Energy Stocks Soar On Jump In Oil; Goldman Expects Spike In Energy Market-Cap Weighting WithIn S&P

With tech stocks still reeling from the post-CPI rout (with the bizarre exception of Tesla which is enjoying another gamma squeeze), it is energy stocks’ turn to shine because after dumping yesterday even as commodities rebounded, with big thanks to the White House for setting an $80 “Biden bottom” in oil, and reminding us that the SPR drawdown will end at some point. Some ballpark math according to Goldman suggests there is ~20 mmbls remaining over ~5 weeks.

In any case, energy equities are surging, aided by the continued jump in WTI which just hit $90 on news that Chinese mega city Chengdu is easing Covid restrictions, while optimism about an end to Covid Zero comes from the Reuters news that Moderna has talked with the Chinese government about supplying COVID-19 vaccines; at the same time, nat gas prices jumped 5.6% as temperatures rise in the US and on the possibility that coal shipments could be disrupted by a rail strike.

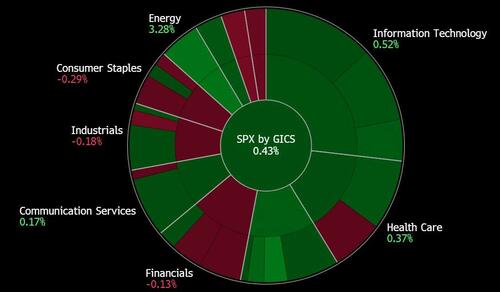

The S&P 500 Energy Index rose as much as 3.5% Wednesday, its biggest intraday gain since Aug. 23, led by APA +7.1%, Coterra Energy +6.5%, Devon Energy +5% and Pioneer Natural +5%; all 21 members of the energy index climbed Wednesday, while energy was the top performer of the 11 sectors in the broader S&P 500.

If that wasn’t enough, this morning Goldman’s Neil Mehta published a report (available to pro subs) laying out three bullish factors:

The return of Iran oil supply is looking increasingly unlikely based on recent comments from the State Department.

The OPEC Monthly Oil Market report, published on Tuesday, September 13, highlights continued production underperformance relative to OPEC+ quotas.

US weekly oil production continues to show lackluster growth, and the US rig count has plateaued.

Goldman’s bottom line: despite strong YTD performance (Energy equities vs. S&P are +62%), the bank’s Portfolio Strategy team still recommends Energy as an S&P overweight, expecting energy market-cap weighting within the S&P500 to further increase.

Goldman’s recos: “oil large caps with solid risk/reward include XOM/COP (Majors), FANG (E&P), SLB (Services) and CVE (Canada).”

Tyler Durden

Wed, 09/14/2022 – 13:25