Will The S&P 500 Hit 2,900 By The End Of The Fed’s Tightening Cycle?

Authored by Ven Ram, Bloomberg cross-asset strategist,

The S&P 500 Index will decline about 7% for every additional 100-basis point increase in the Fed funds rate, a study of its duration shows, suggesting the index may sink as low as 2,900 should the policy benchmark rise to 6% in the current cycle.

The S&P tumbled to 3,492 earlier this month, its low for this cycle that represented a 27% decline from the start of the year, while the Nasdaq 100 Index slumped as much as 36%. The declines point to an empirical duration of 7.1 years for the S&P and 9.6 years for Nasdaq.

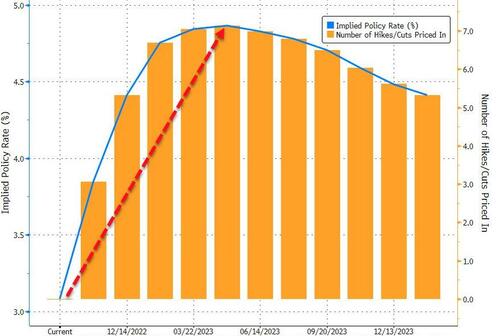

The calculations are based on the 300 basis points of increase in the Fed funds rates we have seen so far in this cycle, and factor in another 75 basis points that the markets have already priced ahead of next week’s policy review.

Interest-rate traders are penciling in a cumulative 185 basis points of further tightening in the current cycle…

…and the chart below shows how the S&P and Nasdaq may fare if the Fed were to keep raising rates to quell inflation:

Investors have repeatedly attempted to buy US stocks on every dip, though that hasn’t been a successful strategy so far.

In fact, there are indications that the Fed may have to raise rates even further than levels of around 5% the markets anticipate.

Historical evidence shows that the monetary authority has, on average, only been able to stop tightening when its inflation-adjusted policy rate has reached a full 200 basis points.

The findings on empirical duration are consistent with earlier analysis that treated stocks as quasi-debt securities, which suggested that the S&P may decline to 2,934 and Nasdaq 100 to 9,208.

The S&P now offers an additional earnings yield of about 125 basis points over the 10-year Treasury yield at 4.15%, a margin that may look increasingly anemic should the Fed keep going and spur yields higher.

What could go wrong with the declines penciled in for the S&P and Nasdaq based on empirical durations?

Any indication that the US economy — which has thus far been resilient — is approaching a stall may deter the Fed from raising rates further than levels of around 4.6% that its members have penciled in. Such a scenario may offer stocks some reprieve, although that prospect will also raise questions about the depth and length of any slowdown, which may act as a drag on earnings.

Any systemic crisis and liquidity issues that dog Treasuries may also throw a spanner in the works and act against the Fed’s calculus.

The findings on empirical duration provide a useful framework for pricing in the vicissitudes of stocks against a backdrop of the most ambitious Fed tightening cycle in decades

Tyler Durden

Wed, 10/26/2022 – 12:40