Next British Leader Faces Same Old Bleak Outlook

By Joe Easton and Michael Msika, Bloomberg markets live commentators and reporters

After weeks of political chaos, a new UK leader could bring some much-needed stability for the country’s financial markets. But for investors, the broad picture won’t change anytime soon: the UK economic outlook remains bleak.

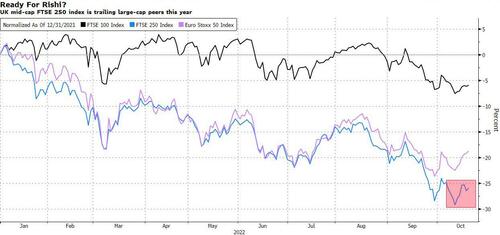

Domestic-focused shares like homebuilders, banks and retailers all rallied after Liz Truss said she would quit as prime minister on Thursday, but gains were quickly trimmed. The FTSE 250 index, which makes about half its sales in Britain, ended the session up 0.8%.

No matter who enters Downing Street next — be it frontrunner Rishi Sunak or even Truss’s predecessor Boris Johnson — British companies are facing an economy being pushed into recession by surging inflation and interest rates. That’s unlikely to change any time soon.

“I wouldn’t expect UK equities to have a significant bounce,” said Peter Chatwell, head of global macro strategies trading at Mizuho International, “We are on the wrong side of a deep and painful recession.”

Those recession concerns are most evident in banking stocks, which have slumped despite the jump in bond yields. Investors are too concerned about a collapse in loan volumes and a surge in defaults to get excited about a boost to profits from rising interest rates.

Meanwhile, once the new leader is named next week, the focus will turn to Chancellor Jeremy Hunt’s planned statement a few days later, after he scrapped almost all of Truss’s growth-targeting policies.

To ensure calm in markets, investors need to see a fiscally responsible budget presented alongside an independent assessment by the Office for Budget Responsibility, according to Liberum strategist Joachim Klement. The market’s preferred replacement PM would be Sunak, who managed the country’s finances well during the pandemic, Klement adds.

However, greater fiscal prudence under a new PM could actually be a further negative for the economy and stock market, with reduced household energy support and scrapping of an income tax cut likely to put further pressure on consumer spending. The upcoming corporation tax hike — which Truss wanted to stop — will also dent British firms’ profits.

Still, UK stocks are historically cheap, and may attract more interest when the economic outlook shows signs of improvement. British shares are trading at a 40% discount to the MSCI World index — an all-time low. Jefferies strategists say an M&A wave in UK stocks is likely, as companies have become inexpensive in dollar terms.

“Political uncertainty and messy news flow can explain part of the discount,” said Charles-Henry Monchau, chief investment officer at Syz Bank, “But this seems exaggerated.”

Tyler Durden

Fri, 10/21/2022 – 12:00