Goldman Jumps As Traders Spark Q3 Revenue Beat But Total Earnings Plunge 45% As Investent Bank Slump Continues

Concluding the big banks’ Q3 earnings reports, some of which were disappointing (MS), some were mediocre (JPM, Citi and Wells), and some were spectacular (BofA), moments ago Goldman Sachs reported a 43% Y/Y drop in Q3 profits – as the Wall Street giant suffered from a continuing slowdown in investment banking fees and asset management revenue, offset by a jump in trading profits – and confirmed the previously reported overhaul of its organizational structure meant to prop up the bank’s stagnating stock market valuation; despite the drop, results than analysts expected, while CEO and occasional DJ, David Solomon (D-Sol) confirmed Goldman would combine its trading and investment banking business into one unit as it shrinks from four to three divisions.

Let’s dig into the Q3 numbers:

Revenue $11.98 billion, down 12% y/y, but beating the median estimate of $11.43 billion.

Net income $3.1BN, down 43% y/y from $5.4bn, but beating the median estimate of $2.9BN. This was Goldman’s 4th straight profit decline. or $14.93 per share in the same period last year.

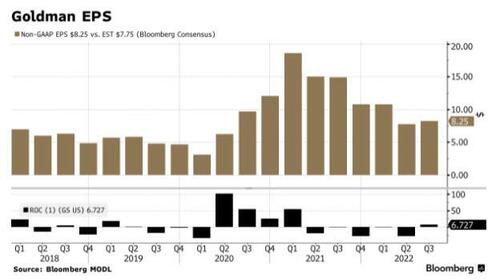

EPS of $8.25, down 45% y/y from $14.93, but also beating the $7.75 median estimate.

Some more details from the quarter:

Annualized ROE +11%, estimate +10.5%

Return on tangible equity +12%, estimate +11.2%

Standardized CET1 ratio 14.3%, estimate 14.3%

Book value per share $308.22

Efficiency ratio 64.3%, estimate 62.7%

Net charge-offs $172 million, estimate $174.1 million

Assets under management $2.43 trillion, +2.3% y/y, estimate $2.5 trillion

Total AUS net inflows $27 billion, estimate $12.28 billion

Loans $177 billion, estimate $176.07 billion

There was a curious flip in the company’s effective tax rate which rose to 16.9% from 16.3% due to “a decrease in the impact of tax benefits on the settlement of employee share-based awards.”

“Against the backdrop of uncertainty and volatility in the markets, we continue to prudently manage our resources and remain focused on risk management as we serve our clients,” CEO Solomon said in a statement. The bank also announced a realignment of its business segments which will now include Asset & Wealth Management, Global Banking & Markets and Platform Solutions. “We are confident that our strategic evolution will drive higher, more durable returns and unlock long-term value for shareholders,” Solomon added.

Solomon also appeared on CNBC, discussing the compoany’s results and its transformation. Here are the highlights from that interview:

Marcus Still Important Part of the Firm, Solomon Says

Capital Markets Don’t Close for Years at A Time

Firms With Reason to Go Public Will Still Go Public

Goldman Has Been Taking Market Share From Other Banks: Solomon

‘There’s A Good Chance We’ll Have A Recession’

The big culprit behind the continued results weakness was investment banking, where revenues were down a whopping 57% Y/Y and 26% lower Q/Q to $1.576BN, below consensus estimates for $1.63BN. The decrease compared with the second quarter of 2021 primarily reflected significantly lower net revenues in equity and debt underwriting, as well as disappointing financial advisory and corporate lending revenues.

According to Goldman, the drop in net revenue was “significantly lower” compared with a strong Q3 2021 reflecting:

Financial advisory net revenues which reflected a significant decline in industry-wide completed mergers and acquisitions transactions from elevated activity levels in 3Q 21

Equity underwriting and Debt underwriting net revenues reflecting a significant decline in industry-wide volumes

Corporate lending net revenues primarily reflecting net markdowns on acquisition financing activities and net losses on hedges

Here are the details:

Equity underwriting rev. $241 million, beating the estimate $226.7 million

Debt underwriting rev. $328 million, missing the estimate $430.4 million

Financial advisory revenue $972 million, just beating the estimate $970.7 billion

There was some silver-lining news for Goldman’s investment bankers, as their backlog “was essentially unchanged” which is likely good news all things considered.

There was more bad news in Asset Management (loosely Goldman prop), where net revenues were just $1.82 billion for Q3, 20% lower than the third quarter of 2021 if 68% higher than the second quarter of 2022 when stocks crashed. The bank made less money on equity investments as well as equity and debt investments, which was partially offset by gains in management fees as well as other fees. According to Goldman, the decrease compared with the third quarter of 2021 reflected “significantly lower net revenues in Equity Investments and Lending and debt investments.” Some more details:

Management and other fees reflected the inclusion of NN Investment Partners in 3Q 22 and the impact of fee waivers on money market funds in 3Q 21

Equity investments net revenues reflected significantly lower net gains from investments in private equities, partially offset by mark-to-market net gains from investments in public equities compared with significant net losses in 3Q21, to wit:

Private: 3Q 22 ~ $310 million, compared to 3Q 21 ~ $1,755 million

Public: 3Q 22 ~ $215 million, compared to 3Q 21 ~ $(820) million

Goldman also provided the following useful breakdown of the bank’s equity and debt investments

The weakness in iBanking and Asset Management was modestly offset by a stronger than expected quarter for the bank’s Global Markets group, where net revenues rose 11% Y/Y from Q3, 2021 to $6.2 billion, if 4% lower than the second quarter of 2022. The number was half a billion beat to the consensus expectation of $5.69 billion.

Some more details:

Q3 FICC net revenues were $3.525 billion, 41% higher than the third quarter of 2021, and well above the $3.04 billion consensus, reflecting “significantly higher net revenues in interest rate products and currencies, and higher net revenues in commodities and credit products, partially offset by significantly lower net revenues in mortgages; FICC financing net revenues were significantly higher, primarily driven by repurchase agreements and mortgage lending.”

Q3 Equity net revenues were $2.676 billion, 14% lower than Q3 2021, and also beating estimates of $2.65 billion, due to “significantly lower net revenues in cash products and lower net revenues in derivatives; Equities financing net revenues were slightly lower”

Elsewhere, revenues in Consumer & Wealth Management were $2.377 billion for the third quarter of 2022, 18% higher than the third quarter of 2021 and 9% higher than Q2 2022. Net revenues in Wealth management were $1.63 billion, unchanged from the second quarter of 2021, as Management and other fees were essentially unchanged YoY despite recent market depreciation; Incentive fees were significantly lower, driven by harvesting in 3Q 21. Private banking and lending net revenues were significantly higher, reflecting higher loan and deposit balances.

Meanwhile, net revenues in Consumer banking were $744 million, 95% higher than the third quarter of 2021, primarily reflecting significantly “higher credit card balances and higher deposit spreads.” This is notable given that the consumer unit is not going to be its own unit anymore after the bank’s reorganization.

Curiously, even though Goldman has the smallest “balance sheet” of all big banks, the vampire squid said that its provision for credit losses was a surprisingly higher $515 million for the third quarter of 2022, below the $590 million consensus estimate and higher compared with $175 million in the third quarter of 2021. The bank also revealed that Q3 charge-offs were $172 million for an annualized net charge-off rate of 0.4%, unchanged QoQ; while the wholesale annualized net charge-off rate of 0.1% was down 10bps QoQ as the consumer annualized net charge-off rate of 2.9% rose 60bps QoQ. Overall, Goldman’s allowance for credit losses was $5.59 billion as of Sept 30, 2022, up $0.32BN Q/Q.

And while looking at the balance sheet, Goldman reported Net Interest Income of $2.043BN, up $479MM from $1.564BN a year ago, an increase which “primarily reflected higher loan balances and rates.”

On the expense side, Goldman revealed a 17% increase in total operating expenses to $7.7 billion for the third quarter of 2022, and essentially unchanged compared with the second quarter of 2022. The firm’s efficiency ratio for the YTD period was 62.7%, compared with 52.8 for YTD Q3 2021.

According to the release, compensation and benefits expenses were higher, reflecting a smaller reduction in the year-to-date ratio of compensation and benefits to net revenues, net of provision for credit losses, compared to 3Q 21. Non-compensation expenses were significantly higher, reflecting i) Higher expenses related to growth initiatives (including acquisitions)l ii) Higher net provisions for litigation and regulatory proceedings; iii) Higher business activity.

In kneejerk reaction to the stronger than expected sales and trading numbers (and generally ignoring the disappointing asset management and ibanking results), Goldman stock jumped about 3%, rising as high as $320, the highest price since Sept 22.

The full Goldman presentation is below (pdf link)

Tyler Durden

Tue, 10/18/2022 – 09:32