Andreessen Horowitz Raised A $2.2 Billion Crypto Fund Just Months Before The Crash

Andreessen Horowitz’s timing in investing in the crypto world arguably couldn’t have been worse.

The firm, widely known as a major crypto bull, was the topic of a new Wall Street Journal piece this week examining just how poor its timing was before going “all in” on the blockchain and cryptocurrency boom.

As the Journal notes, crypto prices have been thrashed this year and Andreessen’s flagship crypto fund was down about 40% in the first half of the year, marking a decline that was “much larger” than other venture funds invested in crypto.

As a result the firm has “dramatically slowed the pace of its crypto investments this year”, the report says. And now, the question is being raised as to whether or not the firm even has the option of “buying the dip”.

Ben Narasin, a general partner at the VC firm Tenacity Venture Capital, told WSJ: “They’ve just pushed it so far with crypto that I’m not sure they can rebalance.”

The firm’s main crypto advocate, partner Chris Dixon, who joined in 2012, said he “remains faithful” in the industry, stating that crypto “is about the political and governing structure of the internet” before adding: “We have a very long-term horizon.”

Dixon championed bitcoin well before it was adopted in its current form, the report says. Andreessen Horowitz was an early investor in Coinbase because of Dixon’s enthusiasm for the space, the piece notes. When ethereum was launched in 2015, he decided he wanted to run his own crypto-based fund.

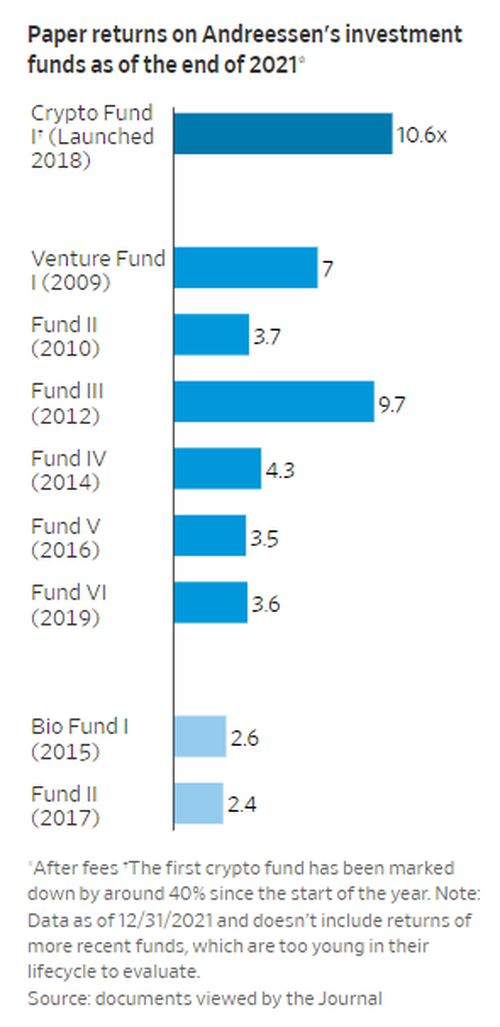

In 2018, the firm launched a $350 million fund and raised a second fund worth $515 million in 2020. By the end of 2021, “the first crypto fund had multiplied its initial investment by 10.6 times after fees”, the Journal wrote. Andreessen then returned over $4 billion in shares to investors after Coinbase went public in April 2021. It solidified Coinbase as “one of the most-lucrative bets ever made in venture-capital history”.

The firm then raised $2.2 billion in June 2021 to raise a third crypto fund, but months later the market turned against them, with demand for many of the company they invested in being “vaporized”. The Journal wrote:

OpenSea’s monthly trading volume has plummeted since its December funding round in the midst of a broader collapse in the market for NFTs, while Coinbase’s monthly active users declined 20% in the second quarter from last year’s fourth-quarter peak of 11.2 million. Both companies have cut around one-fifth of their staff this year.

Solana, an upstart cryptocurrency that the firm bought in June 2021, has shed over 80% of its value since the beginning of the year. In the first six months of this year, Andreessen lost $2.9 billion of its remaining stake in Coinbase as the crypto exchange’s stock price cratered by more than 80%.

But despite the plunge, Dixon is sticking by his strategy. He lamented: “What I look at is not prices. I look at the entrepreneur and developer activity. That’s the core metric.”

Tyler Durden

Fri, 10/28/2022 – 06:55