Markets Tread Water Ahead Of CPI Chaos, Shrug Off Hawkish Minutes

An unexpected lack of chaos in the UK started the day off somewhat brightly but PPI hotter than expected and a hawkish Fed Minutes did not help that sentiment continue.

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

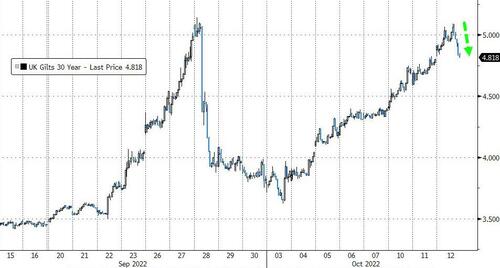

UK Gilt yields tumbled after early weakness…

Source: Bloomberg

Fed rate-trajectory expectations were unmoved by the FOMC Minutes…

Source: Bloomberg

Stocks fell on the hotter than expected PPI, bounced around the EU close, then oscillated in a small range after The FOMC Minutes…

S&P and Nasdaq down 6 days in a row now after that late-day puke.

S&P closed at its lowest since Nov 2020 (down over 25% from the highs)

VIX was bid today back above 34, likely driven by positioning ahead of tomorrow…

Bonds were bid, accelerating after The Fed Minutes interestingly enough, with the belly outperforming (5Y -6bps). On the week, 5Y is the best (-3bps) while 30Y is worst (+4bps)…

Source: Bloomberg

The dollar dipped on the FOMC Minutes but was quickly bid back to end basically unchanged on the day…

Source: Bloomberg

Bitcoin was very quiet today finding support at $19000 again…

Source: Bloomberg

Oil was down for a 3rd straight session amid OPEC/EIA cutting global demand growth expectations (ahead of API data tonight after the close)…

Gold gained modestly on the day, rallying after The Fed Minutes hit but giving that spike back before the cash equity market closed…

Finally, as we noted earlier, while history is an unreliable guide, prior CPI-day sessions have been rough for equity bulls, with the S&P 500 falling in seven of the nine instances this year…

Consensus expects to see inflation increase 8.1% from a year ago in September. Anything above the prior reading of 8.3% could put the stock market at risk of a quick 5% tumble, according to JPMorgan’s trading desk.

As SpotGamma notes, since the October monthly OPEX deltas are fairly large, there is plenty of fuel to extend the CPI reaction to a large 5% rally, or push us down to the 3500 Put Wall. The key insight here is this CPI trigger will spark a multi-session directional trend into October OPEX.

Recall that headlines matter more in large negative gamma regimes, where algos spark an initial reaction which is reinforced by options hedging flows.

After October OPEX we arrive to another window of catalysts including various global central bank meetings, an FOMC and US midterm elections. Therefore we view the CPI reaction as fairly limited in duration (i.e. into Oct OPEX).

Tyler Durden

Wed, 10/12/2022 – 16:01