Apple Slides Despite Record Revenue, EPS Beat As iPhone, Warns Of Slowing Revenue Growth

Update (5:30pm): While Apple’s earnings were at worst (or best) mixed, things got decidedly uglier during the earnings call, when the company revealed that it’s about to get uglier:

Total company revenue growth will decelerate compared with 4Q

Mac revenue will decline substantially in holiday quarter due to tough comparison from last year’s redesigned MacBook Pro launch

This is as good as it gets on the guidance front: Apple said that there will be no revenue guidance due to uncertainties in the world, so it will hardly be great.

Additionally, while Apple has not blamed the soaring dollar or using constant-currency conversions, CFO Maestri did say that services revenues would be up double digits in constant currency; he also said that the company is seeing softness in gaming (App Store and Apple Arcade likely) and in digital advertising. Maestri also said that Apple will likely see 10% of currency impact in the first quarter. That’s much more severe than many tech peers (MSFT said cloud sales are hit by 5% from FX).

Some more details from the call, in which Maestri says that Apple’s paid subscriptions topped 900 million across services on Apple platforms, up 155 million in the last 12 months. That’s double three years ago. This includes Apple and third-party services through the App Store.

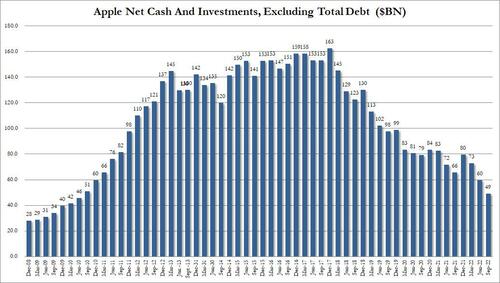

Maestri also said that Apple continues to generate “very strong” cash flow, which isn’t exactly true: yes, Apple ended the quarter with $169 billion in cash and marketable securities, but its net cash was down to just $49 billion, the lowest since 2010!

Away from the call, CFRA Research says the quarter was solid, but conditions should get more challenging “as the iPhone 14 cycle extends given the uncertain economic conditions.” That said, Apple’s premium brand should allow it to successfully increase prices, CFRA says.

* * *

With Amazon imploding after dismal earnings and catastrophic guidance, it was all up to the world’s biggest company, AAPL, to provide some – any – hail mary for a tech earnings season that has been an unmitigated disaster. Alas, it was not meant to be and despite beating on the top and bottom line, AAPL has joined the parade of doom and tumbling after hours due to numbers which the market was clearly not impressed with, and which confirm that the US and global economies are on the verge of a painful recession.

Here are the fiscal Q4 details:

EPS $1.29 vs. $1.24 y/y, beating estimates of $1.26

Gross margin $38.10 billion, +8.3% y/y, beating estimates of $37.31 billion

Revenue $90.15 billion, +8.1% y/y and a record for the September quarter, beating est. $88.64 billion

Products revenue $70.96 billion, +9% y/y, beating estimate $69.04 billion

IPhone revenue $42.63 billion, +9.7% y/y, missing estimate $42.67 billion

Mac revenue $11.51 billion, +25% y/y, beating estimate $9.25 billion

IPad revenue $7.17 billion, -13% y/y, missing estimate $7.81 billion, and down for the 4th quarter in a row.

Wearables, home and accessories $9.65 billion, +9.8% y/y, beating the estimate $8.8 billion

Service revenue $19.19 billion, +5% y/y, missing estimate $19.97 billion

Commenting on the quarter, Tim Cook said that “as we head into the holiday season with our most powerful lineup ever, we are leading with our values in every action we take and every decision we make. We are deeply committed to protecting the environment, to securing user privacy, to strengthening accessibility, and to creating products and services that can unlock humanity’s full creative potential.”

CFO Luca Maester chimed in: “our record September quarter results continue to demonstrate our ability to execute effectively in spite of a challenging and volatile macroeconomic backdrop. We continued to invest in our long-term growth plans, generated over $24 billion in operating cash flow, and returned over $29 billion to our shareholders during the quarter. The strength of our ecosystem, unmatched customer loyalty, and record sales spurred our active installed base of devices to a new all-time high. This quarter capped another record-breaking year for Apple, with revenue growing over $28 billion and operating cash flow up $18 billion versus last year.”

Cutting to the chase, yes: Apple repurchased some $25 billion in stock in fiscal Q4. The question is will it continue the buybacks at this crazy pace, or will it slow down as many are worried that it, and other tech peers, must do as we enter a recession.

Going back to the results, while Apple actually did pretty well in most categories, it disappointed in iPhone sales, which however was to be expected with several warnings in the past 3 weeks that iPhone 14 sales will be a disappointment. At $42.63 billion, or up 9.7% y/y, this missed the estimate of $42.67 billion.

iPhone sales aside, Apple’s other product categories were a mixed bag: iPad sales came in at $7.2BN, down 13% Y/Y and sliding for the fourth quarter in a row and missing estimates of $7.81BN; Mac revenue was $11.51N, up 25% and solidly beating estimates of $9.25BN. Most of the quarter’s beat appears to be in this segment. Wearables were also solid at $9.65BN, up 9.8% Y/Y, and beating the $8.8BN estimate.

But where the market was especially concerned, was Service revenue of $19.19BN, which badly missed the $19.97BN estimate…

… and rose just 5% Y/Y, the lowest annual growth in history.

A silver lining here: the price hikes for Apple Music and Apple TV+ earlier this week should give investors confidence that the miss on Services may not be a long-term issue. Still, the services number is strong compared with last year.

One other place where investors were disappointed, was China sales, because while for the most part the sales breakdown came in as expected, with growth everywhere except in Japan…

… China revenue rose 6.2% to $15.47BN, missing the estimate of $15.65BN.

And another potential problem: AAPL’s net cash has cratered, sliding to just $49 billion, or where it was in 2010, having spent tens of billions on stock buybacks. Let’s hope that Apple doesn’t actually need to use that cash…

In response to these mixed earnings, the stocks first tumbled, then rebounded and was last seen drifting modestly lower, about 1% below the closing price although that is a notable improvement from where it traded briefly after hours. As Bloomberg puts it, “Apple shares are teetering between red and green, which makes sense. This is a mixed report. Overall revenue is great, all things considered, but investors probably wish that the iPhone and Services — which should have been highlights — were a bit stronger. Still, Apple is in a far better position right now than competitors like Meta, Alphabet and Amazon.”

Still, down 1% after earnings is not a bad result compared with tech peers. Amazon is down 18% at last check.

Developing.

Tyler Durden

Thu, 10/27/2022 – 17:15