Is This Just The Start Of Another Bear Market Rally?

With stocks exploding higher in October, and Q4, scrambling to undo the bitter taste from the worst September and Q3 in many a career, the market is trying to assess whether this was finally the real bottom or we are at the beginning of another bear rally.

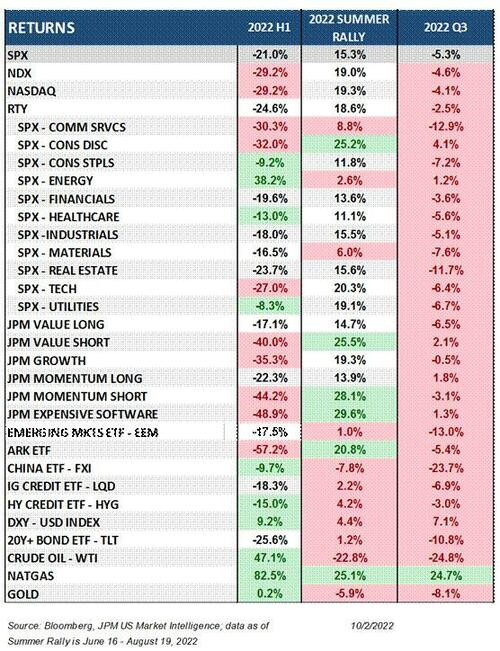

While nobody knows the answer, courtesy of JPMorgan’s trading desk below we have shared a chart looking at the summer rally vs. 22H1 and 22Q3.

As JPM trader Andrew Tyler writes, “it may be the case that the potential for this rally is predicated on the outcome of next week’s CPI, where consensus for Headline CPI YoY is 8.1% vs. 8.3% prior.” Assuming an in line number (or a miss), is that enough of a step-down to continue the move higher especially as that level may cement calls for 75bps in both November and December meetings”, especially after today’s dramatic JOLTs miss.

According to Tyler, the answer is “Maybe… though the view on the length of a bear rally may be more tied to yields. This week, the 10Y is -24.9bps to 3.5795% relative to 3.3578% before global bond markets were roiled by the UK fiscal situation. Positioning remains light and multiple asset classes continue to see a dearth of liquidity; combined that is a recipe to move higher.”

Tyler Durden

Tue, 10/04/2022 – 15:40