“The Fed Is Fuct…” Part 4

Via AdventuresInCapitalism.com,

The Fed is trapped in a box of their own creation. As a result, they may want to talk tough, but their ability to maneuver is severely restricted. The Fed claims that they’re targeting a terminal rate of 4.6% for Fed Funds, but if they did that for any period of time, they’d only succeed in blowing up the Treasury.

Our government has run obscene deficits over the past two decades. This was only made possible by the Fed suppressing interest rates. Despite a succession of Treasury Secretaries, the US debt was never termed out. The majority of the debt is actually quite short term. During 2021, the Federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding—or an average interest rate of 1.8%.

Now imagine if Fed Funds actually got to the terminal rate and stayed there for any period of time. What would paying an average rate of 4.6% on year-end 2021 debt do to the interest expense? Well, it rises by $636 billion to $1.028 trillion or the more than the cost of our entire military spending of $801 billion in 2021. Ignoring the budget pressure, the interest cost would then be 4.5% of total GDP, up from 1.7% in 2021. That’s like tying a lead weight around the neck of our economy.

Both political parties have engaged in a drunken spending spree. There is zero political desire to reduce spending and it seems almost inevitable that deficits will continue and even expand into the future. The question is, “who then funds the increased cost of interest expense in addition to the already egregious annual deficits?”

Over the past few years, our deficits have increasingly been funded by the Federal Reserve purchasing government bonds through their QE, which is quite inflationary as we’re now learning. Except, QE is now going in reverse as the Fed claims that they’ll be selling off bonds as they conduct QT. If they’re selling bonds while the Treasury needs to accelerate their own debt issuances to cover the increased cost of interest, then rates will be forced higher—potentially much higher. As rates go higher, government interest costs will increase, and the cycle will accelerate the cash drain from the Treasury. At some point, the Fed will be forced to step in and monetize this debt as the buyer of last resort—which is effectively what happens in most Emerging Market crises—often making the crisis much worse. This is a cycle that once started, gets ugly quite fast.

Just look at how fiercely the Japanese are defending the interest rate on their own sovereign debt. The Japanese must know that once rates rise, the whole game is over. The Bank of England belatedly came to a similar conclusion after only testing QT. Over here in the states, I’m not sure if the Fed has actually done any math on the issue.

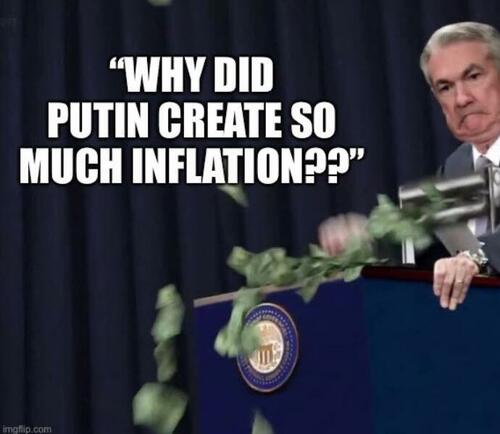

Look, Powell may want to be Volcker. He may want to crush inflation. However, he’s trapped. The Fed simply cannot take rates up beyond a certain point without blowing up the Treasury and then being forced back into even more aggressive QE to absorb the bonds from the Treasury—which would only accelerate inflation. Besides, despite Powell desiring a recession to crimp inflation, he must realize that a recession will certainly crimp tax receipts—only making the deficits worse.

It’s all quite reflexive and low rates are what’s stopping the snowball from rolling down the hill. Raising rates will set an avalanche in motion. When your debt to GDP exceeds 100%, your ability to maneuver is restricted. The US is on the precipice of an Emerging Markets debt crisis and Powell seems determined to be the one who sets it all in motion, but only after he first blows up every other global Central Bank.

I am always reminded that the Fed is full of useless academics, but in the end, it’s a highly political institution and they’ll craft the white papers to justify whatever idiotic course they choose to take. As the above scenario begins to unfold, the political class will force Powell to back down. They will decide that increased inflation is preferable to detonating the treasury. The Pause is coming and it will send equities parabolic. There will be a few more nasty moments between then and today.

The trick is to survive and then max it out when the Fed admits that they’re trapped. It’s going to be one of the great wealth transfers of all time. Who’s ready??

* * *

If you enjoyed this post, subscribe for more at http://www.adventuresincapitalism.com

We’ve been chatting about inflation quite regularly in the KEDM Discord channel. Join now athttps://link.kedm.com/AIC

Tyler Durden

Sun, 10/09/2022 – 18:30