Bonds & Stocks Battered As ‘Good’ JOLTS Print Sends Rate-Hike Odds Soaring

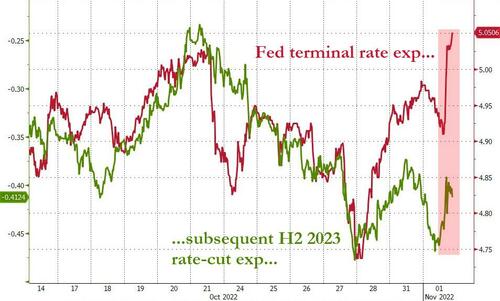

Weak ISM and PMI data (and a big drop in prices within them) was shrugged off by the market which focused on a notable headline JOLTS beat (a two-month-old metric that’s likely manipulated ahead of the midterms) sparking a ‘good news is bad news’ reaction in markets, punching rate-trajectory expectations dramatically more hawkish just a day ahead of the FOMC decision. The market is now pricing in a cycle-high terminal of 5.06%…

Source: Bloomberg

And while tomorrow’s 75bps hike is a lock, the odds of a 75bps hike in Dec jumped today and the odds of a 50bps hike in Feb also jumped notably today…

Source: Bloomberg

There was one weird headline today (that sparked consternation among many Fed watchers) as White House economic advisor was interviewed on Bloomberg TV and told the anchor that “President Biden has endorsed The Fed’s policy pivot.” Did Bernstein just front-run tomorrow’s announcement? How does Bernstein know that Powell is pivoting given that the FOMC meeting just started? Is Bernstein explicitly signalling to pressure Powell and the independent Fed to ‘pivot’?

No, none of the above, Bloomberg headline writers ‘corrected’ their report to note that Bernstein was merely confirming that Biden endorsed The Fed’s pivot to tightening this year. Pretty big difference there, Bloomberg!

US equity market had been grinding higher overnight but puked on the JOLTS data and Nasdaq extended losses while Small Caps caught a BTFD bid back into the green…

AMZN was ugly today, losing as much today as it did after earnings last week, and falling back below $1 trillion market cap for the first time since April 2020…

Source: Bloomberg

Treasury yields followed a mirror path, sliding overnight then spiking dramatically on the JOLTS data. The long-bond remains a significant outperformer on the week (-2bps) while the short-end is getting slammed (+13bps)…

Source: Bloomberg

10Y yields broke back below 4.00% overnight but by the close were back to unchanged at around 4.05%…

Source: Bloomberg

The yield curve flattened dramatically with the 3m30Y spread inverting for the first time since 2019 and now the most inverted since April 2007…

Source: Bloomberg

…and its also the 5th consecutive inverted close in 3m10Y…

Source: Bloomberg

The dollar mirrored everything else with overnight weakness instantly reversed on the JOLTS data…

Source: Bloomberg

The Brazilian Real extended its massive short-squeeze today (to its strongest against the dollar in 7 weeks) but then faded a little after Bolsanaro’s quasi-concession. That was a 32-handle rally in 2 days…

Source: Bloomberg

Bitcoin roundtripped (higher then lower) to end practically unch today…

Source: Bloomberg

Oil prices jumped today after the JOLTS data, ahead of tonight’s API data

NatGas prices plunged on warmer weather hopes…

Gold held on to some gains on the day after tumbling on the JOLTS data…

Finally, despite tomorrow’s huge event risk, VIX has continued to press to one-month lows, decoupling from stocks in the last few days…

Source: Bloomberg

As SpotGamma notes, the thing which most catches our eye this morning is IV, which continues to decline lower despite tomorrows FOMC. Below we’ve plotted VIX, VOLI, SDEX, VVVIX – they’re all at 1 month lows. Further, our RiskReversal metric remains at -0.04 which is reflecting puts being sold and/or calls being bought.

It’s always a bit surprising to us when volatility is crushed into a catalyst like FOMC. This serves to both “pull forward” some of the potential rally-fuel (via vanna) and also expose the market to more of a violent downside reaction. The point here is that its harder for well hedged markets to crash, and we’re no longer well hedged with IV readings at relative lows and the 3600 Put Wall a full 300 points lower.

So do you feel lucky again?

When $SPX was (15%) or worse at the October-end mark:

(via B of A) pic.twitter.com/49YXysnK4W

— Carl Quintanilla (@carlquintanilla) November 1, 2022

Is this what happens next?

Tyler Durden

Tue, 11/01/2022 – 16:00