“This Is Not A Functioning Market”: Massive Short Covering Creates A Bottom, But A Vulnerable One

By Simon White, Bloomberg Markets Live reporter and commentator

A large short in both stocks and bonds triggered a burst of position covering yesterday, causing stock prices to surge and yields to drop. However, while this may be a bottom in equities, it is unlikely to be the bottom while financial conditions remain very tight and real money is still very long.

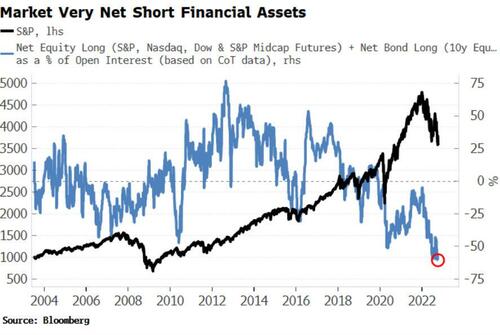

One veteran trader friend described it to me as “the wildest 60 minutes since the flash crash, an inverse flash crash”. This was a short-covering rally at base. The market was not only very short equities, it was very short bonds too. According to the CoT data, the net short in US equities and Treasuries is as large as it has been going back to 2004.

When Thursday’s inflation data came out stronger than expected, both stocks and bonds slumped. As everyone was so short in both, short covering in one triggered short covering in the other.

The 10-year yield started to fall before S&P futures started to bounce. CTAs and macro funds may have been the culprits. We can infer their likely positioning and it looks like they were short both stocks and bonds. That has been a very rare occurrence over the last 15 years, but it’s now more likely as inflation causes stocks and bonds to trade with greater positive correlation.

Short covering in bonds therefore probably caused these funds to start buying stocks. Not only was the market very short index futures, there has been a rise in call buying in recent days. This is part of a general pattern this year where the volatility on calls has been rising versus the volatility on puts, leading to very low put-call skew.

The combination of short covering, and option dealers frantically having to hedge calls they have sold by buying the market as it rises, led to a near vertical rise in stock prices.

This, though, is not a well-functioning market. And while yesterday may mark an interim bottom, it was not marked by several of the usual characteristics of a secular low.

CTAs and other fast-money traders may have been short, but real money remains very long. As the chart below from Bernstein Research shows, the vast pandemic inflows into US equity funds have yet to be unwound.

This is a big overhang and one that — while financial conditions remain tight and are set to get tighter as QT gathers pace — will be a sword of Damocles hovering over the market.

Tyler Durden

Fri, 10/14/2022 – 11:25