“They’ve Totally Lost Control” – Yen Puke Sparks Market-Wide Chaos

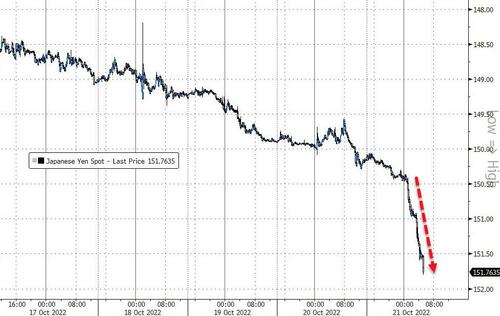

Despite intervention chatter overnight, the Japanese Yen is puking hard this morning, crashing above 151/USD just hours after breaching 150/USD for the first time in 32 years…

That Finance Minister Shunichi Suzuki reiterated Friday that Japan was ready to act, saying that the recent sudden, one-sided yen weakness was undesirable and he was watching markets with a high sense of urgency.

160/USD (from April 1990) looks like the next support…

That puke is triggering chaos across the rest of global markets.

US Treasury yields are spiking (10Y above 4.30%)…

US equity futures are getting hit hard…

And Bitcoin plunged back below $19,000…

As one veteran trader MSG’d us: “they’ve totally lost control, The BoJ is f**ked either way here.”

He is referring to the fact that while no one is talking about it, The BoJ’s YCC scheme has failed with 10Y JGBs now trading above 25bps for over a month.

The Bank of Japan on Thursday said it would launch an emergency bond-buying operation, offering to purchase ¥250bn ($1.7bn) of government debt as it works to pin down yields even as long-term interest rates rise globally.

The choices before Japanese policy makers are stark:

either relax the yield-curve control framework;

or be willing to yen the weaken.

Until then, as we discussed last month, further interventions are doomed to failure.

Indeed, as Bloomberg’s Ven Ram recently noted: “there is no third choice really at a time when inflationary pressures in the US are likely to compel the Fed to keep going and causing inflation-adjusted yield differentials to move in favor of the dollar against the yen. “

Tyler Durden

Fri, 10/21/2022 – 08:26