Futures Jump, Squeezed By Reversal In UK Fiscal Plans And Apocalyptic Trader Sentiment

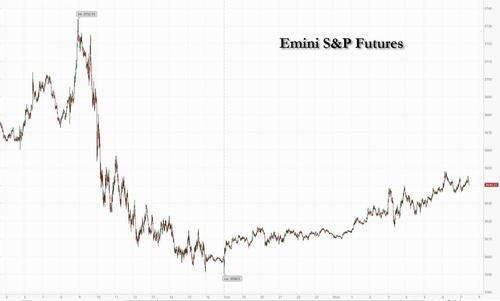

As we discussed and previewed over the weekend in “Behind Friday’s Market Massacre: A Huge Burst Of Hedge Funds Shorting, Setting Up Another Squeeze“, futures are indeed sharply higher to start the week as Treasury yields slumped and the dollar eased as the British peso (also called Britcoin) rallied and UK bonds surged as the new Chancellor Jeremy Hunt scrapped plans to cut taxes and signaled consumers would shoulder more of the increase in energy prices from next April as he set out a package of measures to get a grip on the public finances, effectively reversing pretty much all UK tax cut measures announced just a few weeks ago. Sentiment was also boosted by company results after Bank of America reported beats on the top and bottom line, rising in premarket trading while utilities and auto stocks led gains in Europe. That was indeed enough to spark a modest (for now) squeeze and as of 730am, S&P 500 futures trade higher by 1.3% and Nasdasq 100 futs rose 1.5% bouncing back from a selloff on Friday that left the technology-heavy gauge at its lowest since July 2020; Europe’s Estoxx50 rose 0.7% in early London session, which sees cable higher by 1%. The BBG Dollar index was down 0.2% and the 10Y traded at 3.95%.

And if all those record retail puts purchased in recent days get monetized, expect another epic meltup today.

I don’t think people really appreciate what’s happening in the options market right now.

Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open.

This is the first time in history that puts were 3x calls. pic.twitter.com/GR2apNfFtb

— Jason Goepfert (@jasongoepfert) October 16, 2022

Among notable premarket movers, Splunk rose after a Wall Street Journal report about activist investor Starboard Value building a stake of just under 5% in the application software company. Opendoor Technologies Inc. slipped after Goldman Sachs downgraded the stock to sell. US-listed Chinese stocks gained as President Xi Jinping reiterated that economic development is the party’s top priority in his speech at the Communist Party Congress, although he signaled little change in the Covid Zero strategy and housing market policies. Alibaba (BABA US) +1.9%, Pinduoduo (PDD US) +2.8%, JD.com (JD US) +3.3%, Nio (NIO US) +2.7%, Li Auto (LI US) +2%. Here are some other notable premarket movers:

Opendoor Technologies (OPEN US) slides 1.8% in premarket trading after Goldman Sachs downgrades stock to sell, saying it sees the ongoing weakness in housing through next year to “depress” the online real estate platform’s earnings power and in turn limit upside in shares.

Keep an eye on Fox Corp. (FOXA US) and News Corp. (NWSA US) shares after the companies said on Friday they were exploring options to recombine, while analysts suggested a deal is unlikely to solve the valuation problem for the pair.

Watch PPG Industries (PPG US) shares as KeyBanc Capital Markets initiated coverage of the stock with an overweight recommendation, saying there’s probably going to be a sharp decline in costs in 1H23 that will help offset cyclical volume pressure.

Keep an eye on household products stocks as Morgan Stanley is starting to warm to the sector with margins seen rebounding in 2023, while toning down its preference for beverage stocks.

The broker upgrades Church & Dwight (CHD US) and Clorox (CLX US) to equal-weight from underweight, while cutting Edgewell Personal Care (EPC US) to underweight from equal-weight.

Investors are focused on results due this week — including from Bank of America which just reported stronger than expected revenues and EPS, Goldman Sachs and Tesla — for clues about how company earnings are holding up. They’re also monitoring the possibility of more aggressive rate hikes in the US after Federal Reserve Bank of St. Louis President James Bullard on Friday left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings.

“I think the likelihood of them doing 75bps and more is definitely higher after the University of Michigan survey last week, reason being is that they’re late to the party of inflation control and the world economy is paying the price,” said Sunaina Sinha Haldea, global head of private capital advisory at Raymond James. “The risk is that they break growth, but what is much more concerning is that they’re risking financial stability in parts of the market, which is a risk that needs to be priced in,” she said on Bloomberg TV.

In major corporate reorganization news, the WSJ reported that Goldman Sachs plans to recombine the bank’s asset management and private wealth businesses into one unit in yet another overhaul.

Morgan Stanley’s in-house permabear, Michael Wilson, echoed precisely what we said on Saturday, namely that technicals may now take the upper hand over fundamentals, with the 200-week moving average acting as a strong support to equities, while inflation expectations peak. They see a tactical rally looking likely until earnings estimates are cut or a full-blown recession arrives.

Meanwhile, the outlook for consumer prices in the US continues to fuel bets that the Federal Reserve may make jumbo rate hikes at its next two meetings, weighing broadly on the outlook for global economic growth and markets. Fed officials in their latest comments suggested they were ready to hike rates higher than previously planned. Kansas City Fed President Esther George said the terminal rate may need to be higher to cool prices. San Francisco Fed’s Mary Daly said she’s “very supportive” of raising to restrictive levels and to between 4.5% and 5% “is the most likely outcome.”

In European stocks, utilities, autos and insurance are the strongest performing sectors. Euro Stoxx 50 rises 0.3%. IBEX outperforms peers, adding 1.1%. Here are the most notable European movers:

ITV shares jump as much as 9.7%, the most since March, after the Financial Times reported that the company is exploring options for its production arm ITV Studios, including a stake sale.

Nel shares rise as much as 10%, the most since late July, after the company won a NOK600m contract to provide alkaline electrolyser equipment to Woodside Energy.

Made.com shares soared as much as 35% after the online furniture seller said it has received several “non-binding indicative proposals,” including possible offers for the company.

Sulzer shares climb as much as 4.4% after the Swiss company announced Suzanne Thoma will replace CEO Frédéric Lalanne, who is stepping down at the end of the month. Thoma’s experience and continuation of the company’s strategic review is viewed as a positive, according to analysts.

Hargreaves Lansdown shares fall as much as 7.9% after its 1Q trading update, with its CEO announcing his intention to retire amid a lawsuit relating to a failed equity fund run by Neil Woodford.

Asos shares drop as much as 13% after the online fast fashion retailer said it was in talks with banks to boost its financial flexibility, following a Sky News report that the firm’s lenders were hiring restructuring advisers, including AlixPartners.

Draegerwerk shares tumble as much as 7.5% after company withdrew FY22 guidance following market close on Friday, based on its preliminary 9-month figures.

Shares in bike helmet maker Mips plunge as much as 27%, the most in three years, as Handelsbanken said lower-than-expected 3Q sales from the company show the bike boom of the past years turning “into a bust” while 2023 risks becoming a “lost year.”

European luxury stocks drop after Chinese President Xi Jinping signaled no change in China’s strict Covid rules at the country’s Communist Party congress in Beijing on Sunday. LVMH shares decline as much as 1.8%.

As noted above, the yield on 10-year gilts fell 36 basis points to 3.97% and the pound traded 1.1% higher at $1.1293 after new Chancellor Jeremy Hunt scrapped plans to cut taxes and signaled consumers would shoulder more of the increase in energy prices as he set out a package of measures to get a grip on public finances in a televised statement on Monday. It’s the start of what may be a particularly torrid week for British assets, with the beleaguered Truss battling to rescue her premiership after the Bank of England ended its emergency bond-buying program on Friday and as mutinous backbenchers plot to oust her.

“I think we’re in for a period where UK credibility is continually questioned and UK assets remain incredibly volatile for a significant period of time,” Benjamin Jones, Invesco Director of Macro Research, said on Bloomberg Television. “Watching the gilt market will be absolutely key in understanding if the market does believe Hunt to be more stable and if he will be able to push these policies through.”

Hunt will also speak to the House of Commons at 3:30 p.m. London time and Truss is due to host a reception for the Cabinet at 10 Downing Street on Monday evening. U-turns on the government’s “mini budget” now total £32 billion, however that may not be enough as the official estimate of the black hole in the public finances is believed around £70 billion.

Earlier in the session, Asian equities resumed their decline, led by tech stocks, as investors analyzed Chinese President Xi Jinping’s speech at Party Congress, in which he ruled out changes to strict Covid rules. The MSCI Asia Pacific Index retreated as much as 1.4% before paring the drop, with TSMC and Keyence among the biggest drags after a broader US tech selloff last week. All sectors but real estate were in the red. Taiwan’s benchmark was a notable regional loser, ending 1.2% lower as the local currency weakened following comments by Xi’s about the island. Stock gauges in Japan fell about 1% after the Bank of Japan vowed to continue with monetary easing as the yen approached a key level. Benchmarks in Hong Kong erased losses, while gains in defense and tech stocks helped gauges in mainland China close moderately higher after Xi’s Sunday speech emphasized national security and self-reliance in core technologies. Planned steps by Chinese regulators to stem a slump in equities also buoyed sentiment. Asian stocks have underperformed US and European peers this year as the region struggles with challenges in China in addition to aggressive rate hikes by the Federal Reserve, prompting an exodus of foreign funds from emerging countries.

“The work report made no reference to future policy changes on Covid containment,” Nomura economists including Ting Lu wrote in a note, adding that they expect Chinese markets to suffer regardless due to disappointment about either no real opening or a surge in Covid infection numbers. Concerns of aggressive tightening by the Fed were reinforced after a survey Friday showed US year-ahead inflation expectations rose in early October for the first time in seven months. “More bad news is baked into Asia, which might suggest that the risk reward is a little bit better if we can see overall the Fed starts to stabilize at some point, perhaps early next year,” Timothy Moe, chief Asia equity strategist at Goldman Sachs, said in an interview with Bloomberg TV, citing Asia’s “excessive discounting particularly in valuations.”

Japanese stocks dropped, with electronics makers the biggest drag, following US peers lower after a report showed American year-ahead inflation expectations rose for the first time in seven months. The Topix fell 1% to close at 1,879.56, while the Nikkei declined 1.2% to 26,775.79. Keyence Corp. contributed the most to the Topix Index decline, decreasing 2.9%. Out of 2,167 stocks in the index, 476 rose and 1,603 fell, while 88 were unchanged

Australia stocks slid, the S&P/ASX 200 index falling 1.4% to close at 6,664.40, tracking a decline in US shares last week after inflation expectations rose. All sub-gauges slid, with energy and materials companies the worst performers. In New Zealand, the S&P/NZX 50 index fell 0.8% to 10,785.92.

In FX, the dollar weakened against all of its G-10 peers apart from the yen, as the Bloomberg dollar spot index fell 0.2%. SEK and JPY are the weakest performers in G-10 FX, GBP and AUD outperform; the pound topped the leaderboard and UK government bonds surged on the fiscal policy u-turn. Yields on 10-year gilts fell 26 basis points to 4.05%, while sterling advanced up to 1.2% higher on the day to touch $1.1305 after the BOE confirmed it terminated its emergency bond-buying program. Hedging the pound overnight remains a costly exercise after UK Chancellor of the Exchequer Jeremy Hunt announced measures to “support fiscal sustainability”. Commodity currencies also outperformed. The Australian and New Zealand dollars rose as traders covered shorts after Chinese President Xi warning of “dangerous storms” ahead failed to spur broader selling. The euro traded in a narrow $0.9711-57 range. Bunds and Italian bonds rose alongside Treasuries as central bank tightening bets were pared. Japan’s Yen traded in a narrow range, close to 32-year lows, as traders await fresh impetus to drive it lower and assess potential action from Japanese authorities. Japan’s 30-year bond yield rose to a seven-year high.

In rates, Treasuries rallied, led by the belly and richer by 5bp to 8bp across the curve with gains led by front-end and belly, richening the 2s5s30s fly by almost 5bp on the day; 10-year yields around 3.945%, richer by 7.5bp on the day and lagging gilts by additional 27bp in the sector, following a surge across gilts as BOE rate-hike premium is pared after Chancellor Hunt scraps vast portions of the expansive fiscal stimulus plan that had plunged the market into turmoil. UK yields off lows of the day, although remain richer by 35bp to 40bp across the curve into early US session. UK bonds rally across the curve, led by the long-end, as the new Chancellor is expected to make a statement on the government’s fiscal plans, with the yield on 10-year gilts falling 36 basis points to 3.97% and the pound traded 1.1% higher at $1.1293.

In commodities, WTI drifts 0.2% lower to trade near $85.41 as it fluctuated after a weekly slump as fears over an economic slowdown continue to weigh on the outlook for demand. French PM Borne said about 30% of the country’s petrol stations face supply issues due to a slight worsening of strikes at refineries, while Borne also stated that TotalEnergies ( TTE FP) CEO agreed to extend the fuel discount, according to Reuters. Spot gold is propped up by a softer Dollar, with the yellow metal back above USD 1,650/oz and eyeing its 21 DMA at USD 1,670.10/oz. LME metals are mixed with 3M copper losing some ground and just about holding onto USD 7,500/t+ status, whilst LME aluminium underperforms following an enormous LME stockpile increase of over 65k tonnes.

Bitcoin was rangebound and holding just above the USD 19k mark at present.

Looking at the day today, it’s a quiet day with just the Empire Manufacturing index on deck (exp. -4.3).

Market Snapshot

S&P 500 futures up 0.9% to 3,630.00

STOXX Europe 600 up 0.3% to 392.36

MXAP down 0.8% to 136.71

MXAPJ down 0.6% to 442.50

Nikkei down 1.2% to 26,775.79

Topix down 1.0% to 1,879.56

Hang Seng Index up 0.2% to 16,612.90

Shanghai Composite up 0.4% to 3,084.94

Sensex up 0.6% to 58,280.17

Australia S&P/ASX 200 down 1.4% to 6,664.44

Kospi up 0.3% to 2,219.71

German 10Y yield little changed at 2.27%

Euro little changed at $0.9728

Brent Futures down 0.2% to $91.45/bbl

Gold spot up 0.63% to $1,654,87

U.S. Dollar Index down 0.17% to 113.12

Top Overnight News from Bloomberg

UK Chancellor of the Exchequer Jeremy Hunt will accelerate plans on Monday to try to bring order to the UK’s public finances and reassure markets, after Liz Truss’s economic program triggered weeks of turmoil

Chinese President Xi Jinping signaled no change in direction for two main risk factors dragging down China’s economy — strict Covid rules and housing market policies — providing little lift to a worsening growth outlook

Double-digit inflation is set to return in the UK and linger through the end of this year despite the government’s effort to cap energy bills, a survey of economists shows

Speculation intensified among Tokyo’s yen watchers that Japan may be using subtle ways to slow the currency’s decline, zeroing in on the volatility seen after Thursday’s surprise US inflation data. By one estimate, authorities may have spent around 1 trillion yen ($6.7 billion) to support the currency

Further rate hikes are costs without benefits, Polish Monetary Policy member Ireneusz Dabrowski says in interview with Parkiet newspaper

ECB Governing Council member Martins Kazaks said interest rates should be raised beyond year- end — a time when economists increasingly expect the euro zone to be in the midst of a recession

ECB Governing Council member Olli Rehn said financial stability risks on the international markets are “clearly increasing”

EU natural gas prices fell to the lowest level in more than three months as the European Commission plans to propose a temporary mechanism to prevent extreme price spikes in derivatives trading through a dynamic limit for transactions on the Dutch Title Transfer Facility, according to a draft document seen by Bloomberg News.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were negative as the region took its cue from last Friday’s declines on Wall St where risk assets were pressured by inflationary concerns, while the region also digested hawkish global central bank rhetoric and China sticking to its strict zero-COVID policy. ASX 200 was led lower by the commodity-related sectors and with Australian Treasurer Chalmers flagging an increase in the cost of living due to floods in the primary food growing areas. Nikkei 225 weakened with Japan said to consider a rise in corporation tax as an option to fund the nation’s defence budget which could double in the next few years. Hang Seng and Shanghai Comp. were lower following Chinese President Xi’s speech to kick-start the Communist Party Congress in which he defended the zero-Covid policy and reaffirmed intentions for the reunification of Taiwan, while attention was also on the PBoC which rolled over CNY 500bln of MLF loans and kept the rate at 2.75% which suggests a likely pause in its benchmark rates later this week.

Top Asian News

Chinese will delay the release of Q3 economic indicators including GDP, according to the Stats Bureau; no new date mentioned.

PBoC injected CNY 500bln via 1-year MLF with the rate kept at 2.75%, as expected.

China locked down nearly 1mln people near an Apple (AAPL) iPhone factory in which Zhengzhou city ordered residents in one district to stay home, according to Bloomberg.

BoJ Governor Kuroda said the BoJ is continuing with monetary easing since Japan’s headline inflation is likely to fall below 2% next fiscal year, while he added it is appropriate to continue monetary easing to ensure a shift in the deflationary norm and achieve the inflation target in a sustainable and stable manner, according to Reuters.

BoJ Deputy Governor Wakatabe said it is up to the Finance Ministry to decide on whether or not to intervene in the FX market and that current FX fluctuations are clearly too rapid and too one-sided.

Japanese top currency diplomat Kanda said they are ready to take decisive action if excess FX moves continue and are backed by speculative trading, while Kanda reiterated that recent JPY moves were somewhat rapid, according to Reuters.

BoK Governor Rhee said he does not see interest among US officials in pursuing a plaza accord to stem the dollar strength, while Rhee also stated that the BoK needs a little bit more experience and technical capacity for forward guidance, according to Reuters.

South Korean Finance Minister Choo said the government will scrap taxes on foreigners’ income from Korean treasury bonds and monetary stabilisation bonds from Monday, according to Reuters.

China Delays Release of GBP Data Due Tuesday, No Reason Given

Xi Says China’s Power Has Increased, Warns of ‘Dangerous Storms’

EU Agrees to New Iran Sanctions Over Human-Rights Issues

Mizuho CEO Eyes Expanding Investment Banking in US: Nikkei

European bourses see a choppy session but have tilted towards the green after experiencing a mixed cash open. Sectors are mostly firmer with no overaching theme – Insurance, Autos, and Utilties lead the gains whilst Chemicals, Retail and Consumer Products lag. US equity futures see gains across the board following the steep losses on Friday – with the NQ and RTY narrowly outperforming

Top European News

BoE Governor Bailey said they will not hesitate to raise interest rates to meet the inflation target and that the Bank had to intervene to deal with the threat to the stability of the financial system, while they think inflation should peak at around 11% and his best guess is that inflationary pressures will require a stronger response than perhaps thought in August, according to Reuters.

BoE Governor Bailey said he does not comment on fiscal policy but has to emphasise sustainability, while he spoke with UK Chancellor Hunt and said that there is a meeting of minds on sustainability. Furthermore, Bailey said they are going to have to stay very focused on the risks of second-round effects on inflation, according to Reuters.

UK Chancellor Hunt said taking difficult decisions now is the best way to stop interest rates from rising and that the PM hasn’t changed the destination, she has changed the way we are going to get there. Hunt also commented that the PM is in charge and the last thing they need is another Conservative leadership campaign, according to Reuters.

UK Chancellor Hunt said ‘yes’ when asked if he can change the mini-Budget plans and noted that the priority will be to help struggling businesses and families, while he is leaving all possibilities open when asked about government spending and stated that tax will not be cut as quickly and some taxes will go up, according to Reuters.

UK Chancellor Hunt is to make a statement later today, bringing forward measures from the Medium-Term Fiscal Plan that will support fiscal sustainability, via Treasury. Hunt will deliver the full medium-term fiscal plan, to be published with OBR forecasts, on 31st October. Chancellor Hunt met with BoE Governor Bailey and the DMO head on Sunday night, to brief them on these plans.

UK Chancellor Hunt is to delay plans to reduce the basic rate of income tax by a year and it was also reported that the draft forecast by the OBR fiscal watchdog sees the UK will have a black hole in public finances of up to GBP 72bln by 2027/28, according to The Sunday Times.

Senior Tories will hold talks this week on a “rescue mission” that could see the swift removal of Liz Truss as leader, after the new Chancellor Hunt tore up her economic package and signalled a new era of austerity, according to The Observer. Furthermore, The Times reported that Tories held secret talks on installing a new leader and Daily Mail also reported that UK lawmakers will attempt to oust UK PM Truss this week despite warnings from Downing Street that it could trigger a general election.

Reportedly almost all of Kwarteng’s GBP 45bln of unfunded tax reductions is set to be scrapped by Chancellor Hunt, via FT’s Parker; “including income tax cut and stuff on dividends, stamp duty, foreign shoppers and IR35.”

US President Biden said he wasn’t the only one who thought that UK PM Truss’s original economic plan was a mistake, according to Reuters. It was also separately reported that Goldman Sachs downgraded its UK growth outlook after the government tax U-turn.

Head of UK’s Unison union warned the largest nationwide strike of NHS workers since the early 1980s could occur this winter if ministers ignore calls to match pay with inflation, according to FT.

BoE is publishing a market notice which sets out how energy firms and commercial lenders can apply to participate in the energy markets financing scheme; open to applications today; alongside this the UK Gov’t has published a release, outlining the financing scheme and specifying that the gov’t will only be liable if a firm defaults on their repayment; scheme is designed to help firms facing temporary shot-term financing problems.

Europe Gas Drops to 3-Month Low as EU Plans More Crisis Measures

Germany Faces $85 Billion Hit as Labor Shortages Intensify

Dominant Hunt Refuses to Rule Out New U-Turn on Truss Taxes

ITV Jumps as Report Says It’s Exploring Options for Studios Unit

FX

Pound perkier on premise that new UK Chancellor will be more frugal with public finances, Cable comfortable on 1.1200 handle and EUR/GBP probing 50 DMA just shy of 0.8650.

Aussie and Kiwi recover amidst less risk-off environment ahead of RBA minutes and NZ Q3 CPI; AUD/USD hovering around 0.6250 and NZD/USD just under 0.5600.

Loonie, Franc and Euro all firmer vs Greenback as DXY slips from Friday’s peak to pivot 113.000, USD/CAD eyeing 1.3800, USD/CHF close to parity and EUR/USD above 0.9750.

Yen propped ahead of 149.00 vs Dollar as Japanese officials turn up volume of verbal intervention.

PBoC set USD/CNY mid-point at 7.1095 vs exp. 7.1331 (prev. 7.1088)

Major Chinese state-owned banks were seen swapping yuan for dollars in the forwards market and selling dollars in the spot market to stabilise the local currency, according to sources cited by Reuters.

Fixed Income

Gilts gap-up and lead the way ahead of a potential “mini-Budget” U-turn from new Chancellor Hunt, peers buoyed in turn.

Specifically, Gilt Dec’22 posts upside of over 300 ticks around the 97.00 mark with the associated 10yr yield down to near 4.0%.

Amidst this, SONIA is taking a dovish-turn despite the weekend’s remarks from Bailey, with pricing dipping to ‘just’ a ~75% chance of a 100bp increase in November.

Stateside, USTs are firmer by around 15ticks with the US-specific docket comparably sparse after last week’s key inputs.

BoE Gilt statement: As previously announced, the Bank terminated these operations and ceased all bond purchases on Friday 14 October. As intended, these operations have enabled a significant increase in the resilience of the sector.

Commodities

WTI and Brent futures trimmed earlier gains in downside that was exacerbated after reports China is to delay is Q3 GDP release.

French PM Borne said about 30% of the country’s petrol stations face supply issues due to a slight worsening of strikes at refineries, while Borne also stated that TotalEnergies ( TTE FP) CEO agreed to extend the fuel discount, according to Reuters.

Spot gold is propped up by a softer Dollar, with the yellow metal back above USD 1,650/oz and eyeing its 21 DMA at USD 1,670.10/oz.

LME metals are mixed with 3M copper losing some ground and just about holding onto USD 7,500/t+ status, whilst LME aluminium underperforms following an enormous LME stockpile increase of over 65k tonnes.

CCP National Congress

Chinese President Xi declared the new core mission of the party is to lead China united in the challenge to be a powerful, modern socialist nation by 2049. Chinese President Xi said they will promote a high level of opening to the outside world and will maintain pluralistic and stable economic relations with other countries. Furthermore, Xi said they will strengthen the ability to prevent and control the epidemic, while he also commented that the next five years will be crucial for building a modern socialist power and will aim for high-quality growth, as well as support the private economy unwaveringly, according to Reuters.

China Communist Party spokesman Sun said China is capable of greater miracles going forward but noted China has entered a new normal of slower growth and is more focused on fixing long-term issues than growth. Sun also stated that they all hope the pandemic will end soon but what they see now is that the pandemic is still on and that their Covid prevention policy is the best and most economically efficient, according to Reuters.

Chinese government officials are backpedalling on efforts to organise a meeting between US President Biden and Chinese President Xi on the sidelines of the G20 summit next month, according to Politico.

Chinese President Xi said they will firmly promote reunification efforts with Taiwan and it is up to the Chinese people to resolve the Taiwan issue, while he added they will never renounce the right to use force and said reunification of the motherland must and will certainly be achieved.

Chinese Communist Party spokesman Sun said achieving reunification with Taiwan by peaceful means best meets the interest of all and the use of force is the last resort under compelling circumstances, while he added that Taiwan will plunge into a disaster if pro-independence Taiwan and external forces are left unchecked, according to Reuters.

OPEC Headlines

OPEC Secretary-General al-Ghais said slow economic growth reflects on oil demand and that OPEC+ took the pre-emptive decision, while he added OPEC doesn’t target a specific price but targets a balance between supply and demand. Al Ghais also stated that they do not control oil prices and that their decisions are purely technical, as well as noted that there is always space for flexibility in OPEC when asked about reviewing this month’s oil output cut. Furthermore, he commented that oil markets are going through a stage of great fluctuations, according to Reuters.

Iraq said OPEC+ decisions are based on economic indicators and there is consensus in OPEC+ to be pre-emptive to deal with the current uncertainty in oil markets, while it added that the OPEC+ latest decision is based on market inputs and it is essential to achieve market stability, according to a SOMO statement cited by Reuters.

UAE Energy Minister said the OPEC decision was purely technical and unanimous not political as some described, according to Reuters.

Kuwait said it welcomes the recent decision by OPEC+ to cut output and said it is keen to maintain balance in the oil markets for the benefit of consumers and producers, while it added that expected slow global economic growth led to more disturbance in the balance of supply and demand in oil markets, according to Reuters. Furthermore, Kuwait appointed Badr Al Mulla as its new Oil Minister and appointed Wahab Al Rasheed as Finance Minister, according to a tweet.

Oman’s Energy Ministry said OPEC+ decisions are based on purely economic considerations, as well as realities of supply and demand in the market, while the decision was important and necessary to reassure the market and support its stability, according to a Tweet.

Bahrain’s Oil Minister said the OPEC+ decision was reached by consensus among all member states and that OPEC+ will study any economic developments in the future to ensure the stability of markets and global supply, according to the state news agency cited by Reuters.

ECB Headlines

ECB’s Knot said he is increasingly convinced that rates need to rise above neutral and once rates hit a neutral level, it makes sense to consider running off APP stock, according to Reuters.

ECB’s Rehn said the threat of stagflation has intensified. The stability risks of international financial markets are clearly increasing. Although the global financial crisis has been avoided for now, it is not time to breathe a sigh of relief.

ECB’s Lane expected to propose a 75bps hike at the upcoming ECB meeting, according to an ECB insider cited by Econostream.

ECB’s de Guindos expects FX rate to stabilise in the coming months, via Reuters.

Some ECB officials are seeing legal basis to toughen bank TLTRO terms, according to Bloomberg sources.

Geopolitics

Ukrainian President Zelensky said Bakhmut and Soledar in eastern Donbas are hotspots at the front with heavy fighting, while it was separately reported that that Kyiv’s Mayor Klitschko said blasts hit Kyiv’s city centre, according to Reuters.

Russian Defence Ministry said Russia destroyed three US-made M777 Howitzers in Ukraine’s Kharkiv region and that Russian troops repelled Ukrainian attempts to advance in the regions of Donetsk, Kherson and Mykolaiv, according to Reuters.

Russian Defence Ministry said 11 people were killed and 15 were wounded after two Tajikistan citizens committed an act of terrorism at a training ground in Russia’s Belgorod.

US Event Calendar

Oct. 14-Oct. 21: Sept. Monthly Budget Statement, est. -$50b, prior -$64.9b

08:30: Oct. Empire Manufacturing, est. -4.2, prior -1.5

DB’s Jim Reid concludes the overnight wrap

After numerous weeks of immense volatility, will the fact that US payrolls and CPI are out the way and the fact that the UK has sacked its Chancellor, and is gradually backtracking, bit by bit, on its recent fiscal giveaway, lead to calmer markets? We shouldn’t underestimate how much the relatively small UK market has buffeted global markets in recent weeks. The politics are slowly moving in a more market friendly direction but a very sharp sell-off in Gilts on Friday afternoon left a nasty taste as we ended the week. 30yr Gilts closed +24bps on Friday to 4.79% but were around +55bps higher from the lunchtime lows. The Bank of England won’t be buying today for the first time in this mini-crisis so we’ll soon have a decent idea if there are still pension fund liquidity problems.

Part of the reason Gilts sold off late on Friday was a global related sell-off but part of it was a buy the fact sell the rumour trade after news leaked in the morning that the Chancellor was to be sacked. PM Truss’s subsequent afternoon press conference seemed to leave the market wanting more climb downs. In fact new Chancellor Hunt did extensive media rounds over the weekend saying that nothing is off the table in terms of reviewing the mini budget and that some taxes may have to rise. Several media reports suggest that the planned 1p income tax cut next April will be delayed by a year. So it’ll be fascinating to see how UK yields open up. Over the weekend, the Bank of England (BOE) Governor Andrew Bailey stated that the central bank will not hesitate to increase interest rates to meet its inflation target as it believes that the current inflationary pressures demand a stronger policy action than announced in August. In early Asia trading, the pound (+0.52%) is rallying rising to $1.1230 on the weekend’s tighter fiscal commentary. Literally as we go to print, a headline has come through saying that the UK Chancellor will make a statement today on the medium-term fiscal plan. So things are accelerating rapidly.

For this week China’s Party Congress that started yesterday could generate plenty of headlines, with key leadership roles and priorities for the next five years in focus (see latest below). The country’s Q3 GDP and key economic activity indicators will be released tomorrow.

Elsewhere, housing market indicators from the US, inflation data in the UK and economic sentiment indicators from Europe will be released. Netflix, IBM, Tesla, Bank of America, and Johnson & Johnson will be among the corporates reporting as earnings season starts to gather momentum. This could be key to sentiment in the coming weeks.

Let’s go through the key economic data in a little more detail now. Starting with the US, this week will feature industrial activity indicators such as industrial production (Tues) and the Empire manufacturing index (today). For the former, our US economists expect a -0.4% print (-0.2% in August). The housing market will be in focus too, with fears over a big softening on one hand but balanced in the short-term by last week’s CPI print that showed strong momentum in rents. The releases will include housing starts, building permits (both Weds) and existing home sales (Thurs).

Over in Europe, the UK will continue to be in the spotlight with CPI, RPI and PPI to be released on Wednesday with the first expected at 10.1% (August CPI printed at 9.9% YoY and below July’s 10.1%). Staying in the UK, October GfK consumer confidence figures will be released as well as September retail sales on Friday.

Elsewhere in the region, sentiment indicators will include the ZEW survey for Germany and the Eurozone tomorrow and business and manufacturing confidence for France on Thursday. We will get the PPI for Germany on the same day. In politics, the European Council’s two-day meeting will start on Thursday with topics of Ukraine, energy and the economy on the agenda.

In Asia, China’s Q3 GDP, industrial production and retail sales, along with other indicators, will be released tomorrow. The median estimate on Bloomberg points to a +3.4% YoY reading, up from +0.4% in Q2. On Friday we will also get the nationwide CPI from Japan and our Chief Japan economist expects core inflation excluding fresh food to show a +2.9% YoY increase (+2.8% in August) and core-core inflation excluding fresh food and energy to rise by +1.8% (+1.6% in August). Durable goods and food prices are seen as the core inflation drivers.

Finally, this week will be packed with corporate Q3 results from key American and European firms as this earnings season ramps up. The tech names we will hear from include Netflix, ASML, IBM and Lam Research, with hardware makers particularly in focus amid slowing demand concerns. Other notable reporters will include Johnson & Johnson, Lockheed Martin, Tesla, Bank of America (today), Procter & Gamble, and Goldman Sachs. The day by day week ahead guide at the end has which days each report.

Asian equity markets are trading in negative territory at the start of the week, following a weak close to the week in the DM world, although US futures are up as we start the week. Across the region, the Nikkei (-1.43%) is leading losses with the Hang Seng (-1.16%), the CSI (-0.45%) and the Shanghai Composite (-0.10%) also trading lower. The KOSPI is flat. Contracts on the S&P 500 (+0.43%) and the NASDAQ 100 (+0.39%) are both edging up.

Over the weekend, Chinese President Xi Jinping, in his speech at the opening ceremony of the ruling Communist Party of China’s 20th National Congress, gave a defiant message to the world as he warned against “interference by outside forces” in Taiwan. At the same time, he reiterated the validity of the Zero-Covid policy while signaling that there would be no immediate loosening in restrictions despite the social and economic pain caused by the policy.

Staying on China, The People’s Bank of China (PBOC) announced that it will maintain its 1-yr Medium-Term Lending Facility (MLF) interest rate at 2.75% for the second consecutive month while injecting liquidity worth 500 billion yuan into the banking system through MLF operations. So far in 2022, the MLF rate has been cut by 20bps with 10bps moves in January and August.

In FX, the Japanese Yen dropped to 148.77 against the US dollar, a fresh 32-year low, before easing to settle at 148.70. Meanwhile, yields on 10yr USTs are trading just below 4% level (-2.5bps) as we go to press.

Looking back on last week now, yet another upside CPI surprise ruined any chance of a near-term Fed policy pivot, driving yields higher and the curve flatter. All told 2yr Treasury yields were +19.0bps higher on the week (+3.5bps Friday) while the 10yr climbed +13.5bps (+7.3bps Friday). That left the 2s10s curve at -48bps, near its most inverted levels of the cycle, as additional tightening and a harder landing was priced in. By the end of trading, markets were pricing +142bps of tightening through the next two FOMC meetings. That’s close to our updated US Economic call of +75bp hikes in November and December, but markets are pricing some risk of +100bps in November following the blockbuster CPI, with +78.6bps priced at the end of last week.

The S&P 500 staged a befuddling rally the day of the print (with a 5.5% turnaround) but ultimately retreated -1.55% (-2.37% Friday) on the week. In line with tighter expected policy, the NASDAQ underperformed, falling -3.11% (-3.08% Friday). The moves came with huge intraday swings, which had the Vix index of volatility close above 30 every day, closing the week at 32.02, just beneath the year’s high of 36.45 reached when Russia invaded Ukraine. US banks kicked earnings off in earnest on Friday. As you might expect, FICC revenues have held up given the heightened volatility, and net interest income improved with the blistering pace of Fed rate hikes, while deal making revenue has slowed given the gloomy economic outlook. All told, the S&P 500 banks advanced +2.43% on the week (+0.03% Friday), outperforming the broader index.

In Europe, yields also took another leg higher, with 10yr bunds +15.2bps higher over the week (+5.9bps Friday). However, the curve steepened, with 2yr bunds gaining +9.0bps (+3.5bps Friday). The biggest story was of course in the UK, with the Chancellor gone and the partial u-turn on the budget. That led gilts to outperform bunds, where 10yr gilts gained +9.7bps (+13.7bps Friday) and 2yr gilts fell -25.4bps (+11.6bps) as some near-term crisis management hikes were priced out of the market. However as mentioned at the top 30yr Gilts were still an issue, climbing +39bps in a volatile week (+24hrs Friday).

European equities fared much better than the US. The STOXX 600 pulled back just -0.09% (+0.56% Friday), with the DAX (+1.34%, +0.67% Friday) and CAC (+1.11%, +0.90% Friday) both out-performing.

Tyler Durden

Mon, 10/17/2022 – 07:49