Yield Curve Inverts Dramatically As Goldman Sees Recession Risks Soaring

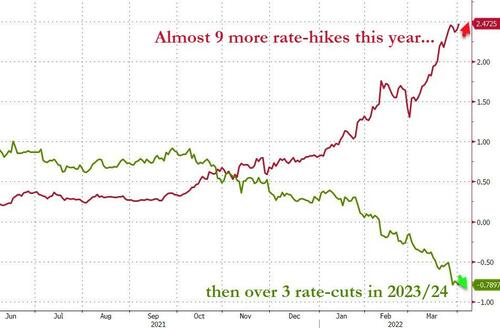

Following this morning’s stagflationary signals from a tumble in unemployment (opens window for Fed hawks), surge in earnings (inflationary pressure building), and slump in ISM Manufacturing (production & new orders down, prices paid spiking), the market has been quick to price in a more aggressive Fed this year (now expecting at least 9 more 2bps-rate-hikes by year-end)… but at the same time, pricing in a dramatic rate-cuts in the following year…

The message – loud and clear – is The Fed’s anti-inflationary actions will guarantee a recession, and that will ensure rapid de-escalation from The Fed and a return to QE.

While few are mentioning it in public – and President Biden just told us just how awesome he is by gloating over the surge in job gains (which merely represents people being allowed by the government to get their old – pre-COVID-restrictions – jobs back) – but a recession is coming faster than the regular asset-gatherers and commission-rakers would care to admit.

BofA’s Michael Hartnett was recently brave enough to state that he expects a recession to strike by H2 2022, and just this morning, no lesser Wall Street giant than Goldman Sachs raises its recession risk for the following year to 38% (with some far more ominous details under the surface of their model)…

On their own, various segments of the curve that have each been relatively reliable recession indicators historically are implying very different probabilities of recession within the next 24 months. This unusually sharp divergence in the probabilities implied by curve segment is another indicator of the unusual structure of the current yield curve: very steep at the front of the curve, but flat/inverted further out.

Combining indicators into a single model unsurprisingly improves the ability to predict recessions and implies that the market is currently pricing recession probabilities that are broadly consistent with the shape of the curve—close to no chance of recession in the next 12 months, but a higher risk of recession (38%) in the following year.

So what does the market say about all this? Nothing good.

The 2s10s spread has collapsed into inversion this morning…

And 5s30s spread is now dramatically inverted…

And 2s30s has inverted for the first time since 2007…

And for all those trying to distract by forcing your attention to the 3M2Y spread’s steepness, here is what the yield curve looks like now… and in one year…

Which leaves the 2s10s curve inverted by 50bps in one year according to the forward curve…

Goldman hedges in its conclusion of course, unwilling to scare its AM clients, explaining that their US econ team has also noted that while they see the risk of a US recession this year as higher relative to an average year, a recession if it were to occur would probably be mild by historical standards as the economy lacks major financial imbalances that would exacerbate a slowdown.

Still – a recession is a recession, and you can’t be half-pregnant… and even from Goldman’s table above, the US equity market is completely decoupled from this risk of recession, blinkered in its desire to keep the dream alive (and offering all those talking heads the constant refrain of “well, how can we be on the verge of recession when stockjs are so closs to record highs?”) Do we really need to show you where stocks were in 2000 (ahead of that recession), 2007 (ahead of that recession), and early 2020 (ahead of that recession).

Tyler Durden

Fri, 04/01/2022 – 11:47