Why Morgan Stanley Is Finding Shelter In IG Credit

By Vishwanath Tirupattur, global head of Quantitative Research at Morgan Stanley

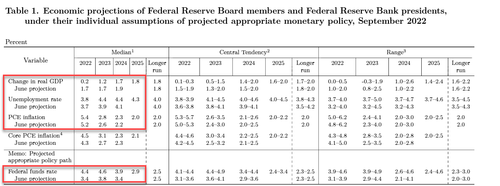

It has been an eventful week. The FOMC delivered a third consecutive 75bp rate hike. While this was in line with consensus expectations, the Summary of Economic Projections (SEP) revealed a bevy of significant changes to its projections – downward revisions to growth, upward revisions to both headline and core PCE inflation as well as the unemployment rate, and a sharply higher fed funds rate path.

Chair Powell said that the Fed will “keep at it until the job is done,” adding that sharply higher rates are needed to get inflation under control, and there’s no “painless way to do that.” The markets took this to mean a higher peak rate and a longer hiking cycle, resulting in sharp spikes in yields and a sell-off in equities.

At the time of writing, both 2- and 10-year yields stand at decade highs amid pervasively bearish sentiment among investors across both stocks and bonds. Of course, this bearishness is in line with the expectations of our economists and strategists. As Seth Carpenter, our chief global economist, has noted, the worst of the global slowdown is ahead of us, not behind us. Mike Wilson, our chief US equity strategist, has recently revised down his earnings expectations for US equities and continues to think that market consensus earnings forecasts are too high, particularly for 2023, and will come down.

Navigating these choppy waters for the economy and the markets is a challenge in both risk-free and risky assets due to duration risk in the former and growth/earnings risks in the latter. Against this backdrop, we think that US investment grade (IG) corporate credit bonds, particularly at the front end of the curve (the 1- to 5-year segment), provide a safer alternative with lower downside for investors looking for income, especially on the back of much higher yields.

Some numbers may be helpful. First, the front end is a sizeable market: Based on the ICE-BAML index, it stands at some $3 trillion in face value and $2.87 trillion in market value. At current prices, on average the yield is around 5% with a duration of 2.64 and A3/Baa1 credit quality. These levels incorporate the steep hikes ahead that the Fed has signaled at this week’s meeting. Of course, further hikes beyond market expectations are possible. However, the relatively low duration of these bonds makes them less sensitive to incrementally higher rates, and with yields at 5%, they offer fairly attractive carry. It’s also worth noting that with just 13% of the ICE-BAML Index due to mature between now and the end of 2024, the wall of maturities for these bonds is not particularly imposing. This means that the vast majority of the issuers of these bonds don’t have to come to the new issue market to borrow at the current higher rates.

What about credit fundamentals? Won’t they deteriorate if the economy slows or, worse, enters a recession and company earnings decline? Here is where the starting point matters. As our credit strategists Vishwas Patkar and Sri Sankaran have noted, after inching higher last quarter, median IG gross leverage improved modestly in 2Q22, moving down to 2.33x versus 2.37x in 1Q and well below the post-Covid peak of 2.9x in 2Q20. Gross leverage is roughly in line with pre-Covid levels (2.38x in 4Q19). Notably, while median leverage is back to pre-Covid levels, the percentage of debt in the leverage tail (>4x) has declined meaningfully. Taking our equity strategists’ earnings downgrades into account, gross leverage could rise to 2.52x assuming debt growth is flat.

Interest coverage is the offsetting consideration. Given the quantum of debt IG companies have raised at very low coupons over the years, interest coverage has been a bright spot for some time. Despite sharply higher rates, median interest coverage improved in 2Q, trending higher to 12.6x versus 12.5x in 1Q, around the highest levels since the early 1990s. This modest improvement in interest coverage comes down to the fact that even though yields on new debt are higher than the average of all the debt outstanding, the bonds that are maturing have relatively high coupons. Therefore, most companies haven’t had to refinance at substantially higher funding levels. In fact, the absolute dollar level of interest expense paid out by IG companies actually declined in the quarter and is well below the 2021 peaks. With limited near-term financing needs, higher rates are unlikely to dent these healthy interest coverage ratios.

The combination of strong in-place IG credit fundamentals, relatively low duration for the 1- to 5-year segment and yields at decade highs suggests that this part of the credit market offers a relatively safe haven to weather the storms that are coming for markets. History provides some validation as well. Looking back to the stagflationary periods of the 1970s and 1980s, while we saw multiple recessions and volatility in equity markets, IG credit (albeit before the high yield market as we know it came into being) was relatively stable, with only fairly modest defaults.

Finally, it’s worth highlighting that we are talking about front-end IG bonds and not high yield bonds, which are more vulnerable to defaults in a growth slowdown. In sum, front-end IG offers better risk/reward with a decent carry.

Tyler Durden

Mon, 09/26/2022 – 11:20