What The Fed Sees & What The Market Sees Are Very Different

Authored by Simon White via Bloomberg,

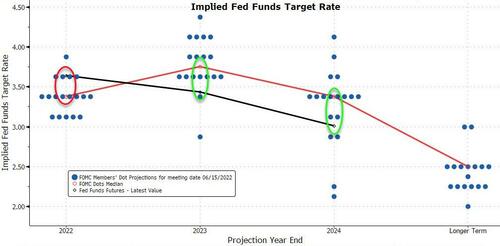

The Fed and the market appear to have very different views about how close we are to the end of the tightening cycle.

That’s a set up for a big disappointment.

The wait is over, with Powell’s speech at Jackson Hole later bringing and end to suspense. The general expectation is that he renews the Fed’s hawkish vows, but of course no-one knows for sure what he’ll say.

So let’s focus on what we do know.

This has been a unique tightening cycle. So soon after the Fed started hiking, rarely have long rates seemingly peaked out. Rarely has the yield curve flattened so aggressively. Rarely has the term premium started falling.

Furthermore, the peak real Fed Funds rate is still less than zero, which is dumbfounding when you consider that inflation is at its highest level in forty years. In the last tightening cycle in 2015-2019, the peak real rate topped out at around +2%, when inflation got no higher than 3%.

We don’t know for sure what’s going on, but here’s a guess.

Perhaps the Fed is living in an arithmetical world and the market in a geometrical one. In the Fed’s case, this would mean rates have risen by 225 bps but, compared to previous tightening cycles, could yet go a lot further.

But the market is well accustomed to looking at things geometrically. (All those years dealing with compound interest!)

On that basis, rates are up 10x since the Fed started hiking, whereas in the median tightening cycle rates barely double. In a geometric world, there’s already been a massive tightening.

So what matters more, magnitudes or changes?

Thus far inflation is still high and financial conditions are not excessively tight, which doesn’t really fit with the 10x tightening of the geometrical world.

The market seems to be assuming the Fed has already tightened a lot, and it only needs to do a little more to pacify inflation. Growth will cool, requiring rate cuts as early as next May.

The market is still in Kansas, but we’re not there any more — which leaves a lot of room for disappointment either today, or very soon.

Tyler Durden

Fri, 08/26/2022 – 08:46