OPEC Is Taking On The Fed… And Goldman Is Buying Every Barrel It Can Find

Earlier today, Rabobank’s Michael Every was the latest to try his hand in defining the conflict that – according to Zoltan Pozsar- has defined not only 2022 but will define the collapse of the dollar and the birth of the Bretton Woods 3 regime, when the geopolitical strategist discussed Putin’s “vitriolic speech” on Friday in which, according to Every, “as Russia rails against “paper dollars and euros” and extolls the strength of commodities, can the West slash rates or do endless QE to bail out the tiny elite who own most financial assets, and in doing so prove Moscow right in the eyes of the rest of the world?”

While Every disagrees with Zoltan on whether the dollar will fall and whether a new Bretton Woods regime will emerge, the two are in agreement that the only response the west has to the commodity shortage created by the Russia-China-Africa-LatAm axis would be either to cause a global dollar funding squeeze (by hiking rates) which however has an unpleasant habit of crushing “friendly” allies such as the BOJ and BOE, or by flooding the world with fiat in order to – as Every put it – “bail out the tiny elite who own most financial assets, and in doing so prove Moscow right in the eyes of the rest of the world.“

But it’s not just the anti-western axis that is taking on the Fed: according to Goldman Sachs, so is the world’s most important cartel (where Russia is also a critical voice): OPEC+.

In a note published by Goldman’s Damien Courvalin, Jeffrey Currie and the commodities team (available to pro subs in the usual place) titled “OPEC Takes on the Fed”, the Goldman strategists recap the latest developments that helped propel oil sharply higher today, namely the reports that in its first in-person meeting in Vienna this Wednesday, the cartel may cut oil output by as much as 1.5 mmb/d…

Reports suggest that OPEC+ is considering a production cut at its meeting on Wednesday, October 5, potentially larger than 1 mb/d. While such a cut would occur amid one of the tightest markets in recorded history, and ahead of a potential decline in Russian exports later this year, such a decision could be justified by the recent large decline in prices, down 40% since their June peak, with mounting global growth concerns.

And while the recent collapse in investor participation, which has driven liquidity and prices lower, is also a likely strong catalyst for such a cut – as it would increase the carry in oil and start to claw back investors who have instead turned to USD cash allocation following the aggressive Fed hikes – what Goldman is effectively saying is that by OPEC is taking the fight back to the Fed, which by hiking and pushing the dollar to record highs sent the price of oil to new 2022 lows. Well, just as the Fed can limit the supply of dollar bills, whether physical or electronic, so OPEC can throttle and cut the all too physical supply of oil in retaliation.

But how exactly does OPEC plan on challenging the attractive yield on the US dollar? Simple: as Goldman writes, “an OPEC cut, by reinforcing this level of backwardation, would further increase the carry offered by a long passive front-month rolling position in Brent futures, which already offers an annualized carry of 24%.“

As such, an OPEC vut – which Goldman has not assumed in its latest published bullish forecasts – would reinforce the bank’s bullish price view while significantly limiting the downside to prices should economic growth disappoint even relative to the bank’s modest global (ex China) 1% real GDP growth assumption for next year. As a result, Goldman – which has laid out the clash between OPEC and the Fed – reiterates both its bullish oil view as well as its preference for long crude timespread positions into year-end. In other words, at least in Goldman’s view, OPEC will fight the Fed, and win.

While there is much more in the full note, below we excerpt the key highlights from the Goldman note:

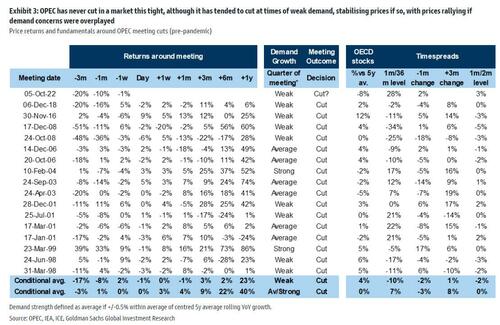

Historically, OPEC has often cut production in the face of weakening demand, yet it has never implemented a cut in such a tight market, with inventories at historically low levels, record strong seasonal crude timespreads and with demand remaining resilient despite the macro headwinds.

While inventory dynamics have loosened in recent months (Exhibit 1), a portion of these builds (100mb+ by our estimates) are required due to the redirection of trade flows under embargo constraints. Adjusted for oil on water, we estimate that the global oil market has instead remained in a seasonally adjusted (2017-19 av.) deficit, which is expected to seasonally and cyclically tighten in the coming months. Very large and unsustainable draws in China have also exacerbated the ex-China surplus. Looking forward, we expect Russian production to decline into year-end with in turn demand expected to be supported by natural gas to oil switching in Europe and Asia.

Beyond the decline in prices, we believe this cut can help remedy the large exodus of oil investors that has left prices under-performing both fundamentals and other cyclical asset classes, as we discussed in our latest oil update. Such an argument can be traced back to our past work our Commodities as an Asset Class. Equity and debt holders of energy companies get compensated for providing capital from which companies profitably produce via dividends and share price appreciation. A commodity investor has no such function, investing in a futures market which is a zero-sum game, simply acting as the counterpart to an offsetting future position. Key however is the liquidity that is provided by this investor position, typically helping offset that of a producer, willing to sell his future production at a discount given the corporate benefits of reducing earnings volatility. While such hedging flows have slowed materially this year, the investor exodus has been even larger owing to the surge in price volatility, exacerbating backwardation – and hence the compensation for long investors – in energy futures.

An OPEC cut, by reinforcing this level of backwardation, would further increase the carry offered by a long passive front-month rolling position in Brent futures, which already offers an annualized carry of 24%. This would make such an allocation increasingly compelling relative to other forms of carry, with, unlike most FX crosses today, supportive fundamentals rooted in exceptionally low inventories. It would further increase the opportunity cost of being short oil futures: given the positive carry, the 12-mo breakeven price on front-month rolling short positioning is already $67/bbl. Similarly, high volatility and the outsized impact of producer hedging on deferred prices have combined to increase the cost of puts, with a Dec-23 ATM put position requiring a fall in that contract’s value to $61/bbl to become profitable at expiration.

Ultimately, the ability for OPEC to conduct such a large cut is rooted in the lack of any supply elasticity, with shale activity showing signs of slowing, no spare capacity outside of GCC producers and with Russia’s production about to decline (leading it to support this time around a large cut by other producers). This is ultimately a return to the Old Oil Order, where core-OPEC acts under the rational behavior of a dominant producer with pricing power. In that sense, while exceptional, this cut is also logical as it maximizes the group’s revenues today with minimal sacrifice of future profits.

While we take no explicit assumption on the meeting outcome for now, given our already bullish forecasts, we highlight three headline scenarios with cuts of 0.5, 1, and 1.5 mb/d respectively – and assess what they imply for prices and timespreads. Due to widespread capacity limits within OPEC+, a headline (“paper”) cut is likely to overstate significantly the effective (“physical”) curtailment of production. We show in Exhibit 4, across these three scenarios, that the effective cut is likely to be only c.50% of the headline quota figures compared to our Nov-22 supply expectations, and closer to c.2/3 of the headline when translated into balances through Dec-23 as we had assumed gradually higher production next year.

As we discussed in our latest oil note, we believe the market is oscillating between its historical pricing framework (based on inventories and convenience yields) and a scarcity pricing regime (predicated on demand destruction as the only balancing mechanism). In the case of a 1 mb/d headline cut, the former regime would lead us to expect a c.$13/bbl positive impact on Brent prices over 12 months, albeit mostly front-loaded, while the latter regime suggests a distinct possibility of a c.$20/bbl spike higher when inventories deplete again and demand destruction remains the balancing mechanism of last resort.

In Exhibit 5, we consider the effect of these potential cuts assuming prices remain near current levels (consistent with our ‘Pre-price’ balance published here). In this scenario, these OPEC+ cuts would tighten inventories to historically unparalleled lows; an unsustainable outcome in our view but one that would initially offer historically elevated roll returns of 25-40% for rolling the prompt Brent contract (Exhibit 6 and Exhibit 7) even at $85/bbl price levels. As a result, we reiterate both our bullish oil view as well as our preference into year-end front long crude timespread positions.

More in the full note available to pro subs.

Tyler Durden

Mon, 10/03/2022 – 21:23