Dow Soars Towards Best Month In 84 Years Amid ‘Eye-Wateringly Speculative YOLO-ing’

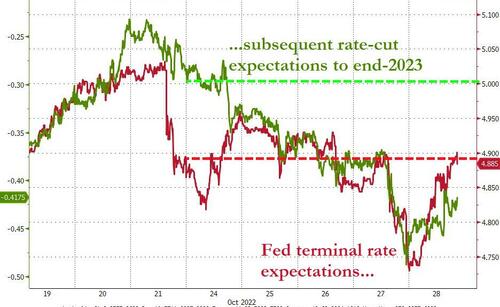

Lots of chatter this week about a Fed ‘pause’, ‘mini-pivot’, or ‘step-down’ in its hawkishness that provided the narrative for every buying-panic, and given that expectations for The Fed’s terminal rate were unchanged on the week (shifting significantly hawkishly today), but the subsequent rate-cut expectations shifted dovishly, it appears traders are focused on the middle ‘mini-pivot’…

Source: Bloomberg

But we also note that the odds of a 75bps rate-hike in December surged today (from around 20% to 40%) with next week’s FOMC a lock for 75bps…

Source: Bloomberg

So, thanks to that fundamental narrative, and a bearishly under-allocated investor base (macro) or explicitly ‘short’ positioned (systematic CTA Trend), stocks melted up amid a ‘chase’ / stop-out ‘buy to cover’ behavior we have seen all too often. On the day, Nasdaq swung from down 2.5% shortly after AAPL/AMZN earnings last night to up over 3%…

On the week, The Dow and Small Caps roared almost 6% higher leading the way while Nasdaq was the biggest loser, ‘only’ gaining 2% (after being down 3% overnight on the week)…

For some context, ahead of Monday’s month-end, we note that The Dow is on pace for its best month since since 1976 (and is getting close to The Dow’s best month since 1938). It is up 4 straight weeks (+14%) – its biggest 4-week gain since April 2020. Nasdaq is ‘only’ up 5% on the month…

This manic meltup should not have been surprise to regular readers (as discussed here, here, and here)…

Was Tim Cook buying?

But it wasn’t just buybacks and positioning, here’s Nomura’s Charlie McElligott to explain:

1) Look at the eye-wateringly speculative “YOLOing” today into 0-1 days-to-expiration OTM Call Options in US Equities Index / ETF, as Gamma is being weaponized, with Dealer hedging flows dictating / helping to self-fulfill a market melt-up…

As of mid-afternoon, 64% of all SPX Options trading today are 0-1DTE…62% of all SPY…and 60% of all QQQ!

And when you stop and think that this morning’s Cash Equities open was ES1 @ 3818—to then see that now through 12:40pm that 13% of ALL SPX Options having traded today are the 3900 Call (along with 8% of all options being the 3880C and another 7% being the 3875C), a full +2.2% above that opening Spot price…that sure is something “special”

Source: Nomura

2) This interplay from short-dated highly convex upside Options is then massive with the following “kindling,” as the monthly SPX Put Spread Collar (3290 3905 4340) is out there for Monday expiration…with Dealers Short that 3905 strike (Fund is long it) which is also pulling us toward that level as it kicks-off ~$1.25B from the associated 14k options (on top of what is already $2.8B of Gamma at the 3900 strike, with ~$325mm of that expiring today)

Source: Nomura

Even though I voiced my skepticism earlier today on what I expect to be the Fed’s “inability” to withstand this violent market-led EASING of financial conditions to an extent that is nearly a de-facto “Fed rate CUT”—which then increases the potential for a “rug pull” in days and weeks ahead vs Inflation / Labor / Wage data that isn’t backing-down…Rates flows are beginning to lend credibility to said “step down” bullish “upside optionality” trades in SOFR / USTs, as highlighted in this morning’s email

And now too on the Vol side, we are also seeing some signs of behavioral change in $Rates Gamma very much worth monitoring—from Natasha:

“The past two weeks has been the first time in a while that we have seen clients putting on payer ladders and payer 1x2s on the LHS. These trades have been untouched for a good year or more at least in swaptions. The market definitely seems to be getting more comfortable with the idea of a FED pivot, as is also apparent via the CME exchange skew which is strongly calls over.”

Industrials led the week along with Staples, Real Estate, and Utes (not exactly aggressive?) Discretionary and Energy lagged (but all sectors were up on the week…

Source: Bloomberg

VIX plunged back to a 25 handle as puts were dumped…

Treasuries were also bid on the week with the long-end outperforming…

Source: Bloomberg

10Y Yields fell back to 4.00% this week…

Source: Bloomberg

The dollar fell for the 2nd week in a row…

Source: Bloomberg

The offshore yuan saw its biggest daily rise in history this week but by the end of the week, the yuan closed weaker against the dollar

Source: Bloomberg

Bitcoin was up on the week, holding mid-week gains above $20,500 (note that the crypto surge coincided with yuan buying)…

Source: Bloomberg

Oil managed gains on the week but copper, gold, and silver all slipped lower…

Source: Bloomberg

WTI rallied up to $88 this week, back to pre-OPEC+ ‘snub’ levels…

Given the diesel crack’s extreme spread, refiners are incentivized to pump out more of that distillate… but to ‘solve’ the problem of near record low diesel stocks (which would truly bring the economy to standstill), refiners would have to switch from gasoline… which would push up the pump price for the average joe (and cruysh Biden’s midterms hope even further)…

Source: Bloomberg

Finally, this dip-buying extravaganza is coming right on cue (just like the one in June)…

Source: Bloomberg

Will FOMC or CPI be the short-term top?

Tyler Durden

Fri, 10/28/2022 – 16:00