Futures Slide As Hawkish Rikshock Sends Dollar, Yields Higher Again Ahead Of Fed

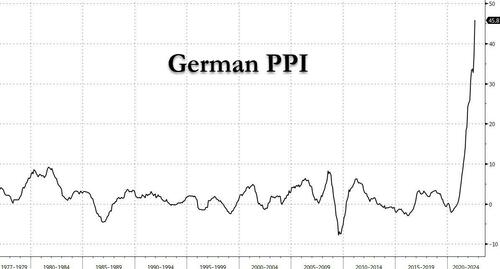

Market sentiment was quite cheerful heading into the overnight session, with futures hitting a third-day high of 3,936 thanks to yesterday’ late day delta squeeze (plunge in VIX as both calls and especially puts were sold) but then it quickly soured after first German PPI came in at a mindblowing 45.8% (vs expectations of 37.1%) the highest on record since World War II…

…but what really spooked futures was the record hike by the Swedish central bank, the Riksbank, which pushed the repo rate higher by a more than expected 100bps to 1.75%, and even though the central bank eased back on terminal rate expectations, the market still saw the Riksbank surprise as potentially indicative of what the BOE and Fed may do in the coming hours.

As such, European stocks fell with US equity futures, giving up early gains, as traders braced for another supersized US rate hike amid rising anxiety the Federal Reserve could overtighten and raise the odds of a hard landing. Europe’ Stoxx 600 Index dropped 0.8%, paced by losses on real estate and miners as US equity futures also stumbled those the tech-heavy and rate-sensitive Nasdaq 100 underperforming S&P 500 peers. As of 730am, S&P futures were down 0.4% and Nasdaq contracts were down 0.5%. 10Y yields hit a fresh 11 year high as the dollar surged and gold resumed its slide.

In premarket trading, Ford shares dropped 5.2% after the carmaker said 3Q supply costs were running $1b above expectations and warned that EBIT could be in the $1.4b -$1.7b range, below what was previously foreseen. General Motors stock also slid 2.3% in premarket trading. Here are some other notable premarket movers:

Change Healthcare shares rise 7.1% in premarket trading after winning court approval for the $7.8b acquisition by UnitedHealth, defeating a Justice Department lawsuit that had sought to block the deal

US- listed Macau casino stocks rise in premarket trading, on the possibility that Hong Kong would ease Covid restrictions such as mandatory hotel quarantine. Las Vegas Sands and Wynn Resorts gain about 3% in US premarket trading; Keep an eye on Melco (MLCO US) and MGM Resorts (MGM US) when trading volume picks up

Western Digital shares slid 1.7% in premarket trading as Deutsche Bank cut the recommendation on the stock to hold from buy, saying it’s difficult to see meaningful upside in the next six to nine months as oversupply in the flash memory market persists

Watch Cognex shares after the company boosted its revenue guidance for the third quarter; and the guidance beat the average analyst estimate

The Fed kicks off its meeting today and is expected to again hike rates by 75 basis points Wednesday – now that Timiraos has taken off 100bps off the table – signal rates are heading above 4% and will then pause. Market participants have dialed back expectations of an even larger increase and only two of 96 economists in a Bloomberg survey now predict a full-point move.

“The Federal Reserve is likely tightening policy straight into the teeth of a recession,” Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence, wrote in an email. “The stock market’s addiction to Fed easing when stocks decline may be what Jerome Powell is aiming to quash by aggressively hiking rates, in addition to inflation.”

Meanwhile in rates, Treasury 10-year yields topped 3.5% rising to a fresh 11.5 year high, while yields on the more policy-sensitive two-year rate hit the highest since 2007 and are poised to crack above 4%, reflecting hard-landing fears. In a worrying trend for stocks, real rates – Treasury yields adjusted for inflation – rose to the highest level since 2011. When they were pinned in negative territory during a decade of easy-money policies, real rates had been a key driver of risk-asset rallies.

Markets have fairly priced in yield on the two-year Treasury inching closer to 4% and “it might scratch a bit higher, but not an awful lot at this point,” Peter Kinsella, head of foreign exchange strategy at Union Bancaire Privee Ubp SA, said on Bloomberg Television. It would still be reasonable for the 10-year Treasury yield to go towards 3.5% or 3.7%, “but there’s probably not a lot more juice in that trade,” he said.

In Europe the Stoxx 50 fell 0.5%, reversing earlier gains with the UK’s FTSE 100 flat but outperforms peers, IBEX lags, dropping 0.8%. Real estate, retailers and miners are the worst-performing sectors.

Earlier in the session, Asian stocks advanced, on track to snap a five-day losing streak, amid signals that Hong Kong will move toward easing Covid restrictions. The MSCI Asia-Pacific Index gained as much as 1% as Tencent, Alibaba and TSMC provided the most support. Benchmarks across the region rose. Indexes in Hong Kong gained at least 1.2%, with one key gauge climbing from the edge of a bear market. Hong Kong’s chief executive said the city wants to relax Covid travel curbs after nearly three years of restrictions. The Hang Seng Tech Index added 2%. Australia’s main gauge rose more than 1%, led by the materials sector. Japan’s stock market advanced despite high inflation data, after being closed Monday.

“China’s reopening has helped revive sentiment in Asia this week,” said Charu Chanana, a senior strategist at Saxo Capital Markets. “There’s some level of positioning there ahead of a slew of central bank meetings this week, but volatility will likely remain elevated.” Despite Tuesday’s rally, Asia’s benchmark is still close to its lowest level since the middle of 2020 amid concerns over higher US interest rates and the dollar’s strength. Investors are betting that the Federal Reserve will hike interest rates by 75-basis-point at a policy meeting on Wednesday. Investors are also awaiting other central bank decisions this week from nations including the Philippines, Indonesia, Taiwan and Japan

Some more details: Japanese stocks advanced, tracking a rebound in US shares, as investors continued to weigh the market impact of further interest rate hikes from the Federal Reserve. Tokyo’s stock market was closed Monday for a holiday. The Topix Index rose 0.5% to 1,947.27 as of market close Tokyo time, while the Nikkei advanced 0.4% to 27,688.42. Keyence Corp. contributed the most to the Topix Index gain, increasing 2.2%. Out of 2,169 stocks in the index, 1,481 rose and 582 fell, while 106 were unchanged. “Assuming it is 75bps, the thing to consider is where it will go from there, as I think that the rate hike will remain hawkish as far as the Jackson Hole and economic indicators are concerned,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management. “A comment that accelerates the rate hike would be negative, while a comment that takes the economy into consideration would be positive for the stocks.” Traders are betting the Fed will hike by 75 basis points Wednesday.

India stock indexes rose for the second day, driven by a continuing rally in consumer goods makers and a surge in healthcare stocks. The S&P BSE Sensex gained 1% to 59,719.74 in Mumbai, while the NSE Nifty 50 Index rose 1.1%. The main indexes rose as much as 1.6% and 1.7%, respectively but failed to hold the advance. “Intraday volatility could be the ongoing theme for markets as investors world over are bracing for a stiff interest rate hike by the US Federal Reserve to weigh on rising inflation,” said Prashanth Tapse, an analyst with Mehta Securities. All of the 19 sector sub-indexes traded higher, led by a gauge of healthcare companies. Banking and consumer goods stocks continued their climb on expectations of a demand surge during the upcoming festive season. ICICI Bank contributed the most to the Sensex’s gain, increasing 2%. Out of 30 shares in the Sensex index, 26 rose and 4 fell.

In rates, the Treasury curve bear-flattened and yields rose by 4-5bps as Treasuries extend Monday’s session slide. Supply pressure in the form of 20-year bond auction awaits for Tuesday’s session, before Fed meeting Wednesday where OIS has eased slightly, pricing in 78bp of hikes for the meeting, following WSJ report that a three-quarter point move is expected. Core European rates underperform, led by gilts catching up from Monday UK’s holiday. Bunds fell, led by the belly of the curve, with yields rising up to 10bps as money markets continued to add to ECB tightening. UK bonds lead the wider market lower, headed by the short end and belly of the curve, and underperforming bunds and USTs as they catch up after Monday’s holiday. Curves bear-flatten as money markets up their ECB and BOE rate-hike bets. Swedish front-end bond yields rose more than their German peers, in response to the front-loaded rate increase. Australia’s dollar and bond yields declined after minutes from the RBA’s September meeting showed the central bank is getting closer to “normal settings.”

In FX, the Bloomberg Dollar Spot Index reversed a modest Asia session loss as the greenback advanced versus all of its Group-of-10 peers, with GBP and DKK the strongest performers in G-10 FX, NZD and NOK underperform. and yet as Bloomberg notes, options bets in the dollar are the least bullish they have been this year before the Federal Reserve was expected to announce an interest-rate increase. Some more details:

The euro gave up gains to touch parity against the dollar, despite a record German PPI print (the highest since WWII)

Sweden’s krona erased gains after initially rallying on the Riksbank’s surprise jumbo hike, as the market had priced in a more aggressive profile for the rate path, with a peak at around 3.5%.

The pound was supported by growing speculation that the Bank of England may raise interest rates by 75 basis points later this week. Markets were also anticipating a speech by the UK’s finance minister, who is expected to outline details for a big spending plan to help households through an energy crisis in coming months

Gilts dropped, catching up with Monday’s bond tumble when UK markets were closed for a holiday

In commodities, WTI drifts 0.5% higher to trade near $86.19. Spot gold falls roughly $8 to trade near $1,668/oz. Spot silver loses 1.3% near $19. European natural gas benchmark futures drop much as 6.8% for a fourth session of declines, the longest run since July.

Elsewhere, Bitcoin struggled to return to the $20,000 level. Oil slipped below $86 per barrel and gold fell.

To the day ahead now. In data we have US August housing starts, building permits, Germany August PPI, Italy July current account balance, July ECB current account, Canada August CPI, while the ECB’s Muller will give remarks.

Market Snapshot

S&P 500 futures fell 0.2% to 3,911.50

STOXX Europe 600 fell 0.5% to 405.78

MXAP up 0.7% to 150.68

MXAPJ up 1.0% to 493.17

Nikkei up 0.4% to 27,688.42

Topix up 0.4% to 1,947.27

Hang Seng Index up 1.2% to 18,781.42

Shanghai Composite up 0.2% to 3,122.41

Sensex up 1.5% to 60,021.83

Australia S&P/ASX 200 up 1.3% to 6,806.43

Kospi up 0.5% to 2,367.85

German 10Y yield little changed at 1.86%

Euro down 0.2% to $1.0007

Gold spot down 0.4% to $1,669.80

U.S. Dollar Index little changed at 109.80

Top Overnight News from Bloomberg

Treasury two-year yields are poised to crack above 4% for the first time since 2007 as the Federal Reserve’s steepest tightening cycle in a generation drives them higher

ECB Governing Council member Madis Muller said interest rates remain far from levels that would restrict economic expansion in the euro zone

The German government released another 2.5 billion euros ($2.5 billion) of credit lines to secure gas supplies, as it writes off Russia as a reliable energy supplier

Hungary said it was prepared to meet EU demands that it take action to curb fraud and corruption after the bloc threatened to freeze 7.5 billion euros ($7.5 billion) of funds that have been earmarked for the country

A more detailed look at global markets courtesy of Newsquawk

Asian stocks followed suit to the improved risk appetite stateside but with the advances capped ahead of this week’s risk events. ASX 200 was led higher by strength in the commodity-related sectors and with resilience in nearly all industries aside from healthcare, while the RBA minutes provided little in the way of new information but continued to point to a future slowdown in the hiking cycle. Nikkei 225 gained on return from the extended weekend but was off its highs after the mostly firmer-than-expected Japanese inflation data. Hang Seng and Shanghai Comp conformed to the upbeat mood with Hong Kong boosted by outperformance in tech stocks and as authorities consider adjusting COVID restrictions, while the advances in the mainland were contained after the PBoC maintained its 1-Year and 5-Year Loan Prime Rates as expected. “Investors should not be pessimistic about the (Chinese) stock market, as multiple signs emerge that bode well for equities”, according to the Securities Daily cited by SCMP.

Top Asian News

China’s Shanghai unvels RMB 1.8trln (around USD 257bln) worth of inftrastructure investments, has launched eight of them.

Hong Kong Chief Executive Lee said they are exploring further adjustments to COVID policy and aim to make an announcement soon with the details to be announced in one go. Lee added they would like to facilitate events for Hong Kong and bring back activities to the city, while they would want to stay connected with the world and allow an orderly opening up.

Japan’s Ministry of Finance said the government is to spend JPY 3.48tln in budget reserves to manage price hikes and COVID-19, while Finance Minister Suzuki said they will create an additional budget in addition to the reserve fund and for the time being, reserve money will be used for essential output. There were also comments from LDP Secretary-General Motegi that a stimulus package of at least JPY 15tln is needed to fill the output gap.

Bourses across Europe have been dipping from best levels, with sentiment somewhat sullied by a marked and unexpected acceleration in German PPI, coupled with a larger-than-forecast Riksbank rate hike to kick off the myriad of G10 central banks this week. The bias across sectors has titled more towards the defensive side, with Food & Beverages, Personal Goods, and Healthcare making their way up the ranks. US equity futures have slipped into negative territory, but the breadth of the market remains shallow as the clock ticks down to the FOMC tomorrow. German Gov’t draft law re. gas levy says Co’s receiving it may not see any notable profits, manager slaries must be limited. Restriction on profits to those with a market share above 1.0%, via Reuters sources.

Top European News

Traders Wager BOE Will Join Fed With Two Jumbo Hikes by Year- End

Germany to Spend Another $2.5 Billion on LNG to Ease Crisis

UBS’s Khan ‘Confident’ on Asset Target Despite Market Rout

Russia to Flood Asia With Fuel as Europe Ramps Up Sanctions

Riksbank Kicks Off Global Hiking With 100 Basis-Point Move

Central Banks

WSJ’s Timiraos writes “Fed’s Third Straight 0.75-Point Interest-Rate Rise Is Anticipated” and signaling intentions to raise and hold the benchmark above 4.0% in the months ahead, via WSJ.

Riksbank hikes its Rate by 100bps to 1.75% (exp. 75bps hike to 1.50%); Forecast indicates rate will be raised further in the coming six months. Full details, reaction & newsquawk analysis available here.

ECB’s Muller says rates are far from the level that would slow the economy; rates are still low in the historical context.

PBoC set USD/CNY mid-point at 6.9468 vs exp. 6.9483 (prev. 6.9396).

PBoC 1-Year Loan Prime Rate (Sep) 3.65% vs. Exp. 3.65% (Prev. 3.65%)

PBoC 5-Year Loan Prime Rate (Sep) 4.30% vs. Exp. 4.30% (Prev. 4.30%)

RBA September meeting minutes stated members saw the case for a slower pace of rate increase as becoming stronger as the level of the Cash Rate increases, while the board expects to increase rates further over months ahead but is not on a pre-set path. RBA Board is committed to doing what is necessary to ensure inflation returns to target over time and members noted that inflation in Australia was at its highest level in several decades which was expected to increase further over the months ahead with inflation expected to peak later this year and then decline back towards the 2-3% target range. Furthermore, the Board acknowledged that monetary policy operates with a lag and interest rates had been increased quite quickly and were getting closer to normal settings.

FX

DXY remains towards the top of today’s intraday parameter but under the 110.00 mark.

SEK was flagging near recent lows against the Euro and Dollar before the Riksbank delivered a hawkish surprise by raising rates a bigger than expected 100 bp (vs +75 bp consensus).

NZD remained under pressure and extended its decline against the Greenback to the low 0.5900 zone, while sliding through 1.1300 vs the Aussie.

JPY failed to glean much impetus from firmer than Japanese inflation metrics on the premise that the BoJ is unlikely to budge from its accommodative stance this week.

Fixed Income

Debt futures continue to plunge amidst fleeting bouts of consolidation and lame rebounds – the latest catalyst came via Sweden’s Riksbank.

Bunds have been down to 141.08 for a 154 tick loss on the day, Gilts to 104.33, 91 ticks below par.

US 10-year T-note fell to 114-01+, with corresponding yields soaring towards 3.55%.

Commodities

WTI and Brent front-month futures hold onto modest gains, but the upside remains capped by the cautious risk tone in early European trade. Overnight, the complex was relatively uneventful as it took a breather from the recent volatility.

Russia’s government wants to collect about RUB 1.4tln from raw material exporters next year to cover the budget deficit and proposed to raise the export duty on gas to 50% among other measures, according to Kommersant.

Gazprom says it will halt power of Siberia gas pipeline to China on Sept 22-29, citing maintenance, via Reuters.

Aramco CEO says the response to the global energy crisis thus far shows a deep misunderstanding of how we got there, increases in oil/gas investment are “too little too late” in the short term; when the global economy recovers, can expect demand to rebound further – eliminating the little spare oil production capacity available.

Spot gold is subdued by the Dollar but in recent ranges after hitting multi-year lows last week as the yellow metals look ahead to the Fed.

LME futures resumed trade following the long weekend, with 3M copper flat at the time of writing under the USD 7,800/t, mimicking the risk tone and awaiting the next catalyst.

US Event Calendar

08:30: Aug. Building Permits MoM, est. -4.8%, prior -1.3%, revised -0.6%

08:30: Aug. Housing Starts MoM, est. 0.3%, prior -9.6%

08:30: Aug. Building Permits, est. 1.6m, prior 1.67m, revised 1.69m

08:30: Aug. Housing Starts, est. 1.45m, prior 1.45m

DB’s Jim Reid concludes the overnight wrap

It was an extraordinary day here in the UK yesterday for the Queen’s funeral. The vast majority of the world’s leaders and dignitaries were present, hundreds of thousands lined the streets of London, and it was broadcast to an estimated global TV audience of four billion. It was hard not to get swept up in the emotion, pageantry, and enormity of the event. It’s also hard to imagine that the world will see a similar type of event again in our lifetime.

With all this going on, markets started the week on a quiet note, with the UK closed, Japan on holiday, and the data docket light. Yields took another leg higher though and curves flattened on the prospect of another round of global central bank tightening this week. Meanwhile, global equity markets were looking for direction, with European equities slightly lower, and US equities tracking flat for most of the day until a strong late rally (S&P +0.69%) changed the complexion of the day a bit.

The central bank focus remains the main game in town. With Fed pricing for Wednesday (79.8bps of hikes implied by the close, our US economics full preview here) still incorporating some premium of a 100 basis point hike, markets were watching for any blackout period communications from the Fed. A prominent Fed watcher from the WSJ did have a piece that garnered attention, but it was focused more on the previously-recognised pivot from Chair Powell to focus more on fighting inflation rather than providing a strong signal about Wednesday’s potential policy action one way or another. In turn, implied policy pricing for Wednesday was perfectly flat on the day.

Farther out the curve, however, rates markets priced in tighter Fed policy for longer, with the entire Treasury curve selling off, driving a bear flattening. 2yr Treasury yields increased +6.9bps to 3.94%, their highest levels since 2007, while 10yrs were +4.1bps higher to 3.49%, the highest since 2011, leaving the yield curve at -45.0bps and just short of its most inverted levels reached this summer (-49.6bps). Yields have pulled back a touch in Asia though, with 10yr USTs (-1.95 bps) at 3.47% and 2yr yield trading -1bps lower at 3.93% as we go to press.

In line with the tighter expected policy path, real yields are bearing the brunt of the recent selloff, with 10yr real yields increasing +6.5bps to 1.14%, their highest since 2018. The selloff and curve move was replicated in bunds, where 2yrs increased +8.8bps to 1.59% and 10yrs climbed +4.7bps to 1.80%, its highest since early 2014. 10yr OATs were in line with bunds, increasing +4.6bps, while BTPs marginally underperformed, increasing +5.8bps.

The STOXX 600 was as much as -1.0% lower intraday, but climbed through the afternoon to finish just in the red at -.09%, while the CAC marginally underperformed, falling -0.26% whilst the DAX managed to eke out a +0.49% gain. Elsewhere out of Germany, regulators reported that German gas storage levels were at 89.67% as of yesterday, something to keep an eye on as we head into winter. The gas build has been very impressive but with the strong possibility of there being no more Russian gas flowing this winter, unless temperatures are mild, it’s likely that rationing, in some shape or form, is likely.

US equities, opened nearly -1.0% lower, but quickly rallied to flat where it oscillated around most of the day before the late rally send it up +0.69%. 9 out of 11 S&P sectors ended in the green, with sectoral dispersion pointing toward a cyclical over defensives day – materials (+1.63%), discretionary (+1.34%) and industrials (+1.33%) led while health care (-0.54%) and real estate lagged (-0.22%). The NASDAQ was slightly stronger, increasing +0.76%, but very much followed the same intraday price action as the S&P.

In terms of data, the NAHB Housing Market Index declined to 46 (vs. 47 expectations and 49 prior), but didn’t necessarily tell us anything we didn’t already know: housing market sentiment is bad. It remains one of the sectors where the impacts of Fed tightening has already been acutely felt.

Asian equity markets are broadly higher this morning following the late rally on Wall Street overnight. As I type, the Hang Seng (+1.44%) is leading gains across the region, rebounding from two consecutive sessions of losses while Chinese shares are also higher with the Shanghai Composite (+0.46%) and CSI (+0.33%) both up in early trade after the lifting of Covid-19 lockdowns in both Chengdu and Dalian yesterday. Elsewhere, the Nikkei (+0.42%) as well as the Kospi (+0.33%) have held on to their gains.

DMs stock futures are pointing to a positive start with contracts on the S&P 500 (+0.20%), NASDAQ 100 (+0.23%) and DAX (+0.53%) are edging higher.

Early morning data showed that Japan’s core consumer inflation quickened to +2.8% y/y in August (v/s +2.7% expected), notching its fastest annual pace in nearly eight years as pressures from higher raw material costs and a weak yen broadened. Markets were expecting a +2.7% gain compared to July’s +2.4% rise.

Meanwhile, headline inflation hit 3.0% y/y in August, the highest since 1991. The data will be slightly uncomfortable for the BoJ as they meet on Thursday but they are not expected to change direction yet from their increasingly outlier zero rates policy stance on the global stage.

Elsewhere, the People’s Bank of China (PBOC) kept its main lending rates unchanged leaving the 1-year loan prime rate (LPR) intact at 3.65% and the 5-year rate, a reference for mortgages, at 4.3% after a 15bps cut in August.

The latest minutes from the Reserve Bank of Australia (RBA) indicate that the board members “saw the case for a slower pace of increase in interest rates as becoming stronger” over the months ahead but reiterated that the policy is not on a pre-set path considering the uncertainties surrounding the outlook for inflation and growth. Actually our economists have upgraded their RBA call to a 50bps hike in October (from 25bps) in line with the global direction of travel. They don’t think the RBA will step down to 25bps hikes until November and December.

To the day ahead now. In data we have US August housing starts, building permits, Germany August PPI, Italy July current account balance, July ECB current account, Canada August CPI, while the ECB’s Muller will give remarks.

Tyler Durden

Tue, 09/20/2022 – 07:44