ECB Hikes 75bps As Expected And Will “Raise Further” Deciding “Meeting-By-Meeting”, Changes TLTRO Terms

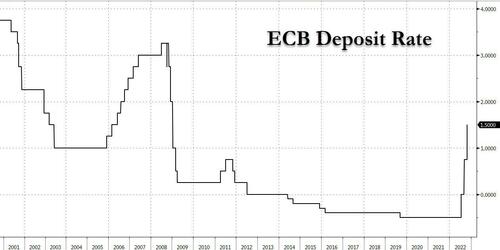

As expected (and previewed), moments ago the ECB hiked rates by 75bps, pushing the Deposit rate to 1.50%, the highest since 2008. The Refi rate was also raised by 75bps to 2.00%, all as expected.

In keeping with the hawkish bias even as the eurozone slides into a deep recession, the ECB guided that “the Governing Council took today’s decision, and expects to raise interest rates further, to ensure the timely return of inflation to its 2% medium-term inflation target. The Governing Council will base the future policy rate path on the evolving outlook for inflation and the economy, following its meeting-by-meeting approach.”

But in a potentially dovish move observed by some, the ECB dropped the language surrounding “several” rate hikes in the future. This is the current language:

With this third major policy rate increase in a row, the Governing Council has made substantial progress in withdrawing monetary policy accommodation. The Governing Council took today’s decision, and expects to raise interest rates further, to ensure the timely return of inflation to its 2% medium-term inflation target. The Governing Council will base the future policy rate path on the evolving outlook for inflation and the economy, following its meeting-by-meeting approach.

And this was the language from the previous meeting:

Based on its current assessment, over the next several meetings the Governing Council expects to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations. The Governing Council will regularly re-evaluate its policy path in light of incoming information and the evolving inflation outlook. The Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

Notably, and also as some had expected, the ECB also changed the terms and conditions of the third series of targeted longer-term refinancing operations (TLTRO III).

From 23 November 2022 until the maturity date or early repayment date of each respective outstanding TLTRO III operation, the interest rate on TLTRO III operations will be indexed to the average applicable key ECB interest rates over this period

In view of the unexpected and extraordinary rise in inflation, it needs to be recalibrated to ensure that it is consistent with the broader monetary policy normalisation process and to reinforce the transmission of policy rate increases to bank lending conditions.

The Governing Council therefore decided to adjust the interest rates applicable to TLTRO III from 23 November 2022 and to offer banks additional voluntary early repayment dates.

In order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions, the Governing Council decided to set the remuneration of minimum reserves at the ECB’s deposit facility rate (prev. 0.50%).

The details of the changes to the TLTRO III terms and conditions are described in a separate press release to be published at 15:45 CET Another technical press release, detailing the change to the remuneration of minimum reserves, will also be published at 15:45 CET.

Some more details from the report on inflation and QE:

Inflation: Inflation remains far too high and will stay above the target for an extended period

QE: The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Full ECB statement below

The Governing Council today decided to raise the three key ECB interest rates by 75 basis points. With this third major policy rate increase in a row, the Governing Council has made substantial progress in withdrawing monetary policy accommodation. The Governing Council took today’s decision, and expects to raise interest rates further, to ensure the timely return of inflation to its 2% medium-term inflation target. The Governing Council will base the future policy rate path on the evolving outlook for inflation and the economy, following its meeting-by-meeting approach.

Inflation remains far too high and will stay above the target for an extended period. In September, euro area inflation reached 9.9%. In recent months, soaring energy and food prices, supply bottlenecks and the post-pandemic recovery in demand have led to a broadening of price pressures and an increase in inflation. The Governing Council’s monetary policy is aimed at reducing support for demand and guarding against the risk of a persistent upward shift in inflation expectations.

The Governing Council also decided to change the terms and conditions of the third series of targeted longer-term refinancing operations (TLTRO III). During the acute phase of the pandemic, this instrument played a key role in countering downside risks to price stability. Today, in view of the unexpected and extraordinary rise in inflation, it needs to be recalibrated to ensure that it is consistent with the broader monetary policy normalisation process and to reinforce the transmission of policy rate increases to bank lending conditions. The Governing Council therefore decided to adjust the interest rates applicable to TLTRO III from 23 November 2022 and to offer banks additional voluntary early repayment dates.

Finally, in order to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions, the Governing Council decided to set the remuneration of minimum reserves at the ECB’s deposit facility rate.

The details of the changes to the TLTRO III terms and conditions are described in a separate press release to be published at 15:45 CET. Another technical press release, detailing the change to the remuneration of minimum reserves, will also be published at 15:45 CET.

Key ECB interest rates

The Governing Council decided to raise the three key ECB interest rates by 75 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 2.00%, 2.25% and 1.50% respectively, with effect from 2 November 2022.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it started raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Refinancing operations

The Governing Council decided to adjust the interest rates applicable to TLTRO III. From 23 November 2022 until the maturity date or early repayment date of each respective outstanding TLTRO III operation, the interest rate on TLTRO III operations will be indexed to the average applicable key ECB interest rates over this period. The Governing Council also decided to offer banks additional voluntary early repayment dates. In any case, the Governing Council will regularly assess how targeted lending operations are contributing to its monetary policy stance.

***

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target over the medium term. The Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:45 CET today.

And a redline comparison with the previous announcement:

In kneejerk response to the announcement, the EURO – which had spiked over the past 48 hours – slid back to parity with the USD amid what was a far more dovish take of the ECB announcement (the removal of the “several” language noted above) than many had assumed.

Tyler Durden

Thu, 10/27/2022 – 08:28