Hedge Fund CIO: “How This Time Might Be Different”

By Eric Peters, CIO of One River Asset Management

Different

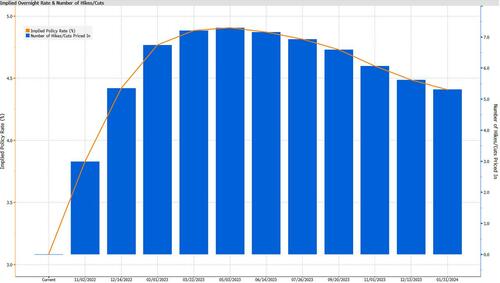

“The baseline expectation should be that the market pricing is generally right, and the mental model that served us well during every market cycle in recent decades remains the right framework today,” I said, seven of us taking turns, sharing market views. “In that model, the Fed will hike to somewhere between 4.50%-5.50% and keep rates there until something breaks, at which point inflation declines, capacity constraints ease, markets puke, and within weeks or months, a new cycle begins.” We were exploring how this time might be different.

“But the preconditions for this cycle are wildly different from those we’ve experienced in our careers, dating all the way back to the 1980s. Heading into the 2020 downturn, monetary policy had lost its effectiveness. Rate cuts and QE were no longer able to stimulate the real economy, even if they could still lift asset prices. But unlike in previous cycles, higher asset prices produced very limited wealth effects, and instead amplified inequality, which itself had become a new kind of economic headwind and a growing political crisis.”

“A post-war trend of deepening globalization was also reversing as we entered the pandemic. And the world was entering a period of rising geopolitical hostility. The pandemic spurred a massive fiscal stimulus, and this required proactive politicians. They had been absent for decades, neglecting to address our growing problems, like climate change, infrastructure, and inequality. With the rising post-pandemic international conflict, these same politicians now must also address inadequate military spending and the re-shoring of strategic industries.”

“Naturally, this has spurred inflation unlike anything seen in decades. But will it sustainably subside as it has in every previous cycle? It seems unlikely. The government needs to unburden itself from excessive debts and entitlement obligations. With potential GDP growth of 1-2% per year, the only practical way to do this is by growing nominal GDP at very high rates. This year, for example, nominal GDP grew at a +7.26% annualized rate while real GDP stagnated at a -0.10% rate. That seems like a decent outcome for the government.”

“So maybe we have years of high and volatile inflation as the global economy deglobalizes, re-shoring production, which is by nature a process of increasing redundancy while losing efficiency. That will keep certain supplies relatively low, and demand for certain inputs high. Whenever there is an economic slowdown, the government will borrow and spend more, putting labor to work on the numerous causes which we deem vital: climate, infrastructure, defense, strategic reshoring, inequality. And such capital allocation will be inefficient.”

“It’s pretty easy to imagine the economy becoming rather dysfunctional if this is how it operates in the years ahead. The inefficiencies will drive continued inflation, which will hurt the baby boomers most, and this will narrow the inequality between young and old. It will hurt people with financial assets, narrowing inequality between rich and poor. And it will inflate away government debt and entitlements, which is far too high and requires a reboot similar to what we faced after the last world war. All these things kind of seem inevitable.”

“We won’t know for years whether this new mental model for what to expect looking forward is in fact the right framework. So much will depend on politicians, policy, geopolitics, and how it all interacts with inflation. How this affects inflation expectations, which no one fully understands in a fiat world, and which have finally started to become unanchored, will also be critical. What we must do, is look out for things in this cycle that behave differently from what our old models suggest. The more persistent the surprises, the more likely it is that this different model should become our baseline.”

Tyler Durden

Sun, 10/30/2022 – 21:00