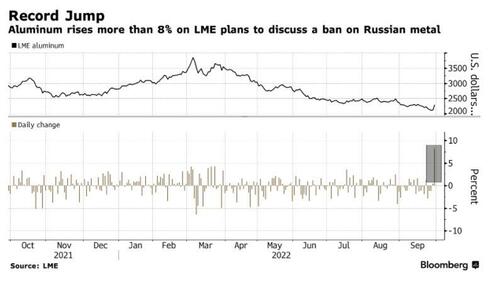

Aluminum Surges Most On Record As LME Considers Russia Ban

The closer we get to year end, the more we are reminded of the turbulent days of February and March when commodity prices soared to record highs on fears Russian supplies would be permanently taken off the market. And while commodities as a whole are sharply below those levels, and in many cases are even down on the year, every now and then we get a reminder just how complacent the market has become when it comes to continued Russian commodity supplies.

Today was such a day for aluminum, which soared by a record 8.5% on the London Metal Exchange after Bloomberg reported the exchange plans to discuss a potential ban on new Russian metal supplies. Prices for the most widely used base metal spiked to $2,305 a ton in the biggest intraday gain on record. Nickel rallied 5% and zinc more than 4%, paring sharp losses for industrial metals so far this month, sparked by market fears that an imminent recession will collapse demand.

Citing sources, Bloomberg reports that “the LME plans to launch a discussion paper on whether and under what circumstances it should block new supplies of Russian metal from being delivered to its network of warehouses.”

The reason for the resulting spike in prices is that any move by the LME to block Russian supplies could have significant ramifications for the global metals markets, as the country is a major producer of aluminum, nickel and copper. Fears that sanctions could disrupt Russian nickel exports helped trigger a massive short squeeze on the LME in March.

While launching a discussion paper doesn’t mean the LME has made any decisions about what it will do, the move marks a shift in approach. The exchange had previously said it did not plan to take any action outside the scope of sanctions, which have for the most part left large Russian metal producers like Rusal and Norilsk Nickel untouched.

“The LME continues to take the required action to ensure market stability in response to sanctions,” the bourse said in a statement Thursday. It will keep the situation under review as it prioritizes an “orderly market,” the LME said.

Tyler Durden

Thu, 09/29/2022 – 08:21