China ADRs Surge As Beijing Considers Giving US Access To Audits

U.S.-listed Chinese stocks surged premarket after Bloomberg reports Chinese authorities are preparing to give the SEC full access to auditing reports for the more than 200 companies listed in New York as soon as this summer.

For months, the SEC has shared its plan for forcing Chinese firms to delist from US exchanges should they refuse to open their books and abide by stringent US auditing standards. Now in what appears to be a rare concession to prevent further decoupling, China Securities Regulatory Commission and other government regulators are drafting a new framework to keep Chinese firms listed in the US, according to people familiar with the framework.

Not all companies will remain listed in the US. Sources said some state-owned enterprises and private companies that utilize ‘sensitive data’ will be delisted. The framework is expected to provide clarity on what exact data may trigger national security concerns.

One source said Chinese regulators discuss whether companies in the consumer sector, such as Alibaba Group Holding Ltd., would be considered a national security concern because of the vast amount of consumer data they process.

Suppose the Bloomberg report is correct. This would undoubtedly be a rare concession by Beijing and possibly end the looming 2024 deadline for expelling non-compliant Chinese firms off top US exchanges.

Discussions are still underway, and the new framework would need sign-off from Beijing, said one of the sources. They expect the new agreement to be announced around the midpoint of summer.

Earlier this week, SEC Commission Chair Gary Gensler cast doubts that a deal with the Chinese was imminent.

“There have been thoughtful, respectful, productive conversations, but I don’t know where this is going to end up,” Gensler said in a Tuesday interview, referring to continuing negotiations. “It’s up to the Chinese authorities, and it could be frankly a hard set of choices for them.”

Chinese companies who want to shield financial documents could delist their shares from US exchanges and move to non-U.S. bourses, such as Hong Kong. Riding-hailing Didi Global Inc. has already proposed such a move.

As for China ADRs, Alibaba shares are up 5.8% in premarket trading, Didi Global jumped 18%, E-commerce firms JD.com +4%, and Pinduoduo +7.9%.

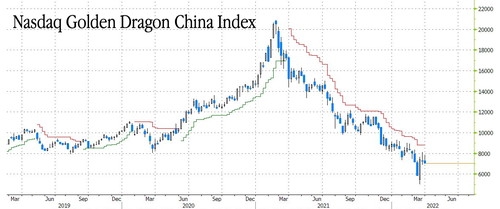

The Bloomberg report comes after the Nasdaq Golden Dragon China Index posted its worst first-quarter performance since 2008 after more than a year of Beijing technology crackdowns, audit disputes, and sagging growth.

China’s plunge protection team stepped in last month the put a floor in stocks. The question everyone is asking is if the floor will hold.

Tyler Durden

Fri, 04/01/2022 – 07:28