China Congress Ends As “Dictator For LIfe” Xi Stacks Inner Circle With Loyalists; Equity Market Implications

One week after it started with a historic, “resetting” speech by China’s President, on Sunday – a day after China’s top political meeting of the past five years wrapped up – Xi Jinping unveiled a new leadership team stacked with loyalists as he looks to consolidate his power in a precedent-busting third term.

One day after his predecessor Hu Jintao was unceremoniously escorted out of the 20th Party Congress for reasons still unknown, Xi walked into Beijing’s Great Hall of the People followed by members of the Communist Party’s new Politburo Standing Committee — the pinnacle of Chinese leadership — in descending ranking order.

As Nikkei reports, Shanghai party chief Li Qiang was the first member behind Xi to walk into a room packed with journalists, confirming his second-in-command rank and signaling that he will become the country’s next premier. The pair were followed by anti-corruption chief Zhao Leji, ideology tsar Wang Huning, Beijing party head Cai Qi, top Xi adviser Ding Xuexiang and Guangdong province chief Li Xi. Most have previously worked with the 69-year-old Xi over the years as he shot up the ranks of the party.

Vice Premier Hu Chunhua, a protege of former President Hu Jintao who had been seen as possible contender for premier, appeared to have been demoted after he not only failed to make Xi’s inner circle but was also excluded from the 24-member Politburo.

And for the first time in a quarter century, there will be no women in the Politburo after the retirement of its sole female member Sun Chunlan, a vice premier and China’s top pandemic handler. Surely US women’s rights group will get right on top of that boycotting Chinese goods.

The unveiling of Xi’s cabunet comes after Xi sealed up his bid for a new term at Saturday’s official close of the twice-a-decade National Congress. Analysts had predicted that Xi would surround himself with loyalists in a bid to crush the party factionalism and infighting that marked the tenures of his predecessors Hu Jintao and Jiang Zemin, and they were absolutely correct.

“The appointments of Xi’s associates to the highest positions of power in China indicates that Xi’s vision for China will be rigidly executed in the next decade,” said Valarie Tan, an analyst at the Germany-based Mercator Institute for China Studies. “Those promoted to power have had their political careers closely tied to Xi’s leadership, implying that this is going to be an administration that will not question or challenge Xi’s authority.”

In remarks to Sunday’s briefing, Xi said his administration would be on “high alert” for the challenges ahead. This echoed a speech to the opening of the congress when he elevated security to the top of the agenda, as Beijing navigates a slumping economy and soaring tensions with the U.S. and other Western nations.

“The journey ahead is long and arduous but with determined steps, we will reach our destination,” he said. “We will not be daunted by high winds, choppy waters or even dangerous storms.”

China would “always champion the common values of humanity” as the world grapples with “unprecedented challenges,” he added.

“When all countries pursue the cause of common good, we can live in harmony, engage in cooperation for mutual benefit and join hands to create a brighter future for the world,” he said. “Just as China cannot develop in isolation from the world, the world needs China for its development.”

On Saturday, nearly 2,300 party delegates chose a new Central Committee composed of 205 voting members that was pivotal to the top leadership shuffle. The newly picked committee met for the first time on Sunday behind closed doors to vote on candidates for the Politburo Standing Committee led by Xi as general secretary, and the larger Politburo.

Some of the current leaders were dropped including Premier Li Keqiang, who was scheduled to retire this year, as well as senior official Wang Yang, who had been seen as a contender for Xi’s second-in-command.

While the just-ended congress set out top officials and Xi as head of the party and military, some governmental positions will be confirmed in March at the National People’s Congress, China’s rubber-stamp parliament.

Most notably, Xi will renew his presidency for a third time, after he ditched a two-term limit from China’s constitution in 2018, opening the door for him to rule for life.

On Saturday, party cadres adopted changes to the party constitution that among other things incorporated Xi’s ideologies and economic policies including a focus on boosting domestic growth and reducing inequality.

“The document gives Xi’s ideas and leadership political legitimacy. Since it is a legal document, it can then be used by Xi to provide the legal basis for justifying the use of force to diffuse any tension, take down any opposition within the party-state,” Tan said. “Those who run afoul of those ideas enshrined in the constitution can be officially deemed as in violation of the party.”

In response to the expected outcome, Rep. Michael Waltz (R-Fla.) on Sunday said Chinese President Xi Jinping has “cemented his place as a 21st century emperor of China” after breaking with tradition and securing a third, five-year term to lead the nation.

“He has stacked to the organs of power in China with his loyalists. He has centralized power with himself. He has eliminated term limits,” Waltz told Fox News’ “Sunday Morning Futures” host Mario Bartiromo. “He is dictator for life now, all with a major step towards what he sees as his legacy.”

Waltz, who sits on the House Armed Services Committee, said Xi has “become the most powerful Chinese dictator” since Mao Zedong, the communist dictator who founded the People’s Republic of China (PRC) party and ruled until his death in 1976.

“And that’s returning China to become the global superpower — not a superpower — but the global superpower, in line with ancient Chinese greatness,” Waltz added.

* * *

Below we summarize and excerpt the key points on the now concluded Chinese Congress from the Goldman economics team, which focuses on the new appointments, and the equity market implications (full note available to pro subs in the usual place)

1. Key features of the top leadership (Politburo Standing Committee)

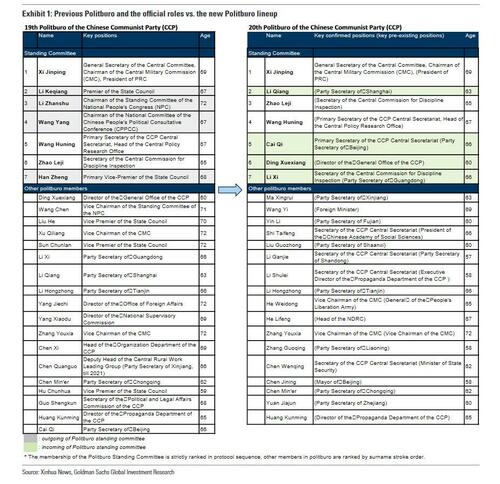

The number of PSC members remains at seven, as widely expected. There are four new members in the Politburo Standing Committee (PSC): Li Qiang (currently serves as the Party Secretary of Shanghai), Cai Qi (the primary secretary of the CCP Central Secretariat), Ding Xuexiang (served as director of the General Office of the CCP) and Li Xi (currently Party Secretary of Guangdong), who are all drawn from the previous 19th 25-member politburo (one rung below PSC in party leadership).

Most of the new appointees worked with President Xi at earlier stages of their careers (for example Li Qiang and Cai Qi worked with Xi Jinping in Zhejiang and Ding Xuexiang has been working with Xi Jinping since 2007 in Shanghai). Li Keqiang (current Premier of the State Council), Li Zhanshu (current Chairman of the Standing Committee of the National People’s Congress), Wang Yang (current chairman of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC)) and Han Zheng (current primary vice Premier of the State Council) have retired, while Xi Jinping, Wang Huning, and Zhao Leji remain as the Standing Committee members of the PSC.

Xi is reaffirmed as the party’s general secretary and chairman of the Central Military Commission (CMC). Based on the lineup of the Standing Committee members, we think Xi will in all likelihood also keep his government position as the President of the PRC, and Li Qiang will likely be the Premier of the State Council; but these government-related roles will not be confirmed until the National People’s Congress (NPC) to be held in March next year.

Li Xi will replace Zhao Leji as the new chief of the party’s anti-corruption body (Central Commission of Disciplinary Inspection, CCDI), a party post that was also officially announced today. The government positions for the rest of the new PSC members will not be formally revealed until the NPC next March. Exhibit 1 compares the members of the 20th PSC with those of the 19th PSC.

2. More broadly on the new Politburo and the Central Committee, and amendments to the Party Constitution:

The number of the Politburo members declined marginally from 25 to 24. He Lifeng (current head of the NDRC (National Development and Reform Commission) newly joined the Politburo and is widely expected to replace Liu He (a key economic policy advisor to Xi Jinping and the director of Central Finance and Economic Affairs Commission, the Financial Stability and Development Committee under the State Council) and to be in charge of policies related to the economy and the financial market. Other notable senior policymakers related to economic/financial policies include Yi Huiman, who is the 20th Central Committee member and currently serves as the head of the China Securities Regulatory Commission (CSRC). The current head of the China Banking and Insurance Regulatory Commission (CBIRC), Guo Shuqing, is no longer a member of the 20th Central Committee; and the current head of the People’s Bank of China (PBOC), Yi Gang, is no longer an alternate member of the 20th Central Committee; these imply they will retire from their government roles as well.

Based on our estimates, overall turnover rate of the 20th central committee (relative to the 19th Central Committee) is 66%, slightly higher than the 65% turnover rate of the 19th Central Committee (2017) and notably higher than the 57% rate of the 18th Central Committee (2012).

Amendments to the Party Constitution: Although the new version of the Party Constitution has not been released as of now, state media including Xinhua News have flagged major amendments. Besides more significant highlights of Xi Jinping’s thoughts, the new Party Constitution will incorporate “modernization with Chinese characteristics”, “dual circulation” strategy, “ensuring both development and security”, “uplifting the fighting spirit and enhancing the ability to fight”, “building a world-class army” and “resolutely opposing and foiling secessionist activities aimed at ‘Taiwan independence’” into the Party Constitution. There will also be continued focus on “high-quality growth” and “common prosperity”. It’s still unclear whether “Two Establishes” (两个确立) and “Two Safeguards” (两个维护) – two political slogans promoted by CCP to reinforce Party leadership under CCP General Secretary Xi Jinping – have been directly added to the Party Constitution, but state media has been emphasizing the importance of these requirements.

3. Policy implications and key upcoming events:

We do not think the 20th Party Congress (and its first Plenum) would be the occasions for key policy changes, and continue to expect a gradual relaxation of “Dynamic Zero Covid” policy stance to start in Q2 2023. Policy implementation could be more efficient though as personnel-related issues (related to party roles) have been settled.

Upcoming key policy events related to the economy include the Politburo meeting inn early December in preparation for the Central Economic Work Conference (CEWC), the CEWC itself by late December, and the Two Sessions in March 2023.

Equity market implications from the 20th Party Congress from the GS Portfolio Strategy team:

1. An unprecedented third term for President Xi. On October 23, at the opening day of the First Plenum of the 20th National Party Congress, President Xi was elected as the General Secretary of the CCP and the Chairman of the Central Military Commission for the next 5 years. The appointments deviate from implicit post-Mao Party conventions in at least two respects: a) a de facto 2-term limit for CCP General Secretary and the unwritten “7 up 8 down” retirement age for senior Party leaders; and, b) marking the first time for a top leader in the Party’s history to officially extend his reign for the third term since the Mao Zedong era.

2. Markets historically have liked political changes. Outside of the General Secretary position, 4 and 15 new members have been introduced to the Politburo Standing Committee (PSC) and the Politburo, effectively keeping the total number of PSC members unchanged but 1 less for the Politburo (24). Notable retirees from the Standing Committee are Premier Li Keqiang and Wang Yang, Chairman of the CPPCC, both at the age of 67. While data-points are limited, empirically, Chinese equities have usually performed well shortly after the conclusion of the Congress in the episodes where top leadership transition took place (i.e. changes in the highest and second-highest ranked Party leaders), with the post-Congress market performance positively correlated with the number of member changes at the Politburo. This perhaps reflects market expectation that incoming leaders would prioritize growth over other competing objectives when they took office, and possibly investors’ appreciation of the fact that the (policy-making) power transition mechanism was in place within the Party.

3. Gauging the policy and political focus of the new leaders. By tabulating the recent speeches during the Congress from outgoing and newly elected Politburo and PSC members as per our selected key words under two broad categories— ideology/politics, and economy/markets—we note that incoming leaders could arguably be more focused on ideological and political subjects while the retiring policymakers appear more economy/market-oriented. This orientation may also apply to two key positions that are influential to the capital markets—Premier and Vice Premier/Director of Financial Stability and Development Committee—possibly assumed by Li Qiang (former Party Secretary of Shanghai) and He Lifeng (Minister of the NDRC) respectively based on their current Party rankings. While we recognize this key-word analysis could be subject to selection bias given the nature of the Party Congress (political as opposed to economic) and the specific responsibilities of the Politburo members, the results are by and large consistent with the key messages from President Xi’s opening speech at the Congress last Sunday and the latest amendments to the Party Constitution, which carry a strong flavor of “development with Chinese characteristics” and national security. Government-related positions will be officially unveiled at the National People’s Congress scheduled in March 2023.

4. Elevated equity risk premium (ERP), even accounting for slower growth and higher risks ahead. MSCI China currently trades on 8.9x forward PE, 11.1x ex banks, and 12.5x on a median basis, all at around 1.8 s.d. below historical averages. Earnings yield gaps from median stocks are at 2.3 s.d. and 0.1 s.d. to the inexpensive side for the onshore and offshore markets, and implied volatility and option skew on HSCEI are close to year-to-date highs (in March), all suggesting that significant risk premia has been built into equity prices. From a modeling standpoint, the market is trading at around 15% valuation discounts to what we view as fundamental-driven fair value for Chinese stocks, and we estimate its prevailing valuations may have already priced in roughly 2.5% probability that left tail scenarios (proxied by Russia’s current index PE), possibly related to heightened geopolitical tensions or structural degradation in growth, could materialize assuming market risk premium and corporate profitability are normally distributed in our probability-weighted fair-value model. That said, more clarity on the Zero Covid Policy (ZCP), stabilization of the property market, and de-escalation of cross-strait and US-China tensions are necessary conditions for ERP to moderate, in our view.

5. Moving on from the Congress to (zero) Covid. Investors have been eagerly looking for policy signposts for re-opening during the Congress. This is understandably so as China reopening could be one of the most visible, long-awaited, and powerful upside catalysts for the market aside from the possibility of a (dovish) Fed pivot and/or a cessation of the Russia-Ukraine war, in our view. In fact, on a perfect hindsight basis, our cross-country empirical study from 36 markets since 2020 reveals that equity markets tended to pre-trade the actual implementation of re-opening (as defined by the peak readings of our economists’ Effective Lockdown index during the initial and the Delta waves), gaining 5% 1-month before Covid-related disruptions began to dissipate, with the positive momentum generally lasting for 2-3 months. Benchmarking this trading pattern to our economists’ baseline view that China will probably start to re-open in 2Q23, we’d argue China could start to trade cyclically better in the early part of next year, everything else being equal.

6. Strategies: Sticking with “Plan A” and “Little Giants”, taking advantage of elevated skew in the Offshore market, selectively raising SOEs. With risk assets globally still being challenged by rising rates, sticky inflation, and lurking recession risk, we reiterate our market preference of favoring A shares over Offshore equities given the former’s lower sensitivity to global macro factors, and domestic-oriented liquidity profile. In contrast, ERP could stay elevated for and weigh on Offshore equities in the short run possibly due to investor concerns over the absence of recognized market-oriented economic reformers in the newly configured PSC, although a combination of elevated option skew (HSCEI), low headline index valuations, and light investor positioning (high short interest ratios) leads us to believe that upside optionality could be an inexpensive hedge to right tail surprises, most likely from improving clarity on the ZCP and re-opening roadmap. Thematically, we believe Chinese Little Giants are well-placed to benefit from strategic policy tailwinds and could be a key source of alpha generation for investors under President Xi’s leadership and development vision. The emphasis on and pursuit of “Common Prosperity” will likely strengthen under the new leadership, boding well for select SOEs that might be deemed as strategically- or socially-important by policymakers. As such, we screen for Buy-rated SOEs (on Conviction List) from our analysts team, and SOEs that are better positioned to generate superior equity returns based on their: 1) R&D intensity and R&D expense growth, and 2) focus on aligning shareholders’ and management’s interests (e.g., have a stock incentive plan), both of which have been key explanatory factors for their outperformance empirically.

More in the full Goldman note available to pro subs.

Tyler Durden

Sun, 10/23/2022 – 14:08