Calls Between Energy Traders, UK Grid Operator Reveal Power Crisis Might Be Far Worse Than Expected

Once a week, energy traders hop on a call with UK’s electricity network operator, National Grid, managers to ask a series of questions about the state of power markets. Bloomberg’s Javier Blas‘ latest opinion piece reveals some of these conversations between traders and managers that paint a rather dark winter for the UK.

Here are a series of questions from power traders from last week’s call:

“Are you war-gaming possible options for if/when cross-border trading collapses under security of supply pressures this winter?”

And another: “Can we have a session where we talk through the emergency arrangements?”

Another participant said that the forecast for demand-and-supply electricity balance showed “how bad the winter could be for anyone who can do the maths.”

The same caller was blunt about the grid’s own predictions: “I don’t think you believe what you’ve written, and nobody else does.”

One trader asked a question about intervention during a winter crisis:

“Based on where winter ’22 products are trading, where does this position yourself with respect to securing power over the winter?” asked one participant.

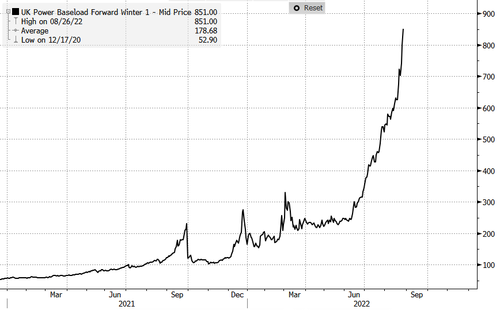

Why are energy traders so concerned about grid instabilities in the months ahead? Well, UK power prices for winter are going parabolic at about £1,000 per megawatt hour, up from £242 in June. The move is due to declining Russian energy supplies to Europe ahead of winter.

As Blas pointed out, the British government is offering an optimistic tone about there’s nothing to worry about:

“Households, businesses and industry can be confident they will get the electricity and gas that they need over the winter,” Downing Street said earlier this week. “That’s because we have one of the most reliable and diverse energy systems in the world.”

Traders are also concerned that if a system-stress event hits a neighboring country and cross-border electricity flows are switched off, that could spark even more chaos for the UK grid.

“Please, the market needs to understand more fully how interconnectors are to be used in periods of very high prices and potential generation shortfall,” one market participant said last week.

Traders also discussed demand destruction by households and businesses because of soaring power costs.

“What level of demand reduction, demand destruction, are you forecasting for the winter ahead from commercial industrial consumers as a price response?” was one recent example.

Another repeated the request: “What demand destruction, if any, is included in your demand forecast for this winter for residential and industry?”

Blas said grid managers could not forecast any figures related to demand destruction to the traders.

He concluded with three critical takeaways after listening to several calls with traders and grid managers:

First, the looming power emergency is worse than many industry executives publicly acknowledge, and a lot more dangerous than the government admits. Second, high prices are a big problem, but security of supply is at risk, too. Third, time is running out to prepare before temperatures start to drop.

Blas warned: “European governments have a duty to come clean with their voters about the magnitude of the coming crisis.”

Tyler Durden

Fri, 08/26/2022 – 13:08