Bank Of England Capitulates: Restarts QE Due To “Significant Dysfunction” In Bond Market, “Material Risk” To Financial Stability

Just a few days ago we wrote that “Something Is About To Break” and prompt a capitulation from one or more central banks, which oddly was met with mockery in the comment gallery. Also, a few week ago, we said that we are nearing a moment in time when central banks will do QE and rate hikes at the same time.

Of course, after the bond market logically blow up following this idiocy, the next step is rate hikes and QE at the same time. https://t.co/iaqLh6LByk

— zerohedge (@zerohedge) June 16, 2022

Finally, for much of the past year we have said it is only a matter of time before the coming market crash and economic collapse forces central banks everywhere, not just in one or two countries, to pivot as the price of economic collapse and tens of millions unemployed is far, far greater than simply shifting the inflation target from 2% to 3%.

Crude: global recession imminent, central banks won’t pivot

Stocks: global recession imminent, central banks will pivot so fast it will make your head spin

— zerohedge (@zerohedge) August 16, 2022

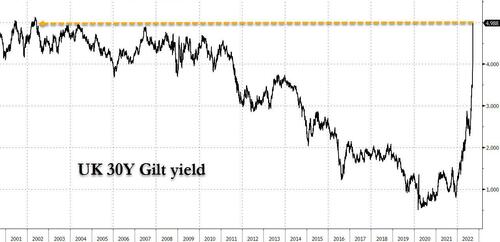

And then, just moment ago, we were once again proven right on all three when – with UK 30Y gilt yields having exploded in recent days above 5% in an exponential move that can only be described as the bond market breaking…

… the BOE became the first bank to capitulate on its plans to proceed with QT on Wednesday when the central bank restarted QE in a “temporary and targeted” bond buying operation – which will be as “temporary” as “temporary” inflation was – warning of a “material risk to UK financial stability” if the turmoil in the UK government bond market were to continue. It also raised the prospect of a “tightening of financing conditions and a reduction of the flow of credit to the real economy”, but what it really meant is that QT is over before it even started, and QE is back.

According to the FT, the “break” in the bond market manifested itself in thousands of pension funds have faced urgent demands for additional cash from investment managers in recent days to meet margin calls, after the collapse in UK government bond prices blew a hole in strategies to protect them against inflation and interest-rate risks.

The BoE’s action said its action was designed to restore order. “The Bank will carry out temporary purchases of long-dated UK government bonds from 28 September,” it said. “The purchases will be carried out on whatever scale is necessary to effect this outcome,” it added, saying the Treasury would underwrite any losses.

Spoiler alert: there will be nothing temporary about the return of QE, as the moment the BOE even thinks of ending the bond buying yields will explode right back to where they were. In effect, the BOE just became the first central bank to admit that it is trapped, and the only other option left is to raise inflation targets to 3%, 4% and so on.

And so central banks realized they are trapped. Inflation targets to rise everywhere next https://t.co/1BUL4nwGyZ

— zerohedge (@zerohedge) September 28, 2022

The bank’s Financial Policy Committee welcomed the “plans for temporary and targeted purchases in the gilt market on financial stability grounds at an urgent pace”.

The BoE added the action would be “strictly time limited” and came after market participants said there was a “proper shit show” happening in government bond markets.

In response, the UK Treasury said that the Bank of England has “identified a risk from recent dysfunction in gilt markets,” so the Bank will temporarily carry out purchases of long-dated UK government bonds from Sept. 28 in order to restore orderly market conditions, according to an emailed statement.

The Treasury blamed “significant volatility” in “global financial markets” rather than the chancellor’s unfunded tax cuts last week.

“The Chancellor is committed to the Bank of England’s independence. The Government will continue to work closely with the Bank in support of its financial stability and inflation objectives” the Treasury said.

Lots of fluff, but the bottom line is clear: we have long quoted Michael Hartnett who said that “financial markets stop panicking when officials and central banks start panicking”, and this morning the Bank of England was the first bank to panic, and the panic will soon move to every other central bank across the world simply because the cost of tightening is too much.

In response to the BOE’s pivot, 30Y gilts yields dropped by the most on record and it price soared some 16% (!) as the formerly most liquid bond market now trades like a penny stock…

… and while risk assets are still debating what this means – and let us break it down for you: pivot means that central banks can’t take any more pain and will soon do QE and rate hikes at the same time everywhere, eventually ending hiking and starting to cut rates – the bottom line is that this is the beginning of the end for the fiat system which now faces a terminal dilemma: fight inflation and suffer market collapse and economic depression with millions laid off, or push to stabilize social order and employment with higher asset prices, runaway (hyper)inflation be damned.

Tyler Durden

Wed, 09/28/2022 – 06:59