Next Blowup Shows The Sheer Pain In UK Backdrop

By Heather Burke, Bloomberg markets live commentator and reporter

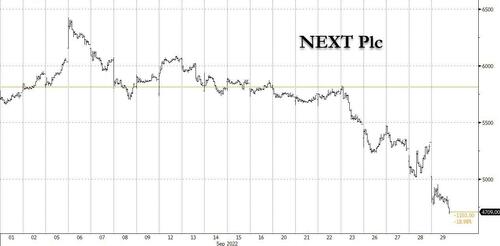

To get a sense of the deteriorating UK macro backdrop, look no further than the slump in one of its biggest retailers as UK stocks, the pound and bonds have another tough day.

Next gave its second profit warning this year, saying inflation is keeping UK shoppers from buying non-essential items. The bellwether said in its financial report:

“Sales during August were below our expectations and, despite improving sales in September, we think it is sensible to moderate our expectations for sales and profit in the second half. It is important to stress that, with so many variables at play, predicting near-term sales trends is unusually difficult. All the more so with recent Government stimulus measures yet to take full effect.”

Next also said the pound’s devaluation looks set to prolong inflation, even once factory gate prices ease. It looks like “we may be set to have two cost of living crises: this year, a supply side led squeeze, next year a currency led price hike as devaluation takes effect.”

H&M is cutting costs after its exit from Russia and higher garment and transport costs pressured earnings. Retail and autos are leading European stocks lower in early trading as recession fears rise, with Next the biggest Stoxx 600 decliner. UK stocks are lagging peers, with FTSE 100 declines led by retail. S&P 500 futures are also extending declines as the risk-off backdrop picks up.

Tyler Durden

Thu, 09/29/2022 – 15:05