“Uncharted Territory”: Housing Market Predictions For 2023

Submitted by QTR’s Fringe Finance

Since Fringe Finance has started, I’ve scoured the Earth far and wide to try and bring a perspective on real estate to the blog that is going to be both no bullshit and an unfiltered on-the-ground opinion that I know and trust (and could add value to my readers). After all, it’s an asset class that I am not nearly as in-tune with as I am with equities and, well…beer.

And to be honest, I didn’t have to scour much, as a good friend of mine is a brilliant up and comer in the world of real estate in Philadelphia. I’ve worked with her several times and have known her for years – she’s insightful, pragmatic, conscientious and has a serious pulse on the industry. I know for a fact that she works her ass off, eating, sleeping and breathing real estate on the daily.

As such, my kind friend, award-winning realtor Kira Mason, has agreed to drop in once in a while to offer up her take on the pulse of the industry for benefit of my readers. Kira runs the Substack Gritty City Real Estate, which you can read & follow free here and she is @kmasonrealtor on Twitter.

Kira’s first exclusive post for Fringe Finance readers was last week’s piece on how quickly the real estate market is deteriorating: “Change Is Afoot”: Home Buyers “Shocked” By Rates, Sellers Lament Price Plunges

Kira’s Housing Market Predictions for 2023

Let’s start with something we can all agree on: housing is in the midst of a major slowdown. Existing home sales are falling faster than they did during the great financial crisis of the mid to late aughts, and mortgage interest rates have just about doubled since the start of the year and are now flirting with 7%. As a result, housing affordability is deteriorating at full tilt. The market is hemorrhaging buyers, and sellers are holding tight to the record low rates they locked these past couple of years and are hunkering down for the ensuing… for the ensuing what? Correction? Crash? Meltdown? It depends on who you ask.

Every expert and industry leader seems to have a wildly different take on what comes next; our patch of common ground is approximately the size of an empty lot in north Philly. The conditions we’re seeing don’t map neatly onto any other time in history. As a result, we find ourselves on uncharted territory in which everyone is busy trying to get a grip and the perspective refresh rate is hourly.

Perhaps unsurprisingly, the most conservative projections I’ve seen have come from industry insiders. The National Association of Realtors chief economist Lawrence Yun predicts that we’ll see 1% appreciation in 2023: essentially a flattening of prices. Our local Bright MLS economist Lisa Sturtevant expects the same. Those in this camp tend to reason that low inventory will prevent prices from dropping, even while demand plummets.

Morgan Stanley, on the other hand, originally predicted price growth in 2023 but recently revised their forecast. They are now predicting that prices will fall 7% YoY by the end of next year. Incredibly, that would only return prices to where they were in January 2022. Goldman Sachs also revised their initial 2023 forecast from a stall to a 5-10% price decline. Moody’s Analytics’ revised prediction matches that of Goldman Sachs.

Bill McBride in his extraordinary CalculatedRisk Newsletter takes a long look and predicts that over the next 5-7 years, nominal prices will decline 10% or more and real prices will decline 25%. This is an important distinction; most other forecasters aren’t adjusting for inflation, which is likely to be an especially meaningful consideration in the coming years. McBride acknowledges that record low inventory will help to anchor prices, but he’s less optimistic about the degree to which they will be able to do so.

Another favorite real estate analyst of mine, Mike Simonsen of Altos Research, thinks there is a chance that prices will stay flat in 2023, but he is not confident that conditions will allow for it. He’s keeping a close eye on inventory in the coming weeks: It is typical for inventory to drop leading up to the holidays; if instead it continues growing into November, Simonsen sees that as an unusual bearish signal that would not bode well for housing prices in 2023.

Get 50% off: If you enjoy this article, would like to support my work and have the means, I would love to have you as a subscriber and can offer you 50% off for life: Get 50% off forever

Inventory nationwide is significantly lower than what we might consider normal, and despite a severe lack of buyer demand, we are still technically in a sellers market. Homeowners today have low housing costs, high equity, and record employment levels. As most sellers are also buyers facing the same affordability issues, they are not easily parting with their homes. Unlike the crash of 2008, unless conditions shift, any inventory buildup is likely to be the result not of seller desperation but of glacial buyer demand.

Subprime lending practices were the driving force behind the great financial crisis, and the market was flooded with inventory when interest rates went up. Since then, mortgage credit availability has rested at below average levels. It is now at its lowest point since March 2013. Underwriting standards have been massively shored up and getting a loan is no longer quite so easy, which will certainly change the flavor of whatever correction we’re poised to see in 2023 and beyond.

What prices end up doing in 2023 seems to hinge on two major factors:

Seller motivation. If anything causes inventory to surge, prices could plummet. If buyer demand stays suppressed there will be some inventory buildup, but for more significant price drops to occur, sellers need more reason to sell. Recession hitting big and causing significant job losses may create the conditions for a sell-off in 2024, and if rates are still high at that time, it would be fair to expect prices to drop precipitously.

Housing affordability. We can tell by looking at metrics from online real estate engines like Zillow and Trulia that buyers are looking at even more listings online today than they were a year ago, despite far less in-person showing activity. Millennials are the largest sector of home buyers in America, making up 43% of the market. Many of them still want to buy homes but have had their plans foiled by rate hikes these past few months. We saw that when rates rose above 5.5%, buyer activity plummeted. If rates fall below this level in the near future, we could see a quick release of pent up demand.

In my little corner of the Philadelphia market, buyers are becoming discouraged as they watch their purchasing power decline as if by the hour. Many of my clients, and those of my colleagues, have decided to shelve their plans until conditions change. In response to this precipitous drop in demand, more and more sellers are reducing the prices of their homes and/or offering to pay down buyer rates in an effort to keep them in the game. At the same time, I’ve got opportunistic buyers in the sidelines rubbing their hands together and waiting for prices to fall, at which point they’ll swoop in with either cash or confidence that rates will drop and allow them to refinance in the near future.

Prices in Philadelphia are 36% higher than they were three years ago. Even if the most extreme predictions I’ve seen come true, prices would not fall below pre-pandemic levels. Inventory is starting to expand slightly in our area, and I will be anxiously tracking what it does in the coming weeks. As of now, prices in the Philadelphia metro appear to be holding pretty firm, but with what I’m seeing on the ground it is awfully hard to believe that we won’t see some price declines once today’s pending transactions close in November and December. Philadelphia’s market these past few years has been more moderate than in places like Austin and Boise; I expect that whatever correction we endure over the course of the next few years will be proportionate to the dimensions of our local boom.

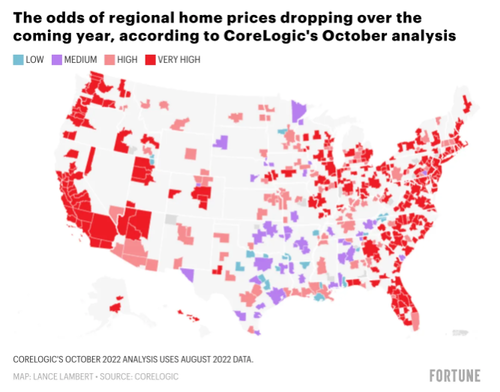

(Sources: CoreLogic, Altos Research, Bill McBride, Mortgage Banker’s Association, National Association of Realtors, Bright MLS, Morgan Stanley, Goldman Sachs, Moody’s Analytics)

Tyler Durden

Sun, 10/16/2022 – 10:30