Futures Rip Higher Amid Reports Of Truss Mini Budget “U-Turn” As CPI Looms

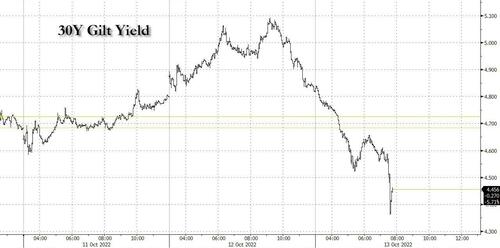

US equity futures traded heavy for much of the overnight session ahead of the much-anticipated (and gloomy, having hammered stocks on 7 of 9 CPI days so far in 2022) inflation data at 830am ET (full preview here), even as gilt yields suspiciously slumped overnight as if someone was aware of some non-public news, before futures ripped sharply higher around 730am ET when first SkyNews…

Downing Street denying any changes to mini budget but I’m told by sources discusssions underway over which bits might yet be junked give the scale of the concern

Looking at a return to the mandate from the leadership contest

No clarity on timing of announcement if it happens

— Sam Coates Sky (@SamCoatesSky) October 13, 2022

… and then Bloomberg reported that UK’s officials were likely to blink first in their showdown with the Bank of England (which recall is set to end its temporary bond buying tomorrow) and were discussing how they can back down from Prime Minister Liz Truss’s plans for a massive unfunded package of tax cuts. And while the officials are drafting options for Truss but no final decision has been taken and they are waiting for Chancellor of the Exchequer Kwasi Kwarteng to return to London from Washington, where he has been attending meetings of the International Monetary Fund, the person said, asking not to be identified commenting on private discussions. Meanwhile, UK long-end bonds surge as the end of the BOE’s bond purchases intervention approaches.

And despite conflicting reports from other reporters such as the Guardian’s political editor Pippa Crerar reporting that “No 10 rules out further changes to the mini-budget despite pressure from Tory MPs saying “the position has not changed””…

No 10 rules out further changes to the mini-budget despite pressure from Tory MPs saying “the position has not changed” but rumours flying around Westminster about a possible U-turn. Timing very unclear.

— Pippa Crerar (@PippaCrerar) October 13, 2022

… the confusion was enough to spark some serious short covering across the risk complex which pushed futures more than 1% higher…

… because, as we noted earlier today, hedge fund positioning ahead of the CPI report is the lowest in 5 years!

The S&P index tumbled to its lowest since November 2020 yesterday, as concerns mounted about the impact of hawkish Fed policy, especially on rate-sensitive sectors such as semiconductors. Europe’s Stoxx 600 gauge steadied, while on currency markets, the dollar slumped as cable surged on hopes that Truss would U-turn and the BOE would go back to doing QT.

Among notable moves in premarket trading, US-listed Macau casino stocks fell amid concerns around the impact from China’s Covid Zero strategy, after the Communist Party’s People’s Daily newspaper ran a series of commentaries this week touting the benefits of the policy. Comcast Corp. and Altice USA Inc. rose after Citigroup Inc. analysts upgraded the cable company stocks given their ability to generate annual cash flow. Here are other notable premarket movers:

American Express (AXP US) declines 0.9% in US premarket trading, as Citi downgraded the stock along with shares of SLM Corp. (SLM US) and Velocity Financial (VEL US) amid likely “rather large” EPS impact even from mild US recession as credit losses build.

Applied Materials (AMAT US) falls as much as 1.3% in premarket trading after the chip- equipment maker slashed its earnings forecast as the semiconductor industry reacts to the Biden administration’s new restrictions on doing business with China.

Chip stocks are in focus after Applied Materials cut its forecast. Taiwan Semiconductor Manufacturing Co., meanwhile, lowered its capital spending target while setting its 4Q gross-margin target above expectations. Watch KLA (KLAC US), Lam Research (LRCX US), Qualcomm (QCOM US), Nvidia (NVDA US), AMD (AMD US)

US-listed Macau casino stocks fall in premarket trading amid concerns around the impact from China’s Covid Zero strategy, after the Communist Party’s People’s Daily newspaper ran a series of commentaries this week touting the benefits of the policy.

Wynn Resorts (WYNN US) -2.2%, Las Vegas Sands (LVS US) -1.4%, MGM Resorts (MGM US) -2.2%

Keep an eye on Owens & Minor (OMI US) stock as it was downgraded to neutral at Citi following the medical and surgical supplier’s “disappointing” third-quarter results on Wednesday. Analyst Daniel Grosslight said Wednesday’s 35% selloff seemed “punitive,” but was not “wholly unwarranted.”

QuidelOrtho (QDEL US) jumped 9% in extended trading on Wednesday after the health-care services company reported better-than-expected preliminary revenue for the third quarter, thanks to higher Covid-19 testing revenue.

Away from the US rollercoaster, the September reading of the consumer price index, due at 8:30 a.m. today, is expected to decelerate to an 8.1% annual pace amid a decline in gasoline prices. However, the so-called core figure, which excludes food and energy, is projected to have returned to a four-decade high. With investors already worried that underlying strength in the economy will prompt the Fed to keep aggressively raising rates, strategists have warned that hotter-than-expected inflation data could firm up bets of another large rate hike next month and fuel further stock-market declines. The index is already down about 25% so far this year and is in a bear market.

“I don’t think it’s quite time to buy the dip right now,” Oliver Kettlewell, head of fixed income and global portfolios at Mashreq Capital, said on Bloomberg TV. “You need to see data bottoming first and I don’t think the Fed will pivot anytime soon. There is more weakness in the stock markets to come. I don’t think it will fall 40-50%, but it certainly looks like it will get weaker from here.”

The third-quarter company earnings season also kicks off tomorrow and the key question for investors is whether profit margins remained resilient amid surging costs. Although analysts have downgraded estimates in recent weeks, some strategists have warned that the cuts don’t yet reflect the bleaker outlook for economic growth.

In Europe, travel, energy and banks are the strongest performing sectors. Euro Stoxx 50 rises 0.4%. FTSE MIB outperforms peers, adding 1%, FTSE 100 lags, adding 0.2%. Here are the biggest movers:

Norsk Hydro shares gain as much as 8% after people familiar with the matter said the Biden administration is considering a ban on Russian aluminum supplies.

Entain rises as much as 4.5% following its third-quarter trading update, with some analysts highlighting rising market share in the US and benefits from upcoming sporting events such as the FIFA World Cup.

UK domestic stocks gain as government bonds bounce back and the pound rises. British assets have been volatile as the Friday deadline for Bank of England’s emergency bond-buying program looms. Lloyds rises as much as 3.7% while Barclays gained as much as 1.8%.

Zotefoams shares surge as much as 30% after the polyethylene foam manufacturer said it expects earnings to be significantly ahead of market expectations. Peel Hunt said positive trends in key end markets makes them confident in the near term and future.

ASML shares fall as much as 3.2% after peer Applied Materials slashed its 4Q sales forecast, citing new US export control rules. Meanwhile, top customer TSMC reduced its 2022 capex target by about 10% amid a collapse in global chip demand.

Shares of Banca Monte dei Paschi drop as much as 20%, to a record low, after the Italian lender set the terms of its rights offer at a discount to the theoretical ex-rights price.

Aroundtown falls as much as 7.9% after Citi downgrades the stock to neutral and opens a negative catalyst watch on the real estate company as it prepares “for the worst.”

Earlier in the session, Asian equities fell for the fifth straight session as caution prevailed ahead of key US inflation data due later Thursday. The MSCI Asia Pacific Index slid as much as 1%, with consumer discretionary and communication services shares falling the most. Chinese tech shares plunged for a sixth day, the longest streak in almost a year, dragging down Hong Kong’s benchmark. Stocks in Japan and South Korea were also down. Chinese shares lost momentum amid a pick-up in Covid cases, after staging a strong intraday rebound in the previous session. Investors also monitored developments ahead of the upcoming Communist Party congress, which may introduce further policies to shore up growth.

A hot US consumer price index reading may spur another outsized interest-rate hike by the Federal Reserve at its next meeting. Minutes released Wednesday from the last meeting suggested some officials considered reducing the pace of rate hikes, but overall market sentiment remains jittery. Fed Officials Commit to Restrictive Rates But Calibration Needed The main MSCI Asian stock gauge is trading around its lowest level since April 2020, having fallen almost 30% this year. The region’s stocks are “pricing in low expectations and limited investor appetite, after significant earnings and price underperformance as an asset class over the last decade,” said Sundeep Bihani, a portfolio manager at Eastspring Investments. But “a rising rate cycle, delayed Covid-19 re-opening versus the West and cash-rich balance sheets provide a good pathway to grow out of this underperformance,” he added.

Japanese stocks fell for a fourth day, dragged by telecoms and services providers, ahead of anxiously awaited US inflation data due later Thursday. The Topix fell 0.8% to close at 1,854.61, while the Nikkei declined 0.6% to 26,237.42. Daikin Industries Ltd. contributed the most to the Topix decline, decreasing 2.9%. Out of 2,167 stocks in the index, 381 rose and 1,725 fell, while 61 were unchanged.

Australian stocks, meanwhile, were steady ahead of the CPI report. The S&P/ASX 200 index closed 0.1% lower at 6,642.60 ahead of the US inflation data due later Thursday. Gains in financial shares were partly offset by losses in miners as gold price retreated. Qantas Airways was the best performer after the airline returned to profit following a streak of five consecutive half-yearly losses. Nib dropped after announcing a share placement. In New Zealand, the S&P/NZX 50 index fell 0.5% to 10,817.48.

In FX, Bloomberg dollar spot index falls 0.1%. CHF and JPY are the weakest performers in G-10 FX, NOK and GBP outperform. Pound reclaims $1.11.

In rates, treasuries were mixed after erasing declines, with 10-year note futures near Wednesday’s high ahead of the key CPI data at 8:30am New York time. US yields in belly of curve are richer by 1bp-2bp, steepening 5s30s spread; 10-year erased a 3.7bp increase, is near flat at 3.89% with gilts in the sector richer by 18bp. Sharp bull-flattening in gilts drove earlier price action; 30-year UK yields fall some 29bps to 4.53% while 10-year declines 20bps to 4.22%. Bunds 10-year yield -3.7bps to 2.27% and USTs 10-year yield is little changed. After CPI, focal point of US session is 30-year bond auction at 1pm. This week’s Treasury auction cycle concludes with $18b 30-year bond reopening; its 3- and 10-year note sales tailed.

In commodities, WTI trades within Wednesday’s range at near $87.33. Like OPEC, the IEA Monthly Oil Market Report lowered 2022 oil demand growth outlook by 60k BPD to 1.9mln BPD, 2023 cut by 470k BPD to 1.7mln BPD. World oil demand will contract by 340k BPD Y/Y in Q4. Spot gold gains traction as the Dollar declines ahead of US CPI, with the yellow metal back above its 21 DMA (1,672.50/oz). Base metals are firmer across the board amid the Dollar’s recent decline alongside the gains across stocks, with 3M copper back above USD 7,500/t, whilst LME aluminium outperforms.

Bitcoin tumbled again, sliding to $18,760 while ethereum dropped to a session low of $1,260.

To the day ahead now, and the main data highlight will be the US CPI release for September. Otherwise from central banks, we’ll hear from the ECB’s Nagel and the BoE’s Mann.

Market Snapshot

S&P 500 futures up 0.5% to 3,605.25

STOXX Europe 600 down 0.3% to 384.73

MXAP down 1.0% to 136.16

MXAPJ down 1.1% to 440.03

Nikkei down 0.6% to 26,237.42

Topix down 0.8% to 1,854.61

Hang Seng Index down 1.9% to 16,389.11

Shanghai Composite down 0.3% to 3,016.36

Sensex down 0.7% to 57,242.19

Australia S&P/ASX 200 little changed at 6,642.61

Kospi down 1.8% to 2,162.87

German 10Y yield little changed at 2.31%

Euro little changed at $0.9705

Brent Futures up 1.0% to $93.35/bbl

Gold spot up 0.0% to $1,673.32

U.S. Dollar Index little changed at 113.28

Top Overnight News from Bloomberg

Chancellor of the Exchequer Kwasi Kwarteng said the Bank of England will be responsible if UK markets suffer renewed volatility after its bond-buying program ends on Friday

UK pension funds are dumping assets to meet margin calls as the BOE confirmed it will end emergency bond buying, and the reverberations are being felt everywhere from Sydney to Frankfurt and New York

Sweden’s inflation rate reached a three- decade high last month, driven by electricity prices and the weakness of the country’s currency, keeping alive bets that the central bank could opt for faster rate hikes than its current path suggests

Yen traders are readying for another volatile session Thursday with the release of key US inflation figures — data which sent the Japanese currency tumbling 2% in a matter of minutes last month on its path toward intervention

A Chinese developer with state backing for domestic funding has defaulted on a convertible bond and warned it may face a similar fate on offshore debt, fueling concern about Beijing’s ability to contain a broader property debt crisis

European natural gas jumped as worries over major facilities in Norway added to supply risks from Russia. Benchmark futures rose as much as 9.2%, after earlier swinging between gains and losses. Norway’s Nyhamna gas project is being evacuated, Dagens Naeringsliv reported

A more detailed global summary of global markets courtesy of Newsquawk

European bourses saw a choppy start to the session but have since been trending higher despite a lack of fresh fundamental drivers. Sectors are now mostly firmer, although tech remains the laggard after TSMC cut its capex guidance and flagged a decline in overall chip industry next year. Stateside, futures have been moving in tandem with their European counterparts, whilst the tech-laden NQ lags vs its peers.

Top European News

ECB’s Wunsch said it is better to start QT sooner than later, via a pre-recorded CNBC interview.

EDF Working Council said in the event of a normal or very cold winter, EDF will be forced to take some users off the electricity grid; capacities will not suffice.

Goldman Analyst Sees UK Property Prices Falling 20% on Rate Rise

NATO Countries Back German Plan for European Anti-Missile Shield

Monte Paschi Sets Terms on Rights Offer as Banks Back Deal

Asia stocks traded cautiously following the soft handover from Wall Street where markets ended the session marginally lower after hot PPI data and mixed FOMC Minutes which spurred a short-lived dovish reaction. ASX 200 was kept afloat by outperformance in its top-weighted financials sector and as earnings optimism provided a tailwind with Qantas shares flying high on expectations for a return to profit for the current 6-month period. Nikkei 225 was lacklustre following recent currency weakness and firm PPI data which climbed to a 5-month high. KOSPI underperformed after North Korean leader Kim guided a test firing of long-range strategic cruise missiles which hit a target 2,000km away and are capable of carrying nuclear weapons. Hang Seng and Shanghai Comp. were both subdued as China continued to advocate the strict zero-COVID approach with a Foreign Ministry spokesperson noting that China needs COVID security to achieve economic growth, although downside in the mainland was contained amid support for the property industry with China local governments to purchase houses as stimulus to help developers.

Top Asian News

China Semiconductor Industry Association said it opposes the US Commerce Department’s export control regulations and hopes the US government can correct wrong practices in a timely manner, while it was separately reported that TSMC (2330 TT) received a 1-year US licence for China chip expansion.

TSMC (2330 TT/TSM) Q3 2022 (TWD): Net profit 280.9bln (exp. 265.64bln), Gross margin 60.4% (exp. 58.9%), and said the Co. faces challenges from rising inflationary costs in 2023; 2022 Capex seen around USD 36bln (vs prev. guidance of USD 40-44bln); sees Q4 business around flat; not considering share buyback

Samsung (005930 KS) has been granted a 1yr exemption from new US restrictions that block exports of advanced chips and related equipment to China, according to WSJ sources.

Chinese Health Official said China will continue to strengthen COVID prevention and control, will resolutely guard against large-scale outbreaks, Reuters.

Chinese local governments are to purchase houses as stimulus to support developers, according to China Securities Times.

Japanese Finance Minister Suzuki said excess FX volatility and disorderly moves can hurt the economy and financial stability, while he told the G20 that Japan is deeply worried about recent sharp FX volatility and explained that recent intervention was prompted by excess moves by speculators. Furthermore, Suzuki said they cannot tolerate excess FX moves by speculators and will take decisive action on speculative FX moves in which they are focused on FX volatility rather than the yen level regarding intervention, according to Reuters.

FX

DXY declined under 113.00 ahead of the US CPI metric, although likely as a function of GBP strength throughout the European morning.

EUR benefits from the pullback in the Buck, with EUR/USD back above 0.9700.

Antipodeans are also faring well alongside the improved risk tone across markets.

USD/CNH tested 7.2000 to the upside, whilst China continues with its zero-COVID policy ahead of the CCP National Congress.

Fixed Income

US Treasuries are still observing some caution before potentially key CPI data, but EU bonds are flying just a day after diving to new cycle lows.

UK debt is leading the mainstream recovery whilst there is chat in UK markets about another possible fiscal U-turn and/or the BoE relenting on buy-backs to offer further assistance beyond tomorrow, albeit all speculation at this stage.

Commodities

WTI and Brent front-month futures are modestly firmer intraday but off best levels after settling lower yesterday.

IEA Monthly Oil Market Report: lowers 2022 oil demand growth outlook by 60k BPD to 1.9mln BPD, 2023 cut by 470k BPD to 1.7mln BPD. World oil demand will contract by 340k BPD Y/Y in Q4.

Spot gold gains traction as the Dollar declines ahead of US CPI, with the yellow metal back above its 21 DMA (1,672.50/oz).

Base metals are firmer across the board amid the Dollar’s recent decline alongside the gains across stocks, with 3M copper back above USD 7,500/t, whilst LME aluminium outperforms

Geopolitics

Sites in Ukraine’s capital of Kyiv were targeted by shelling early today, according to the administration in Kyiv cited by Sky News Arabia. Furthermore, Ukrainian President Zelensky’s office later said that a critical infrastructure facility was hit by drone strikes in the Kyiv region, according to Reuters.

Ukraine President Zelenskiy said cannot have diplomacy with Russia today and cannot respect leaders who are killing and not respecting international law.

Saudi Arabia fully rejected statements criticising the kingdom after the OPEC+ output cut decision, while it said that statements critical of the kingdom are not based on facts and set the OPEC+ decision outside its economic context.

US officials are concerned the Russian oil price cap will fail as a result of the OPEC+ cut, according to Bloomberg.

North Korean leader Kim guided a test firing of long-range strategic cruise missiles which hit a target 2,000km away and are capable of carrying nuclear weapons, while North Korean leader Kim said focus should be on developing nuclear forces, according to Yonhap and KCNA.

North Korea reportedly cancelled a meeting with the EU diplomatic service, while the reason was unclear but followed two recent statements from Brussels that may have impacted DPRK decision-making, according to NK News citing sources.

Japan’s Defence Minister said North Korea has likely achieved the capability of mounting a nuclear warhead on a ballistic missile that could reach Japan, according to Reuters.

US FCC is set to ban all US sales of new Huawei and ZTE equipment as well as some sales of video surveillance equipment from three other Chinese firms amid national security concerns, according to Axios citing sources.

US Event Calendar

08:30: Sept. CPI MoM, est. 0.2%, prior 0.1%

CPI YoY, est. 8.1%, prior 8.3%

CPI Ex Food and Energy MoM, est. 0.4%, prior 0.6%

CPI Ex Food and Energy YoY, est. 6.5%, prior 6.3%

08:30: Oct. Initial Jobless Claims, est. 225,000, prior 219,000

Continuing Claims, est. 1.37m, prior 1.36m

DB’s Jim Reid concludes the overnight wrap

There’s been little relief for investors over the last 24 hours, with the major asset classes fluctuating between gains and losses as markets were left with plenty of global developments to digest. For much of the day it had looked as though we might see equities begin to stabilise, but ultimately the S&P 500 (-0.33%) nose-dived into the close to decline for a 6th consecutive session and hit its lowest level since November 2020. For reference, if we get a 7th consecutive decline, that would be the worst run for the index since February 2020 as fears about the global spread of Covid-19 ramped up. Whether that happens could largely hinge on today’s all-important CPI print from the US, which is the last big piece of data the Fed will get ahead of their next decision in just under 3 weeks’ time. Bear in mind it was only last month that the stronger-than-expected reading on core CPI sparked a big re-evaluation about when the Fed would slow down their rate hikes, with futures pricing out the chances they’d adjust to 50bp hikes in November in favour of a continued 75bps pace. In turn, that triggered the biggest one-day decline in the S&P 500 since June 2020, with a -4.32% move, so investors will be keenly attuned for any fresh surprises today.

Ahead of that release, we got an advance look yesterday at US inflation pressures last month from the PPI reading. That showed the monthly headline measure coming in above expectations at +0.4% (vs. +0.2% expected), which also meant that the year-on-year measure only fell back to +8.5% (vs. +8.4% expected). The core measure excluding food and energy was more in line with expectations however, coming in at +0.3%, with the year-on-year core reading at +7.2% (vs. +7.3% expected). In terms of what our US economists are expecting for today, they think that the headline CPI print will come in at +0.28% (vs. +0.12% in August) as energy continues to drag on the main print. However, they see core CPI which excludes energy and food prices coming in at a stronger +0.44% (vs. +0.57% in September), and it’s that reading which should get the most focus given last month’s upside surprise. In turn, those numbers should push the year-on-year CPI down to +8.1%, while core CPI should pick up to +6.5%.

As we look forward to the CPI print later, there are some initial signs of markets recovering their poise, with the VIX index of volatility (-0.06pts) ticking lower for the first time in a week. That coincided with continued falls in US equities, as mentioned, with the S&P 500 down -0.33% and the NASDAQ a hair lower at -0.09%, although futures today are pointing modestly higher, with contracts on the S&P 500 (+0.16%) and the NASDAQ 100 (+0.11%) both advancing. One factor supporting the amidst the broader uncertainty was some positive corporate news as we head into earnings season, with PepsiCo (+4.18%) being one of the top performers in the S&P after they increased their profit and sales outlook for the rest of the year. That said, the European indices were much less positive, with the STOXX 600 (-0.53%) losing ground for a 6th consecutive session, and European equity futures are pointing towards further losses again today.

Those equity losses yesterday came as we got the minutes from the recent September FOMC meeting, which reflected the growing debate on the Committee about the risks to over- or under-doing the tightening cycle. Several participants highlighting the need to maintain a restrictive stance as long as necessary and the danger of prematurely easing policy, while several participants observed risks would become more two-sided as policy moved into restrictive territory. There was also continued debate about the form of labour market softening that would be required to help return inflation to target; would unemployment go up or job openings go down? This debate isn’t new in Fed commentary, but the emphasis placed on both camps drove Treasury yields a bit lower following the release. In terms of yesterday’s comments, President Kashkari said earlier in the session that the bar for a monetary policy pivot was “very high”. By the end of the day, 2yr Treasury yields had fallen -1.5bps, 10yr yields retreated -5.1bps, while pricing for the November FOMC was almost unchanged at +73.9bps. Overnight, 10yr yields (+2.5bps) have seen another move higher, trading at 3.92% as we go to press.

Back here in the UK, there was still plenty going on yesterday, with the main development being that a BoE spokesperson reiterated Governor Bailey’s comments from Tuesday evening that their intervention in the gilts market would come to an end tomorrow as planned. The spokesperson said that “temporary and targeted purchases of gilts will end on 14 October” and that this “has been made absolutely clear in contact with the banks at senior levels.” That message also pushed back against what the FT had reported in the small hours of yesterday, where they said that the BoE had privately signalled they could extend the intervention past Friday’s deadline.

Against this backdrop, UK assets remained volatile, with the 30yr gilt yield (+2.3bps) rising above 5% at one point for the first time since the BoE’s intervention began, before paring back nearly all those gains to close at 4.80%. In fact, the 30yr was actually one of the few maturities to see yields rise on the day, with 2yr gilt yields down -20.3bps, and 10yr gilt yields down -0.4bps. However, there were other signs that investors were still nervous, with implied sterling-dollar volatility over the next month moving higher once again to the levels seen right after the mini-budget announcement in late September. Interestingly, there was also a warning from the Conservative chair of the Treasury Select Committee, Mel Stride, who tweeted about the government’s tax cuts that “Credibility might now be swinging towards evidence of a clear change in tack rather than just coming up with other measures that try to square the fiscal circle.” In the meantime, we heard from BoE Chief Economist Pill too, who pointed towards further rate hikes in saying that “I am still inclined to believe that a significant monetary policy response will be required to the significant macro and market news of the past few weeks.”

Elsewhere in Europe, sovereign bonds had followed a similar pattern to gilts, with sharp rises early in the session to fresh multi-year highs before those gains were then pared back significantly. For instance, yields on 10yr bunds had exceeded the 2.40% mark at one stage, before only closing up +1.4bps at 2.30%, whilst yields on 10yr OATs (+3.0bps) and BTPs (+6.2bps) echoed that movement. Those moves came as we heard from ECB policymakers, including President Lagarde who confirmed that discussions on QT had started. There were also comments from others on the Governing Council, including Austria’s Holzmann (one of the biggest hawks) who said that markets were “spot on” about the ECB’s plans, and that a 100bp hike was “beyond what we would need to signal to the market that we are serious. The Netherlands’ Knot separately said that policy rates were “still way below neutral” and that “at least two more significant hikes” were needed before the ECB got back into “the range of plausible estimates for neutral”.

Staying on Europe, our colleagues in corporate credit research have separately published a report analysing risk-free hedges in place (link here), and start to quantify the impact on leverage loan and HY issuers. The report may be sector-biased, but the thought process has broader market implications worth considering.

This morning in Asia, the major equity markets have followed the moves lower in the US and Europe ahead of that US inflation print later on. Currently, the Kospi (-1.14%) is the biggest underperformer, although the Hang Seng (-1.00%), the Nikkei (-0.48%) and the CSI (-0.29%) have also lost ground. The main exception is the Shanghai Composite (+0.16%), which has made modest gains. Those moves have occurred amidst further weakness for the Japanese yen, which has remained above the 146 level this morning against the dollar, having hit a post-1998 low yesterday of 146.97 per US Dollar. That follows comments from BoJ Governor Kuroda, who promised to keep monetary easing in place, contrasting with the other central banks. Separately, data this morning showed that producer prices had risen more than expected in September, coming in at +9.7% year-on-year (vs. +8.9% expected).

Looking at yesterday’s other data, UK monthly GDP unexpectedly contracted in August with a -0.3% decline (vs. unch expected), and July’s growth was revised down to +0.1% (vs. +0.2% previously). Elsewhere, Euro Area industrial production grew by +1.5% in August (vs. +0.7% expected).

To the day ahead now, and the main data highlight will be the US CPI release for September. Otherwise from central banks, we’ll hear from the ECB’s Nagel and the BoE’s Mann.

Tyler Durden

Thu, 10/13/2022 – 08:04