“Winter Is Coming”: Taiwan Export Slowdown Implies Darkening Clouds For Global Economy

The slowdown in Taiwan’s exports is further evidence that the risks to the global economic outlook are tilted to the downside and could imply more turmoil is ahead.

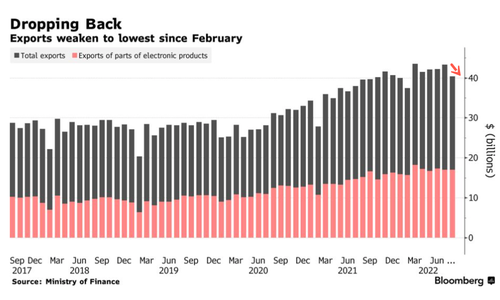

A statement from the Finance Ministry in Taipei said exports grew a paltry 2% in August compared with the same month last year — the slowest pace of growth since July 2020, when exports only grew by .3%. Bloomberg noted economists were expecting an increase of 11.6%.

Imports also decelerated, rising by 3.5% in August, compared to a 19.4% expansion in July. Economists were anticipating an 8.7% rise.

Beatrice Tsai, the Ministry of Finance’s chief statistician, said the trade slowdown suggests “winter is coming.” She outlined how double-digit export growth in the third quarter is unlikely, adding September exports could contract by 3% versus a year ago.

Taiwan’s dominance in semiconductor fabrication is a good barometer of global chip demand.

“While demand for integrated circuits and mineral products continued to be hot, export sales of traditional products such as plastics and base metals were sluggish due to weak end-user demand,” according to a statement from the finance ministry.

The slowdown in exports is a troubling sign that the global tech sector could be entering an alarming downturn due to lackluster consumer demand worldwide:

“There are clearer signs showing that the tech sector has entered a downturn, driven by weakening global demand for mobile phones, PCs and other consumer electronics products, which also weighs on demand for the upstream semiconductors,” said Ma Tieying, an economist at DBS Group Holdings Ltd.

Some macro-tourists closely watch Taiwan’s export data as an early indicator of turning points for the global economy.

Global growth from Asia to Europe to the US has shown signs of deceleration this summer (IMF warned about this in July), with fears major economies could slide into recession amid a flurry of central banks increasing interest rates to combat the highest inflation in decades.

A notable index followed by many is JP Morgan Global Manufacturing PMI. The latest print last month showed global manufacturing is nearing contraction. It fell from 51.1 in July to 50.3 in August.

To sum up, consumer demand is weakening in an environment of high inflation. Central banks aggressively raise interest rates that could tilt developed and emerging economies into recession.

Tyler Durden

Wed, 09/07/2022 – 22:25