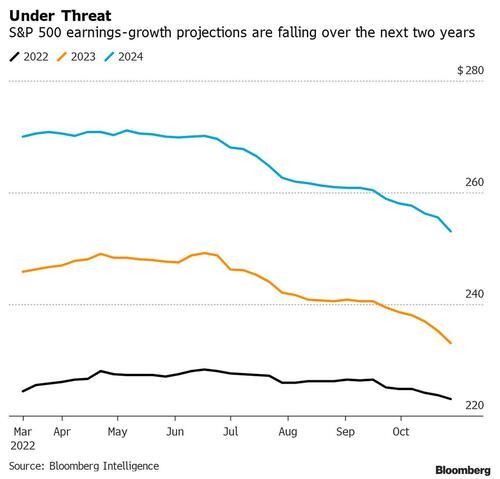

Projections for 2023 earnings have fallen six straight weeks, by 3% to $233 a share for the S&P 500 Index, according to Bloomberg Intelligence data.

For 2024, the consensus has tumbled even more steeply: It’s dropped 19 consecutive weeks, by about 6% since mid-June to $253 a share.

Investors say it’s constructive that many analysts are steadily revising their view lower, after sticking to a rosy outlook while stocks sank into a bear market in the first half of the year. However, money managers like Dan Eye at Fort Pitt Capital Group say the gloom needs to deepen further before the market fully prices in the risk that Federal Reserve policy tightening will weaken the economy.

S&P 500 earnings forecasts for 2023 should be closer to $220 a share, almost 6% lower than the current consensus, he says.

“Earnings estimates getting slashed for 2023 is part of the bottoming process for the equity market,” said Eye, the firm’s chief investment officer.

“Progress has been made, but there’s still more work to do before stocks can bottom. It’s too optimistic to see earnings projections that high next year.”

The strong dollar, which erodes the value of overseas revenue, and slowing economic growth have been the key drivers for the decline in earnings forecasts, said Wendy Soong, a senior associate analyst at BI. That backdrop adds to the strain on multinational companies that are already grappling with higher inflation costs, she said.

Tuesday brought signs of surprising strength in the US labor market that will likely keep pressure on the Fed to prolong its campaign to tame inflation. The central bank is widely expected to lift its benchmark overnight rate by 75 basis points for a fourth straight meeting on Wednesday, and tighten further in December.

To JPMorgan Chase strategist Marko Kolanovic, the reset in earnings expectations may lead investors to seek an inflection point in the market, should they conclude that the Fed’s policy is working as planned.

That’s the debate that will grip the market in the coming months as investors sift through Fed officials’ comments and the latest inflation readings, while assessing the overarching risk: whether rate hikes push the US economy into a recession.

“Analysts earnings forecasts are starting to capitulate,” said Soong.

“From a valuation perspective, it’s better for stocks for sure, but there are still geopolitical and interest-rate risks for equities. Lower earnings projections won’t predict the stock market’s direction from here.”

Elsewhere in corporate earnings:

Tyler Durden

Tue, 11/01/2022 – 18:05